In the early trading session of the Asian market on Thursday (April 3rd), spot gold continued its upward trend and once reached a new all - time high of $3,167 per ounce. This was because US President Donald Trump said on Wednesday that he would impose a benchmark tariff of 10% on all goods imported into the United States and impose higher tariffs on some of...

During the US trading session on Friday, March 28th, international oil prices fluctuated slightly and declined. However, both Brent crude oil and WTI crude oil remained firmly near their one - month highs and were projected to register "three consecutive weekly gains" on the weekly chart. The ongoing tug - of - war between the supply tightness instigated by...

The latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying...

The latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying...

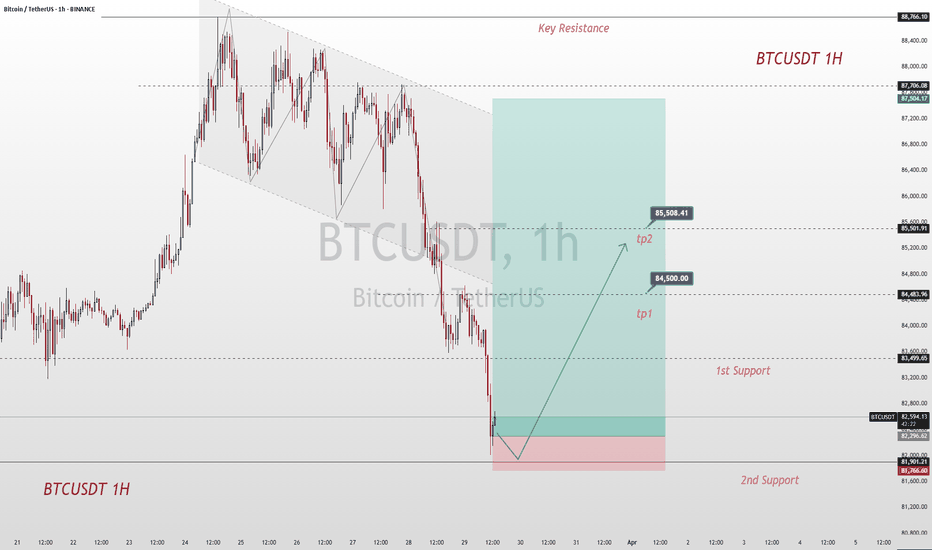

At present, it seems that the situation for the bulls is promising. However, the market is not necessarily so. This kind of behavior to induce more long positions is quite normal in the market. Market makers often operate in a strategic way. After they have reaped the profits from the bulls, it's highly likely that the next target will be the bears. Looking at...

Currently, the market continues to maintain a range - bound oscillation pattern. In the short term, there are no conditions for a significant unilateral upward or downward movement. In terms of short - term trading, the price is currently trading at $3032. From the perspective of intraday trading strategies, this price level can be regarded as an entry point for...

The EUR/USD is trading at 1.0796. After a Thursday rebound from 1.0733 due to a weakening USD, it's now pressured at the intraday high of 1.0799. US President Donald Trump's new 25% import taxes on cars and car parts, with potential additional levies on the eurozone and Canada, have stoked risk - off sentiment. This has led to a temporary dip in the US dollar's...

Today, major funds in the gold market are rapidly covering their short positions, triggering a short - term technical rebound. Despite the bearish outlook remaining solid from a fundamental perspective, investors should prioritize prudent position sizing and effective risk management. Notably, once this corrective upward movement concludes, the market may face a...

Currently, the key support level for the price of Bitcoin is around $86,000. This level has played a supporting role several times in the recent price fluctuations. If the price can hold this position, it will provide strong support for subsequent upward movements. The key resistance level above is at $89,000. If the price of Bitcoin can break through and firmly...

From a fundamental perspective, the USD/JPY exchange rate retreated from around the 151.00 level. Despite the poor Japanese PMI data on Monday, investors bought the Japanese yen influenced by the hawkish outlook of the Bank of Japan (BoJ). The minutes of the January meeting showed that policymakers tend to tighten policies when appropriate. The BoJ governor also...

Trade frictions remain a headwind in the market. US trade measures have triggered concerns, and the Australian economy, which is dependent on exports to China, may be impacted. Meanwhile, inflation triggered by tariffs conflicts with concerns about a slowdown in the US economy. The Federal Reserve has maintained the interest rate unchanged and adjusted its...

From the daily chart perspective, gold closed with a bullish candlestick yesterday, putting an end to the previous consecutive bearish candlestick decline. Currently, the gold price is situated between the short-term moving averages MA5 and MA10. These two moving averages are now showing a trend of being on the verge of forming a death cross. Overall, the price...

Currently, BTC is hovering around $88,000. We had already achieved our profit target yesterday. Ever since BTC broke through the $85,000 mark, it has been rising continuously. The market is in a bullish - dominated trend, with strong buying power driving the price up steadily. Although it's in an uptrend, there's uncertainty about its future movement as it hasn't...

During the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise. If it fails to break through these resistance levels,...

Gold remains buoyed by safe - haven sentiment. Nevertheless, subsequent to a substantial rally to a high, gold underwent a swift retracement. In truth, the support for gold emanating from safe - haven requirements is a rather commonplace occurrence. Given that the bullish impetus in the gold market failed to persist, this implies that the upside potential for gold...

The EUR/USD pair has traded with a soft tone for five consecutive trading days, and the decline has expanded to 1.0776, the lowest level since March 6. However, the broad weakness of the US dollar in the middle of the European session pushed the currency pair to turn upward. In the short term, according to the 4-hour chart, although the possibility of further...

The recent trend of USOIL has been continuously rising in a volatile manner, and the current intraday price has reached a three - week high. Currently, the bullish sentiment in the market is greatly influenced by fundamental news, mainly due to the combined effects of the United States increasing sanctions on Iran's energy and the ineffective and substantive...

Yesterday, towards the end of the trading session, the gold price tested the vicinity of the $3,000 level again. Subsequently, it oscillated higher in the late trading, and continued to surge upward today. The Bollinger Bands are opening downward, indicating a distinctly bearish trend. However, there has been some support near the $3,000 mark, with signs of a...