JohnGonzalez7

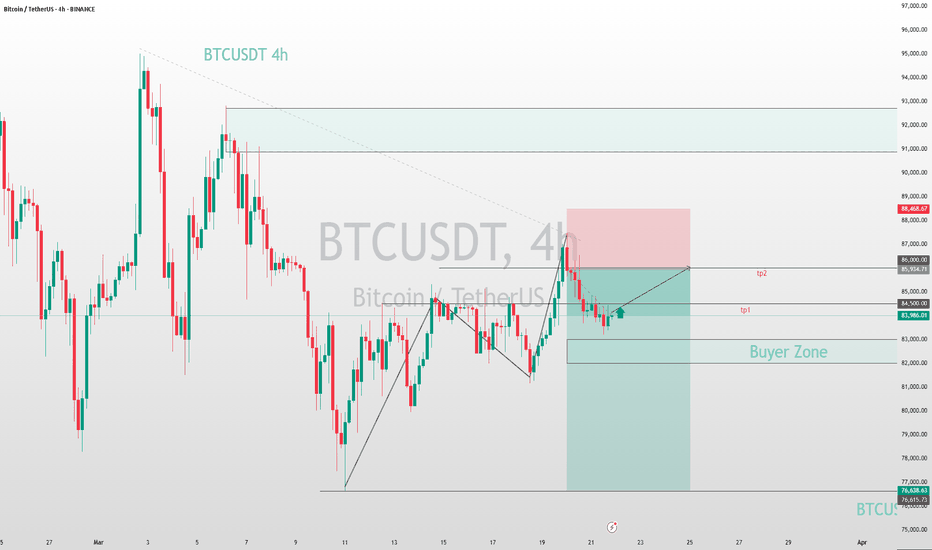

BTC faced rejection at the $89,000 resistance level yesterday, triggering a pullback. However, the overall uptrend remains intact. Investors may consider long positions on signs of stabilization after this corrective move. BTCUSDT buy@84500-85500 tp:87000-88000 I will share trading signals every day. All the signals have been accurate for a whole month in a...

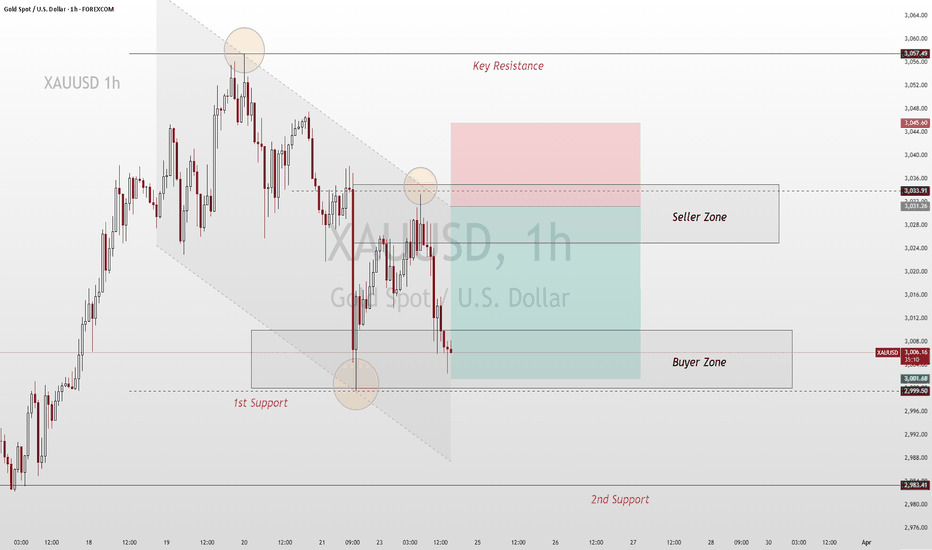

On Monday, the price of gold exhibited relatively subdued behavior, largely oscillating within a narrow trading band. During the European trading session, the yellow metal briefly ascended to test the $3,033 resistance level. Subsequently, in the US trading session, it encountered a significant pullback, with prices temporarily dipping to a low of...

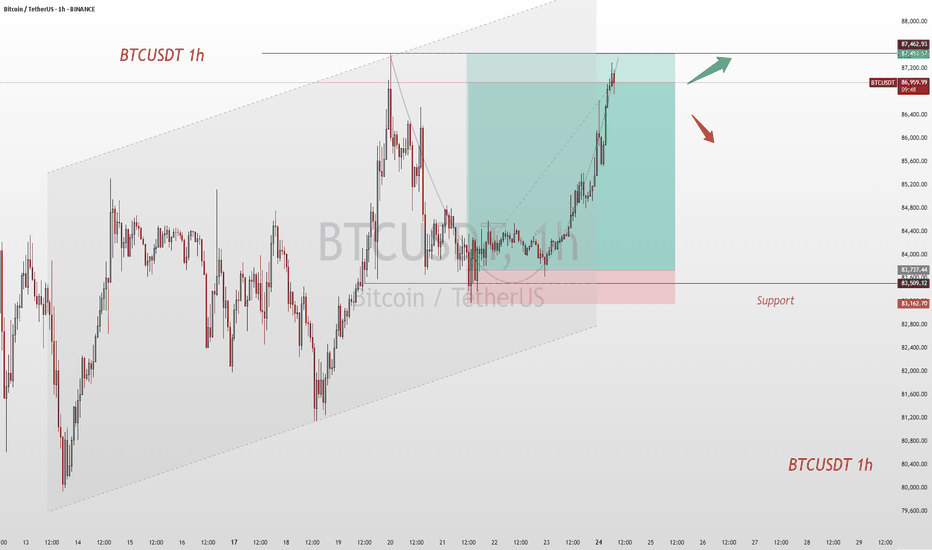

Today, the price of BTCUSDT has shown a robust upward trend. Bullish forces are extremely active, steadily propelling the price to continuously climb, demonstrating a sharp offensive momentum. From a technical perspective, upon in - depth analysis, the current price is gradually approaching the crucial resistance range of 89,000 - 90,000. This range has played a...

Upon reviewing the trading strategy devised last week, the current market price has successfully rallied to the targeted level. Bitcoin against Tether (BTCUSDT) is quoted at 86,780, registering an intraday gain of 0.84%. From the vantage points of technical analysis and market dynamics, the robust resistance level in the vicinity of 87,500 above emerges as a...

After last week's decline, the euro against the US dollar started to recover at the beginning of this week and is currently trading within the positive range around 1.0850. According to the Wall Street Journal, the White House is adjusting its tariff policy set to take effect on April 2nd. It may cancel a series of tariffs targeting specific industries and...

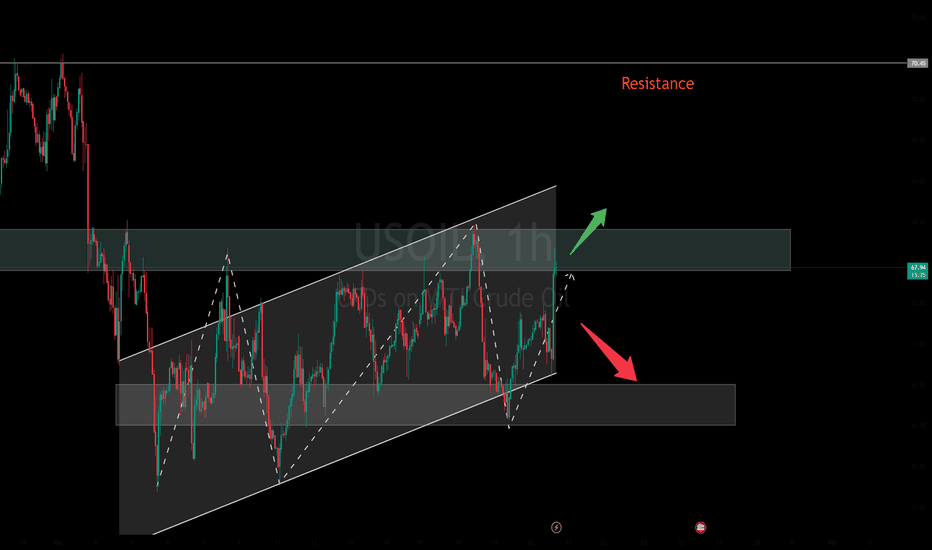

The situation in the crude oil market has been complex recently. On the supply side, it is affected by the uncertainty of the OPEC+ production increase plan, the recovery of U.S. shale oil production, and the potential supply risks in Iran. On the demand side, due to the weak momentum of global economic recovery and trade disputes, demand has been suppressed....

This week, the long position signal on USDJPY at the 1.28500 level has already started yielding profits. As we look ahead to next week, it is advisable to commence position closing once the price reaches the pre - determined target levels. Rest assured, I will persist in furnishing precise trading signals. I will share trading signals every day. All the signals...

The closing price of XAU/USD on Friday was 3,022.790. Indeed, gold prices have broken through that key $3,000 support level, just as we anticipated. Although the $3,000 support level was quite strong—it's always been a tough nut to crack—it still failed to hold firm. Given the current market conditions, gold prices are set to continue their downward trend next...

Right then, BTC/USDT is at a bit of a crucial point at the moment. The buying range we flagged earlier, 82,000 - 83,500, has been left behind, with the price now sitting at 84,139.51 – up 0.06% on the day. The target for taking profits is still 84,500 - 86,000, and we’re currently hovering near the lower end of that at 84,500. If it manages to break through that...

The BTC/USD price is currently in a consolidation phase within a specific range. Pay close attention to the 82,000 - 83,000 zone. Should the price retrace to this area and demonstrate signs of support, it could be a viable opportunity to initiate a small long position. Set the target take - profit levels between 84,500 and 86,000. When the price reaches 84,500,...

Next week, the trend of USOIL still remains highly uncertain. Technically, the current price is continuously fluctuating within a range. Around $70 serves as a strong resistance level, while $66.05 is a key support level. Fundamentally, the tense geopolitical situation and the supply decisions of OPEC+ provide some support for oil prices. However, the slowdown in...

On Friday evening, the spot gold price broke below the key support level of $3,000, which was in line with previous expectations. After reaching a phased high of $3,057, the market witnessed a rather significant downward movement. However, the support at the $3,000 level was relatively strong. Although the price briefly fell below this level, it failed to...

Last week, XAU/USD showed a pattern of high-level consolidation. After reaching the key psychological level of 3000 USD on March 17th, gold prices entered a sideways phase. On March 20th, gold hit a new all-time high of 3057 USD per ounce before pulling back. By March 22nd, gold prices had fallen for two straight trading days, briefly touching 2999 USD per ounce....

This week, the GBP/USD exchange rate has experienced notable fluctuations. As of March 22nd, the pair stood at 1.29114, down 0.00540 (0.42%) from the previous day. The intraday high reached 1.2971, while the low touched 1.2887. On Thursday (March 20th), the Bank of England announced its interest rate decision, keeping the benchmark rate unchanged at 4.5% with an...

Recently, although inflation data in the United States has declined, it remains elevated, and the labour market continues to be tight. The Federal Reserve may maintain a hawkish stance, which is supportive of the US dollar. Meanwhile, the economic recovery in the eurozone has slowed. Weak manufacturing PMI data has dampened business and consumer confidence,...

The BTC/USDT price is currently consolidating within a range. You can focus on the 82,000-83,000 zone; if the price retraces to this area and finds support, consider entering a small long position. The target take-profit levels are between 84,500 and 86,000. If the price reaches 84,500, consider partially closing the position to lock in some profits. If it breaks...

Gold has weakened once again, with the price dropping rapidly and breaking through the support level of 3022, heading towards the sub - 3000 zone. The previous strong upward trend in the gold market has come to an end! The price has dipped to test the 3000 level for the first time, and the market direction has turned bearish. The bearish trend is now firmly...

Currently, USOIL is trading around $67 per barrel. On the supply side, while OPEC+ plans to increase production, ongoing geopolitical tensions in the Middle East are adding supply uncertainties. On the demand side, U.S. fuel demand remains resilient, but the subdued global economic outlook may limit crude oil demand growth. Technically, the daily chart shows...