Wedge and base formation. Starting to break the cloud, I'd look for some pullback and more consolidation along the conversion line (red Line) before entering. Blue rectangles represent area of overhead supply/resistance to break thru. Try for an entry around $43.25 since price should tighten up a bit. Nice vol spike on Jan 10th.

Closed the gap and breaking out of a consolidation area - headed to new highs?? Looking for a metal that is not too far into a trend... Moving averages on $GG are heading upwards in a nice trend. My stop will be the 20 EMA which is below the current supply area. 1st target = $13.04. Compared to $NEM, ATR is less volatile on this one. Entry tomorrow...

Uptrend. Moving Average crossover. Positive earnings. Using the 20 EMA as a stop. Risk: resistance @ the 100 and 200 Keeping a close eye on the SPY for ANY SORT of weakness here esp. with the 200 overhead -a particular hot spot. Super small share size until the 200 is resolved. Break above and hold = add more shares. Actively long 0.2% capital

Positive news. Experienced appointments. Former runner. Beautiful pennant here with low risk entry. Stop= $76.21 Tight stop and trail exit w/ 3 or 5 ema. Actively LONG.

Hmmm...looks like going down and fill that gap, buyers will be trapped and jump ship. Short and medium term downtrend here and losing the 200 EMA. 5 days of lower lows on the daily is a bad sign combined with low volume, I hope it continues to bleed. FB is passé to the youth of today....the glass is half empty here. tight stop = $164.49 Target = $153.30...

Just entering the Ichimoku cloud. Higher highs, higher lows. Nice consolidation and low volatility over last 4 weeks, ideal would be 6 weeks. Also has a short-term moving average crossover which is positive as well as a 1.67% slope to the 20 ema over last few trading days. I have a 0.2% capital risk entry @ 9.56 with a stop loss of $8.82. Will trail with a 10 ema...

Earnings winner on Keytruda sales. In @ $77.00. Tight stop - half the way down on today's candlestick ~ $76.49. (I am not about to lose money on this one-much). Has support at $76.50 ish. Nice long strong uptrend, hopefully the momentum will last. Will close after a 2-3 day swing. Will trail stop @ the 3 ema if it continues up - surfing the wave. Target could be...

Earnings winner. Dividend payer. Probability that this will go higher is positive based on previous chart data. Stock is trading in the lower 1/4 of entire hx of price action going back to year 2016. Also double bottom formation of late. Gap up is bullish. Exponential moving average crossovers = bullish. R/R = 1.7. Loose stop = 29.64 Target = $38 Entry...

Watching for entry on any signs of bullishness here above $37.48. Starting to find support on the cloud. Q4 announcement Feb 1st. New drug(s) release - migraine med + propofol injectable. 0.2 % capital. Super tight stop - a few cents below 20 ema. Consider waiting for price to tighten up a bit more before getting in.

Nice wedge formation. Finding support on the cloud, higher lows. Positive fundamentals, QIWI is the "Paypal of Russia". Stop placed below the cloud @ $13.39. Will consider an entry this week if bullish close above the 10 EMA, it's possible price to fall back into the cloud though. (My cloud is on a different chart layout.) Target $17. Guidance From Yahoo...

Clear uptrend with moving average squeeze. Breakout from base = BUY SIGNAL! Previous runner. 2x volume in last 2-3 days. RSI = 72. Weekly and monthly solidly UP. I bought up here you could wait for it to come back in I guess. Focusing on trend here, rather than entry, and letting runners run. Risking 0.2 % capital since most uptrends fail. 1st resistance = $22.20...

Definition of an uptrend = higher highs, higher lows In bullish territory on Ichimoku chart - above cloud and all lines +1 point for dividend Watching only for now, if it consolidates (looking for doji's here) or shows bullishness I will buy, if it violates the 20 EMA - no trade Target = $17.20 R/R = 2.65 (Stop = $12.38) Fundamental www.reuters.com

In @ $129.27. Stop = $135.55, target = $106.21 R/R = 3.67 Under all MAs, will keep a tight stop - I expect it to work RIGHT AWAY or NOT AT ALL. Stoichastics lower. Fundamental from Motley Fool (Jan 3, 2019) What happened to NVIDIA? Last November, NVIDIA reported its first quarterly revenue miss in three years. Its revenue rose 21% annually to $3.18 billion,...

Long on GLD and SLV, global market blood bath continues unabated and now USA joining in...

Retracement to trend line - longer term downtrend on the hourly. Stop @ 145.33 1st target $139.30 Final target 135.47. In @ $143.23. Risking $2.10 for $7.76. (3.7) Probably hold over night as market seems to be defensive.

I noticed candles unable to break through resistance for several candles (wedge structure), plus double top compared to yesterdays (oct 18) chart. All markets trending down so I decided to take advantage here. $256.39 first target would be 50% fib retracement. Final target of $255. I bought at $257.70 with a stop loss @ 258.03 so 33 cent risk to gain $1.31 if I...

Above Moving averages, positive earnings, consolidating in pennant pattern. Overall upward trend. Low risk entry with good potential reward. Entry $9.37, Risking 35 cents

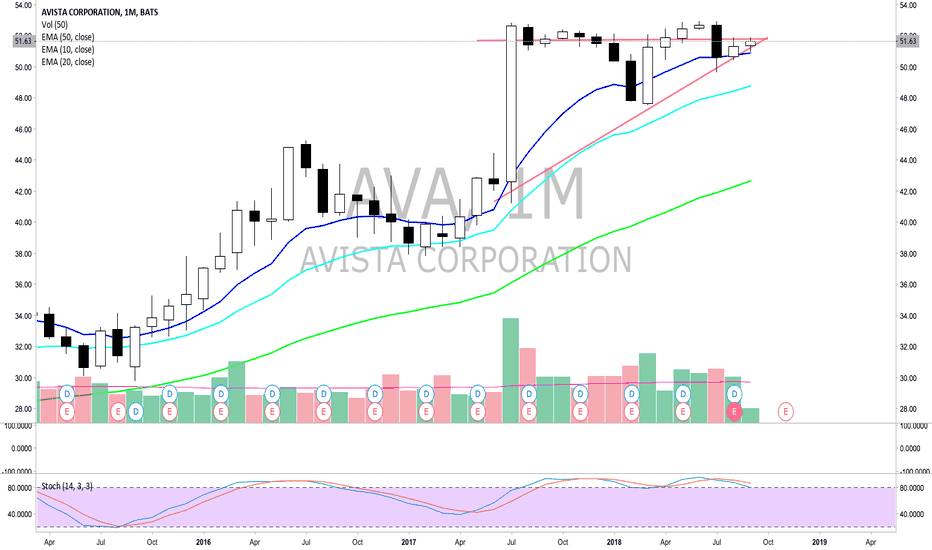

Bull Flag or Ascending triangle Pattern on the monthly, Low- Risk Entry, Accelerating Earnings, Dividend stock.