KT_Houdini

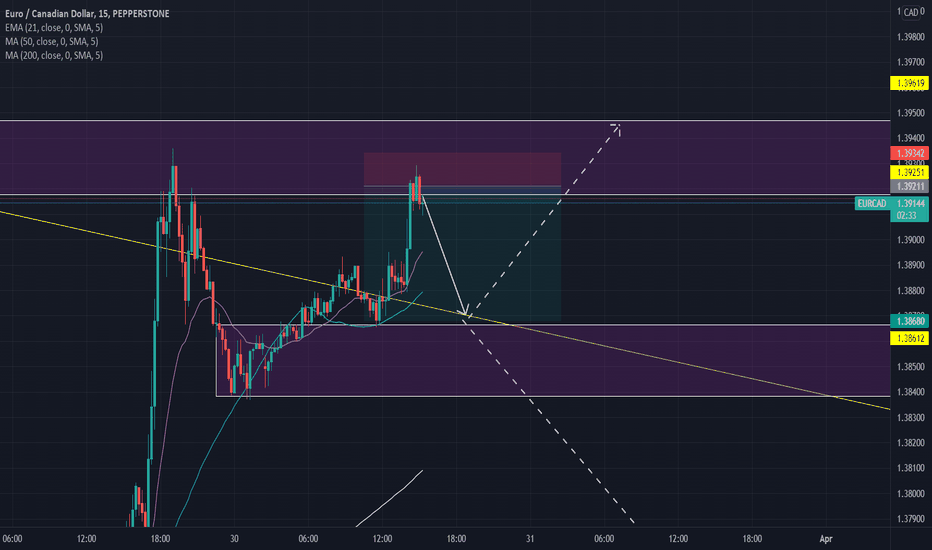

Bullish Flag retesting H4 supply zone, the 3rd overlapping touch marks the end of a pullback and the beginning of another bull run.

Head and Shoulder formation indicating Bullish momentum

Head and Shoulder pattern playing out and positive Pound news inviting bulls into the market

Currently looking to Short GBPAUD based on the previous day bearish engulfing candle and we find an order block or supply zone on the 45 min timeframe coherent with the bearish wedge forming indicating further decline of the pound against the Aussie Dollar. Price has retraced into my golden zone on my fib tool (61.8% - 75%) hopefully if the pattern breaks will be...

anticipating long opportunities around the 50% fib retracement zone as well as the H4 order block to confirm our Elliot impulsive wave analysis.

My outlook on the NAS100 chart is based on the fib retracement drawn after the bullish engulfing candle made on March 15 till date, as we see the market has retraced 75% showing some signs of rejection in my golden zone also supported by the lower band of my anchored VWAP tool plotted from the beginning of the year. However, nothing has been confirmed yet waiting...

H1 Timeframe supply zone retest with a bullish flag looking to complete its cycle

Capitalizing on the momentum built by the market in the previous weeks, we are witnessing a LH formation and a retest of a major supply zone with a tricky breakout pattern but we ride the momentum still. Remember follow your plan and execute keep in mind we in the NFP midweek so scalp as you see fit or swing if u have the balls for it lol.