Hit the daily R now its going to 58.1 more likely sooner than later.

Short opportunity presents itself. 4 hour looks like it will bounce but I believe it will be a fake out with many accumulating to short to potentially $44 a barrel in 3 to 4 months projected. over supply over stocked. factors include climate change awareness, potential tariffs, new tech energy. only reason this is going up is due to the long awaited IPO...

Fisher transform is about to turn suggesting down trend long term for the next month

AMD closed on $21.30 on Friday 30/11/2018 - on a volume of 80.9 mil vs a daily average of 109.4 mil with 1.5 mil shares traded after hours. Key price points Currently Pivot point sits on $21.06 with the first resistance sitting on $21.38 a break of this will move AMD towards $21.58 $21.90 $22.44 $22.56 . Below the pivot point of $21.06 will be...

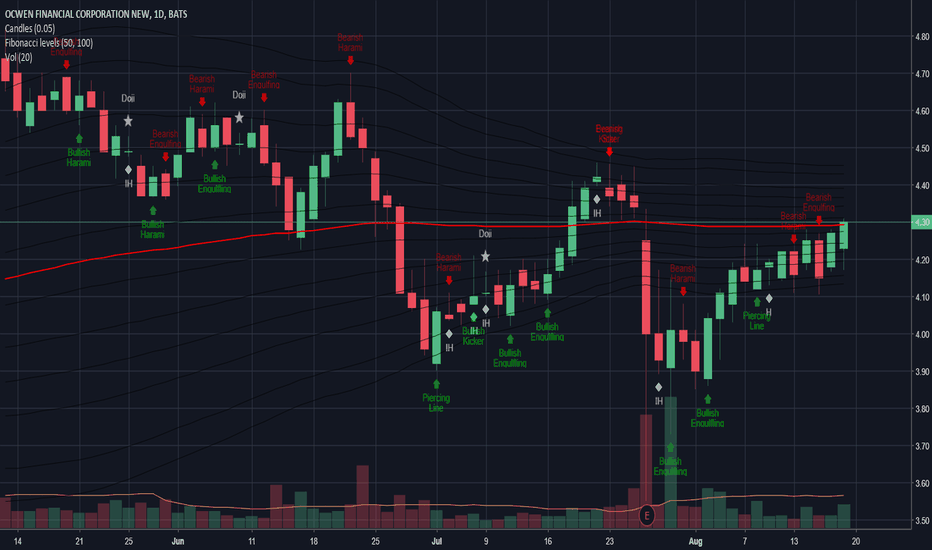

OCN closed at 4.3 on Friday. The average daily volume is about 750K with a 200 day moving average of 3.85 and a 50 day moving average of 4.23 can indicate an uptrend confimation. OCN still managed to close also above the 20 and 10 day moving averages which is a good indication of short term uptrend. It is still up over 40% from January YTD. ADX is above 29 (...

WMIH will be a possible swing for next week. The average daily volume is over 3 million. WMIH on Friday closed at 1.57 which is above the 200/50/20/10 day moving averages which shows a possible UPTREND. Although ADX is just over 19 which may indicate a flat trend overall there has been a volume increase in the last two weeks as well as a positive price action....

EKSO closed at $2.72 on Friday it seems to have broken out on the 08/07/2018 after earnings and continued to swing up to the 08/15/2018. It looks like it pulled back on both Thursday and Friday. Average Daily Volume is about 885K. It has been able to close above the 200/50/20/10 day moving averages which shows a possible new uptrend forming. ADX is over 48 (...

Mu has now confirmed a new down trend from last week. Possible articles and outside factors can include the down trend of bitcoin and the crypto currency market for this GPU manufacturer. Currently MU is closing above the 200 moving day average of 49.83. It is however closing under the 50 day moving average of 55.63 to me that is a possible indication that the...

NIHD also had a volume surge on Friday it is currently OVERBOUGHT with a high ADX of over 34 +DMI is over 31 and -DMI is over 10. It managed to close over the 200/50/20/10 day moving averages. Entry/support is currently 3.09/3.12/3.21/3.38 Pivot is currently at 3.49 Resistance is 3.59/3.66/3.77/3.93 I am currently looking to enter this at 3.21 to 3.38 if...