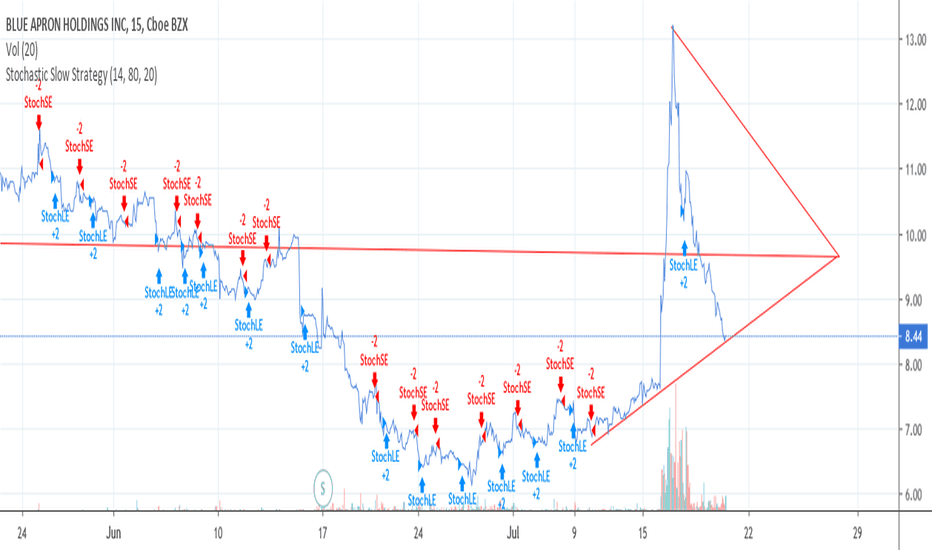

In the short term, I expect a squeeze to the 11- 13 area and if it holds, a return to 20.00.

Bears have dramatically discounted this already over-discounted stock... Honestly I'd definitely look to buy anything below $4.60 (if you can!). I don't see these prices lasting long. As with any stock that is bottoming, don't go all in thinking it's at a bottom and then panic sell because it drops (or goes up) 10 or 20 cents. That is exactly what caused this to...

Another short opportunity has presented itself just a week after the last! Short above 140 and cover below 126.

Roku's recent volatility makes it vulnerable and a decent swing trade for short sellers. And if it breaks 119 then the profits are much larger!

A few days ago ADXS spiked to 60 cents premarket. But it closed at 44 cents. Now it's presently oversold and looking to bounce back to the resistance levels. The Enterprise Value to EBITDA is 0.55 so I think 50 cents is a realistic target to get to. Buying anywhere below 36 cents is a great deal as it's the first and least difficult resistance level to break.

GHSI recently peaked at $3 and is trading below 50 cents currently. Potential upside is over 60% making this a great buy for anyone looking to ride the wave up. I would not hold beyond 50 cents. Day trade only

GHSI has recently peaked at $3.05 and showing signs (again) of a reversal. Volume has been steadily increasing. Not a lot of sellers below $1.80 so a good opportunity for a decent swing trade

My previous charts failed so this is my last attempt to chart this stock. This chart is a little more conservative. Target is $1.80 - $2.00

I think we will make it to $2.40-$2.50 as I don't see many sellers below $2.00

Riding this up to the resistance. Let's see if we can break it!

Overvalued and overbought. To swing trade on the way down... Short/Sell when the 14 day RSI is above 70. Cover/Buy when it's below 45.