Nasdaq100 has had an extreme overperformance relative to the broad market and all other sectors through many years. This trend may continue for the long run, but for now it has reached extremes and we have a few warning signals on the charts: Weekly: - We have seen a positive momentum divergence developing for weeks (reflecting in haDelta+, haOscillator and...

Spot setup is absolutely neutral, forward indication is slightly bearish. Market will likley be stuck in 3200-3400 range until US Elections. Momentum indicators started to cross down. Bulls might try to force the index above 3400, but it would be a very difficult fight for now. I expect the market to top within 2-3 trading days and turn lower in the range. For...

Copper has been one of the best performing metals so far, but are things really that rosy to justify such a high price after such a long bull run? Here are few points that worth to examine: - The trend is still bullish, but I see a minor negative momentum divergence on the daily haOscillator, haDelta+ and EWO. - There is a possible bearish wedge being formed on...

In case Bund fails at Kijun, and can't recapture the bullish trend, it will drop to 173-173,60 zone into the cloud. Watch for further indication of momentum: a cross down of haDelta+ and haOscillator at their mid lines would be a bearish indication. The same is true for US 10y Note (ZN) with 138'05 possible short term target. Surprisingly the two move together...

Gold: Nice and smooth bullish trend. Very comfortable long position even in larger size. Silver: Bullish, maybe a bit of short squeeze too. Momentum is increasing. Copper: Despite all the fears regarding global real economy, copper is also marching up with strong momentum, it doesn't show too long consolidation periods and dips on profit taking are shallow. As...

Ichimoku setup is bullish: bullish T/K cross, Senkou-A started to point upwards, Price is back above Kijun Sen. Heikin-Ashi indicators cross up above their mid lines. A close above 1760 would open space to 1900-1950 target zone. Stay long and add to positions.

While the price is still stuck in a range, there are some early bearish indication for USD Index. - Price could not break and stay above Kijun Sen this time. It runed lower, and if price pressure persists, then... - … HA indicators will cross down at/below their mid lines. It would be a further signal that bearish momentum may accelerate - There is an obvious...

MJ ETF seems to break its first steep and quite long term downtrend line. - Ichimoku stup is neutral with bullish bias as forward Kumo has already crossed up, Price is above Kijun and cloud. - EWO (AO) is positive - It should make a higher high above 14 (which is weekly Kijun Sen level) to give a confirmation and increase odds for a sustained bullish move towards...

A) Market gets some kind of bid around monthly support of 2050-2200, we see a bear market rally to 2600-2700 breakdown point and later this year another leg down to 2008 highs at 1550+ points. B) Things go really nasty, tech giant stocks get a real hit too, ETF run starts by private households and liquidity dries up totally: in this case and market simply...

- Bearish indication by Ichimoku trendfollowing system - Momentum indicators are close to deliver a bearish signal - Price seems to fail at Kijun Sen (26 days avg) bearish support We sold some this morning, waiting for a confirmed HA sell signal to add.

- Ichimoku setup is neutra, with bearish bias ahead as forward Kumo already points down. - Price is attacking 9,0895 key level - EWO is turning to bearish - Heikin-Ashi signals bearish pressure Possible target is 8,89+, where we have weekly Kijun and

- Price finally closed above the long term (nearly 2 years) down trend line. This also makes a breakout from the bullish wedge. - Price is above Kijun, Kumo cloud, quantitative HA indicators turned positive above their mid lines, and EWO is bullish too. All positive. - We also have a medium Strong bullish Tenkan/Kijun cross (within the spot cloud), and Senkou A...

Sooner or later the correlation needs to turn negative again -> means tighter yield spread vs higher EURUSD price.

A break is close. Should it close above 1,1100 on a Daily basis, Ichimoku setup would turn to bullish and price can target 1,12400-1,1300 zone in the first round. Please note how the weekly wedge is getting tighter, and how the weekly momentum indicators just crossed up. Sooner or later the spread compression in EUR and USD rates will matter too.

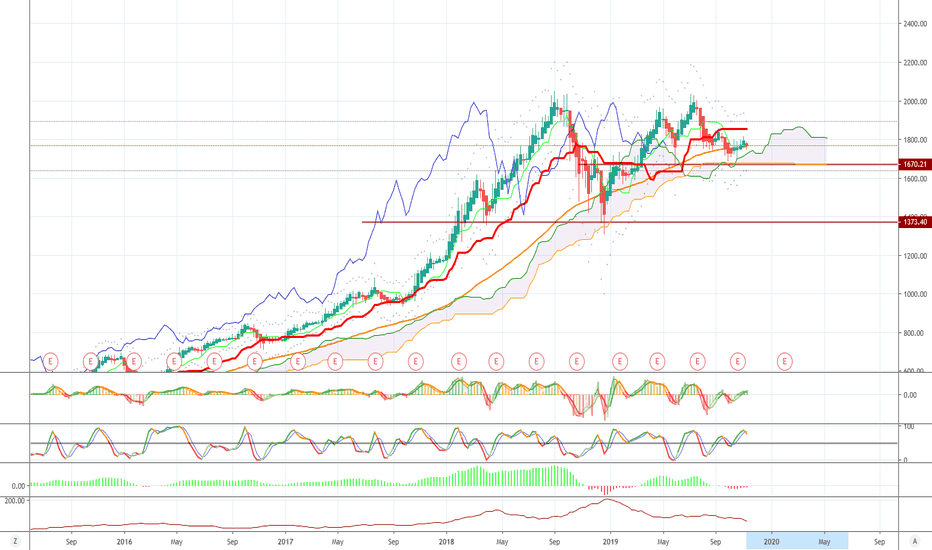

Amazon, one of the biggest companies in US represents the US consumer itself for many of us. The share's price action and the momentum gives some technical signals on the weekly chart, that call for caution. - Ichimoku setup is neutral, and is vulnerable until price is below Kijun Sen (26 days average at 1850 USD) - All momentum indicators have bearish bias: ...

Based only on the Daily setup, it is trading at a support zone of 1,1040-1,1080. If we had to chose, it is rather a buy here, with an initial stop at 1,0975. Watch for change in momentum! Real bullish breakthrough would happen only above 1,1225 and 1,1330 (set by weekly key levels)

Looks like a range, and despite the recent bearish bias and pressure it cannot be considered strategic bearish until it proves with a lower low on close below 51, which seems to be quite Strong supp/res level (so far 4 attempts and failure to break below) Looking at Heikin-Ashi indicators below, it will likely consolidate or slowly drift higher towards the 56 mid...

Left chart: 10y yield spread between US Treasury and German Bund - 6 years bullish trend is broken. Yield spread started to tighten: dow to 212 bps from 280 bps a year ago. - Technically it is firm bearish now, which means that as FED Will likely act and ECB has not much more room to move, the yield spread Will collapse further. (Also US 2s/10s bullish curve...