Kyriakos_CFTe

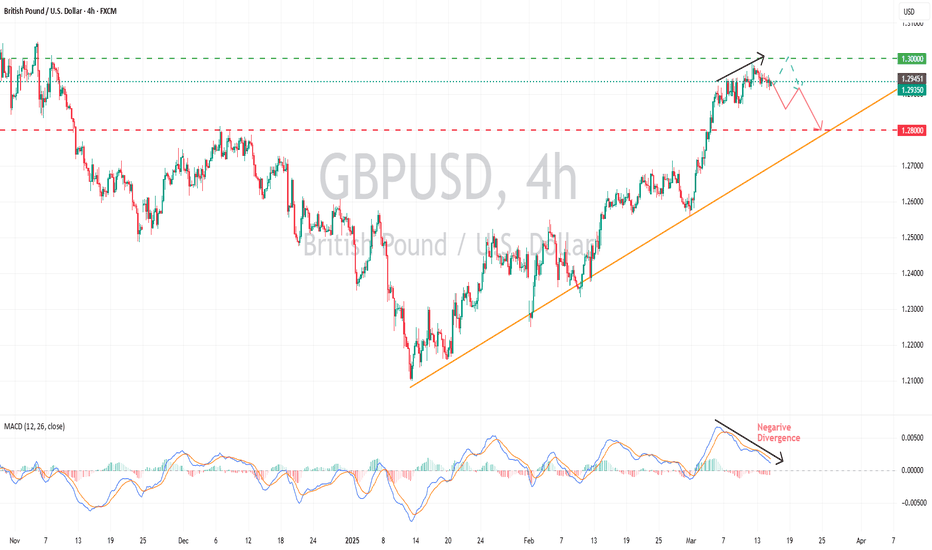

A retracement back its upward trendline is probable with MACD bearish divergence. Price currently consolidating below the major resistance level of 1.3000. Target Price: 1.2800

SOLUSD is building up a bullish pennant; This pattern indicates buyers are consolidating above the major resistance level at $200.00. A valid breakout will validate the pattern, with the next target at $290-300$ and FIB extension level 1.272.

Crude Oil is trending lower with lower highs and lower lows, though price aggressive bounce backs and retracements indicate a non-trending market. The recent penetration of the 68.00 price level (year to day - low) and retest of the 65.00 level, imply the price is heading lower. However, the price rebounded at the second retest of the level and currently trading...

Following the price retracement of the double top pattern, the price target has been reached. A further continuation lower is anticipated. The next target ahead can be set around 1.0700 where a further continuation lower set the 1.0650 and the 1.0600 under the scope as the US elections are round the corner.

Price has retested the 1.1200 major psychological level and followed a retracement lower. It then violated its psychological support level at 1.1000, validating the reversal pattern double top. The minimum measured target is sitting at 1.0800.

GOLD has been trading in a range bound over the last 2weeks waiting for the unemployment releases this Friday. However, a retest at its recent level of 2.476 is expected. If the level holds and the price bounces back, a new high may be underway following the expectation of a cut rate. Alternatively, a further continuation lower toward to 2,450 is under the scope.

SOLUSD has been trading in a big range after its retracement from its high of 210.00. Price has recently retested the 120.00 price level and MACD forms a bullish crossover while remaining below 0, with RSI consolidating just below level 50. A higher continuation is anticipated with a 163.00 price level on the spotlight.

AUDUSD has been stuck in a giant range of 0.6300 - low and 0.6900-high. Following the strong bounce back from the 0.6350 price surge. Currently trading below its 0.6800 price level with MACD in bullish territory and fresh bullish crossover above 0. A further continuation higher is anticipated with the next probable target 0.6850. A continuation above the level set...

USD has been losing its steam against JPY. Price broke below its upward trendline and followed a strong break-out where price continued its downward momentum till 140.00, which is currently consolidating. A further continuation lower is anticipated with the next probable target at 137.30 where a continuation lower set the 130.00 psychological level under the spotlight.

GBPUSD has been trading in an upward channel, where the price retest it-retrace lower and a second attempt followed. As the price failed to reach its previous high at 1.3238, a further continuation lower is anticipated with the next probable target at FIB level 50 - 1.3115.

A possible bullish flag is under development, pointing to a price level 75-80$ which was the previous point of interest (Supp&Ressi). Fibonacci extension 61.8 is coming aligned with the flag pattern target at 140-145$. Additionally, the most recent resistance is coming from April 2022. Let's see how will develop, a pullback at 75-80$ with a strong bounce back...

EURUSD formed its 4th Elliot Wave at Fibonacci 50% retracement of the previous swing. A bounce-back move is probable with Bullish Divergence on MACD. Target could be seen at 1.1285 where the weekly resistance laying along with the weekly downward trendline.

S&P 500 reached its All-Time High at 5,669.67 on 16/8/2024 and followed a second attempt to breach this high on 26/9/24 and form a lower high at 5,661.62 where the price currently continues to trade lower. The pattern can be seen as a double top or failure swing (either hasn't developed yet) indicating a probable major reversal. A bounce-back attempt can be hidden...

While DJI generally looking bullish trading in an ascending channel, the momentum price reacted at the upper band of the channel and retraced lower. Following a second consecutive session lower, a further continuation lower is anticipated with the middle level of the channel at 4,250 to be a reasonable target price for a price reaction. For the long term, bullish...

USDCAD is trading in a range-bound market, where the price recently retested its 1.3900 psychological level and retraced back lower at its current level. Although, as the short-term persists in a downward momentum, a further continuation lower is anticipated with the first target at 1.3365 where a further continuation lower set 1.3180-1.3150 as a second target ahead.

Crude Oil has been trading in a range with a high at 84.30 and a low at 72.53. Price recently bounced from its lower band at 72.53 and currently trading higher. The Stochastic oscillator formed a bullish crossover at its oversold level indicating a further upside move, with the next probable target at its recent high of 80.24.

Visa coming from a strong upward momentum, where over the last 5 months price has been trading in a descending channel. Price currently retracing from its highs at 269.52 with MACD in bullish territory with convergence moving averages. A retracement lower toward its support level of 259.38 and the middle level of the channel.

USDJPY following the strong upward momentum, price broke below its valid trendline and bounced back retested the level, with volume activity increasing as the price was falling. The stochastic oscillator has formed a bearish crossover at its bearish territory below 50. A further continuation lower is anticipated with the next probable target at 140.00