L-Lawliet

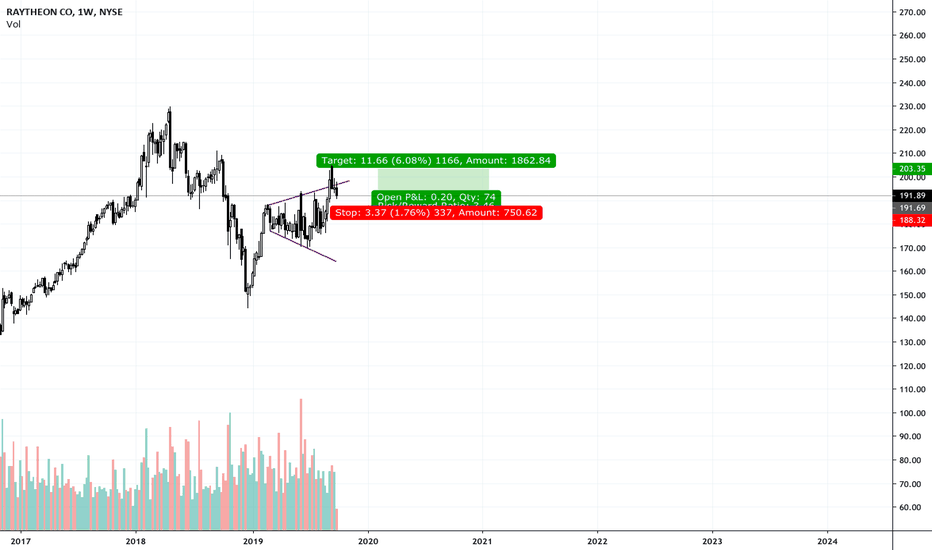

So this is more about finding a way to write all my calls and ideas and be accountable. But I see a broadening wedge on Raytheon , I would hope RTH, would go above the top line and use that as support, The current geopolitical environment with Iran , is one of the reasons why I think RTH, may be a semi-ok play I feel more can happen that would make a RTH, bull...

Some news on an Altari (MO) merger due to poor results, - PM has hit support 5 times and bounced off, I will follow my ta and stop loss in profit , 3 quarters would be a nice holding period for this, but I may close this as soon as we get to some profit.

So this stock has been hammered from ATH, 84. was high and 48 seems a bit low, im going to hopefully play till around october 25th, if i can get an entry at 45.17 ish , i dont think this well be hit too hard by china, a bit of pressure on gamemakers from the shooting dropping it lower might help lower entry, this could be an issue, they have an over-reliance on...

So this my rough idea or take on the market - Where we are right now I have a +/- 10% range each way this is where I think we will realistically stay until , nearer the 2020 election where I will re-evaluate , based on data, I think the downward pull of confluence i.e Debt, Low profit, trade, will always be mitigated, by some policy or at least attempted to be...

Tesla @ 182.51 is where I go in at 5% of my portfolio, - if it flips and gives me a little profit, I may go tight SL and trade around this level looking for scalps and swings, seeing as it it more downtrending at the moment I dont think it will bounce so thats not likely Telsa @ 142 is where I go in at another 5%, Not sure If i will sleep in this position it may...

After looking at the 08 crash , I extrapolated the percentage loss and applied it the 25,000 peak double top seen in 2018 - this is not really based that much on fundamentals 1. nike beat earning popped 7% dropped then followed the general pattern of the market) - some could argue that a bigger percentage loss is possible , due to corporate debt mainly, After...

A look at caterpillar stock Blue == Monthly Day == Weekly

As a new company it is hard to see how the 08 crash can be translated , so I took Mastercard @ 50% and American Express @ 84%

A look at JNJ, A lot more weekly and monthly points where I see some resistance happening

This is an interesting one coming into focus more in the last decade , the crash used was the 2000, as it had the highest percentage drop. Blue == Monthly Red == Weekly

A look at Goldman , this is a younger company than most and seem particularly vulnerable to a financial crash I used mostly monthly resistance, very rare will weekly matter in this case

Again this stock has a higher run up and not much data available at the higher end Unlike the other stocks a drop in price nearer the 2000s , was significantly more comparable to the 08 crash, Cant see much support with the VPVR at the higher time frames

A bit more volume traded at higher level, some more tested supports and resistances VPVR only checked at the monthly levels, I don't think daily and weekly will matter to much in the downtrending market Blue == Monthly Red == Weekly Pink == Daily

Same with BA (Boeing) had a huge run since 08 Very little in way of support and resistance until we go back down to 08/09 level Some weekly resistances in red 1 Monthly resistance in Blue

This is a brief look at some support and resistances on the dow - ( I am not paying any attention to fundamentals or earnings recently - ( nike beat earning broke away and fell again i think the same principles apply) - i will look into fundamentals at a later point and add it in BA , Has had a very good run since 08, so there is very little volume at the higher...

This is a brief look at some support and resistances on the dow - ( I am not paying any attention to fundamentals or earnings recently - ( nike beat earning broke away and fell again i think the same principles apply) - i will look into fundamentals at a later point and add it in BA , Has had a very good run since 08, so there is very little volume at the higher...