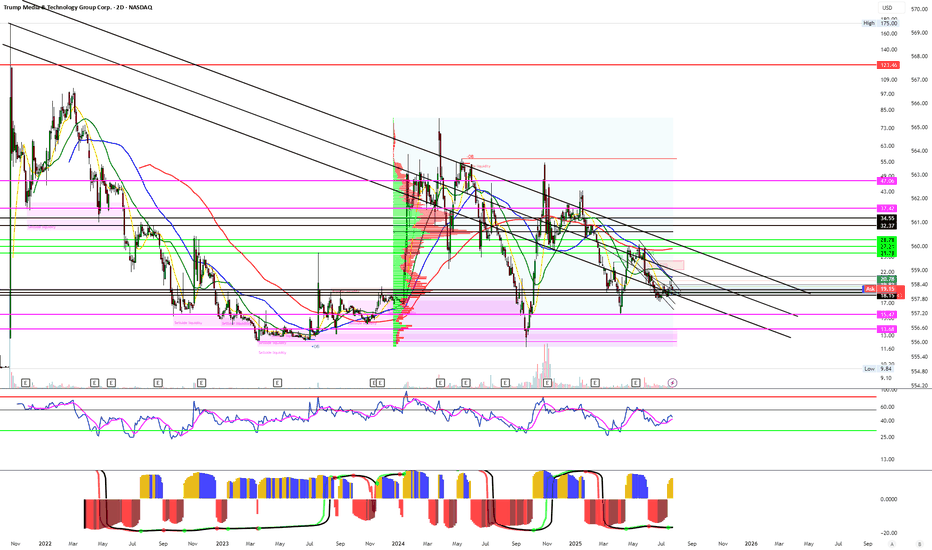

LeapTrades

PremiumTA aside, fundamentally its a no brainer. No matter how much you hate him, there is no reason a stock that has half of its market cap ($2 Billion) in CRYPTOCAP:BTC should stay at the market cap of $5 Billion. Next time there is a pump rally in Bitcoin, this thing will join in on the fun. $47 is not unrealistic. That would set the stock at around a $10-$15...

Target has been re structuring there entire business after DEI was taken away. I think they realized that going down that path is not profitable and would bankrupt them quickly if they continued. They boosted security measures and also strengthened there online store a lot. Target #1: $116 Target #2: $120

May 13th there will be a press conference with the CEO I think. All techinals show a sharp fall will occur soon and I bet its the 13th. Reached the top of the trend line and we are very over extended. Ying and a yang, time for the yang. See my price path for a rough guess.

All indicators such as RSI, descending channel pattern and MACD combined with options exposure make me believe earnings will be good in the stock prices eyes. IWM and small cap stocks are really starting to pop off and nothing is more American then WD-40!!! Target #1 - $240 Target #2 - $250

Huge flag on the weekly. I am seeing it at its largest support level it has dating back to 2017. The next year for crypto will be a boom or bust.

Well well well, Walgreen's is definitely going to try and redo there entire business model in order to save it. There are some weird and unbalanced volume levels left behind that I think we will see again this year. Target is $12 and depending on this earnings, I don't know when it will hit. Shares only.

We have a lot of $10 call options on every expiration date for the next few months, meaning this move might take a while to play out. Unsure of exact date if its earnings call or news but $10 seems to be where the focus is. If tariffs begin or effect Brazil negatively then this stock could plunge on low growth anticipation. Watch very very closely on how price...

With the bill passing and TA indicators popping up. I see these long term channels starting to break and the entire price action start to flip to the other side. Watch the break and retest, especially if we see a spike in volume soon. Really hard to lose long term with this one.

My price path seen above is a complete guess but it stems from long term trend lines and more importantly order flow from last week. On Thursday there was a #1 trade on AMEX:PHYS for $200+ Million at the green levels in my chart above (Equivalent levels). PRICE WILL 100% go to my green lines by end of this week 04/25. We are over shooting the dark pool sale...

The descending channel pattern is always my favorite. Mixed with RSI, channels aligning with gaps and volatility being at $20, its a good chemical mix. AMEX:SOXS to $10 can happen quickly but I think the move will be sharp and quick. Long term bearish signals forming to. Lets see where it goes!

I am seeing a clear break of structure with a large liquidity gap above at my red lines. With benefits to pharma tariffs being lifted it will provide bullish narratives for exporting our pharma production. I honestly don't know much about the stock, but the technicals add up here. Bearish thesis is a gap down to grab liquidity for long term.

First target is $25 and the $30 once we start to see price move closer to its volume profile gap down at my pink lines. The key price level I see for support is 12.62$ but honestly, this looks like it could rip any day now. Im longing until we break below $12

Target level is $415 to $400. Political news will most likely influence this move. Earnings were great. Huge volume profile gap that I think will be closed. Watch out for another bull trap soon, but I think we just peaked.

As seen in the chart, we are at the top of the range with highly over extended price movement and hitting the largest target number at $400 which has been sought after for months. I think a snap down to $360-$350 is inevitable. If we do pop up to $420+ then its a blow off top unless market reacts positively to government involvement to crypto.

Long term buy structure forming now. Large volume sweeps and blocks are being made here. Very large trade at this level happened last week and I think this is going to explode in the coming weeks/months. Target #1 - $35 Target #2 - $40

At the very moment we saw big rejection in this golden pocket zone were in right now from the descending channel its been in for a while. This tells me that the market makers are creating liquidity at this level potentially to revisit at a later date. We could quickly see this go to $6.35 or $5.40 which I would be a major buyer at. Still in the longer term...

I am seeing put open interest and volume spike for PUTS expiring 04/25 for a strike price of $55 that were opened YESTERDAY... There is over 60,000 contracts open and rarely do these not play out. It has been my long term target to hit $65 - $60 even before NVDA split there shares. Lets see tho, the tape for options expiring in late June look bullish at the moment

With the future of the car industry looking dark and bright at the same time, HTZ has been over sold and bullied hard since its last pump with tesla ect. My long term target I know it will hit is $8 over the next year. I rarely call on meme stocks but no one is seeing this one coming ;)