LeonardoSousa

After breaking it's strong Descending Trendline, NZD/JPY has been moving on an uptrend, respecting an Ascending Trendline, and it's now reaching a strong Resistance Zone 1 that coincides with the 50% Fibonacci Level so price is most likely to reverse at this area and move to the downside, before breaking Resistance Zone 1 for further highs. Also, RSI is showing a...

EUR/USD has been on an uptrend on a macro perspective, having made a correction and being now sitting at Support Zone 1 and touching the lower trendline of it's Ascending Channel. Two possible scenarios: Long: -If price fails to break bellow Support Zone 1 and the trendline, making a rejection at this zone, a continuation of the bullish trend may be on the way...

USD/CHF is showing a clear reverse head and shoulders pattern, which indicates a possible trend reversal. However, the edge of the last shoulder intersects a strong descending trendline and so there are two possible scenarios: Long: -If price clearly breaks above the Resistance Zone as well as the trendline, wait for a retest and look for a long entry; -First...

Looking at the weekly chart we can see that NZD/CHF has been on a downtrend since 2015. After making a lower low at 0.53, price has been making a correction and is now almost making its 3rd touch on the descending trendline as well as the Resistance Zone at 0.6400-0.6550. The most likely scenario would be a rejection of the trendline and Resistance Zone, heading...

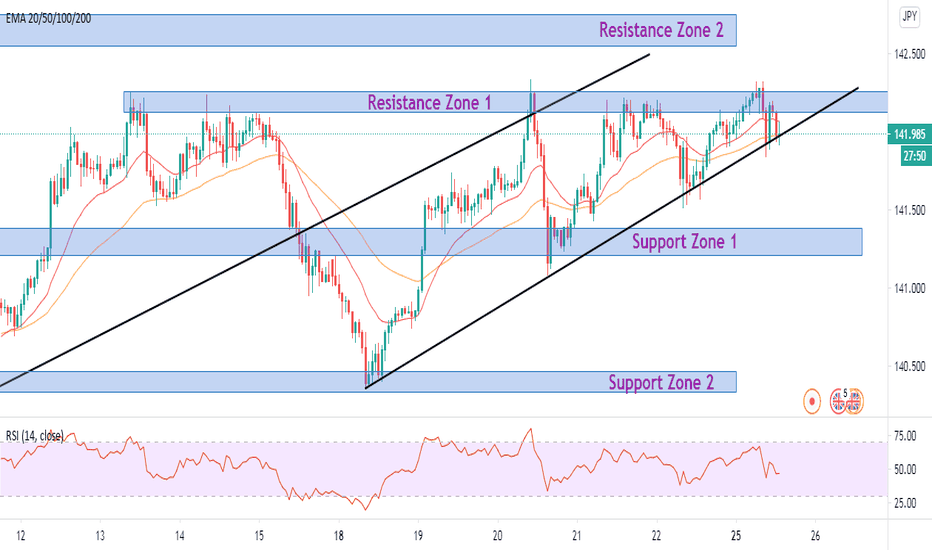

After breaking a major trendline, GBP/JPY came to retest it and it's been forming an ascending channel, although it hasn't been able to break Resistance Zone 1. -If price breaks the ascending channel to the downside, wait for a retest and look for a short entry with possible targets at Support Zone 1 and then Support Zone 2; -If it keeps respecting the ascending...

After breaking our Ascending Trendline on January 15th, GBP/JPY is now retesting that same Trendline, which coincides with the Resistance Zone 1 at 142.12-142.25. Price is looking very bullish, so the retest and continuation of the downtrend, after the break of the Trendline, might not happen. -If we see a good rejection at the Resistance Zone 1 and Trendline,...

After a false breakout of the Ascending Trendline, GBP/USD continued its bullish move and is now at a Resistance Zone at 1.3695-1.3710, with its RSI at extremely overbought levels on the 1H Chart. Here are the two possible scenarios: Long: -If price consolidates around this Resistance Zone and breaks it to the upside, wait for a retest and look for a Long entry...

After the break of the Ascending Channel and the Ascending Trendline, EUR/JPY has been on a downtrend, being at the moment sitting on a really strong psychological level, the Support Zone at 125.00-125.15. Since it'ts impossible to predict the market, here are two possible scenarios for this pair: Short: -For this downtrend to continue, price will most likely...

This is a possible LONG trade for the reasons pointed below: -BTC touched a strong Ascending Trendline and rejected it with an engulfing candle on the 1h Chart; -This touch on the Trendline coincided with a Support Zone of 33400-35000; -It also coincided on the Fib Retracement's golden zone of 0.618-0.65; -After the touch, price went up, retraced a little bit...

GOLD has been consolidating on this purple box for the last week, with its RSI being able to breathe after hitting oversold levels. It's now sitting at the Support Zone 2 and at an Ascending Trendline, after breaking a smaller one. -If price breaks the consolidation box and Support Zone 2, it's very likely for us to see a continuation of the downtrend. Wait for a...

GBP/CHF is near to reach our Resistance Zone 1 at 1.2180 - 1.2200 which is inserted in the bigger and stronger Resistance Zone 2. You should also have in mind that RSI is now at overbought levels. Because we can't predict the market, we should wait to see how it behaves and here are two possible scenarios: Short: -If price rejects the resistance zones, it might...

EUR/GBP is currently following a descending trendline and it's approaching a Resistance Zone at 0.8940-0.8955, leaving us with two possible scenarios: Long: -RSI is close to oversold levels, indicating a possible reversal; -If we get a good rejection candle at the Resistance Zone, price might reverse and head to the upside, at a first instance until it touches...

After rejecting the resistance zone of 3.8 for the 4th time, with a bearish engulfing candle, EOS is making its 4th touch on an ascending channel and might break it to the downside. -RSI is making a bearish divergence; -If the ascending channel is broken, the next target should be the Support Zone around 2.3; -For a safer entry, wait for the break of the channel...

After hitting the resistance zone of 1960 (Resistance zone 2), created in November, and after making the 3rd touch on the lower trendline of the ascending channel, GOLD started a move to the downside, breaking that same channel and hit 1830 (Support zone 2). Before entering any positions, you should take this into consideration: -Price broke below the 20 and 50...

This pair is right now at a resistance zone between 1.7270 - 1.7300 and the 2 possible scenarios are: Short: -RSI is overbought, indicating a possible reversal on this zone; -If price rejects this resistance with a good confirmation on the 1h chart, we'll be looking for a short position. -First target around 1.7150 Long: -If we don't see a good confirmation of...

This pair is right now at a big support zone so here are 2 possible scenarios: Long: -If price rejects well this support, with a confirmation at least on a 1h timeframe; -If it makes a consolidation and we see a good candle (1h timeframe at least) breaking to the upside; -First target at 0.6060 Short: -If price breaks the support with an impulsive candle at...

EUR/AUD is right now making a consolidation on a strong resistance zone between 1.6586-1.6585. Two possible scenarios are on the table: Long: -Wait for a confirmation. An impulsive candle breaking to the upside of the resistance zone would be a great opportunity to go long with a target around 1.6750. Short: -Wait for a good candle closure below the 20 EMA on...

After breaking an ascending channel, price made a re-test at the 74.50-74.80 area and continued its way down. At the moment, AUD/JPY is testing the 72.40-72.60 support zone. Since this is a volatile market and anything can happen, here are 2 different scenarios: -If we can have a clear break of that zone to the downside, wait for a re-test and look for a SHORT...