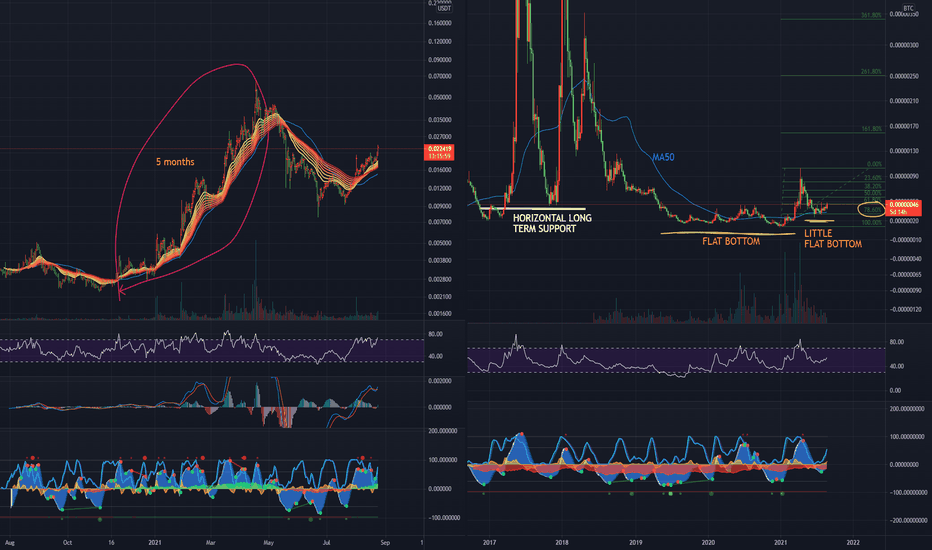

Comparing the daily SC chart to the weekly BTC chart, and their interactions with the respective 50MA's provide a good template for what to expect here. The market structures are practically identical, be it on different time frames. I'll be holding this until at least December I expect.

Left: Daily SC/USD trading above MA50, above the ribbon. Solid bull. Buy any retracement into ribbon. Weekly SC/BTC... Flat bottom. Bump signal. 78% retracement entry from Wave 1. Huge upside to reclaim on coming waves 3 + 5.... 160+ sats first target. High as you like thereafter. This is not a quick flip, but the coming weeks and months look spectacular for Sia.

Left side view: 6month wycoff re-accumulation model. That I believe fits fundamentally, with whales offloading at 50-60k and are now re-buying at 30k. Right side view: A bullish harmonic on the daily. That should run its course in the next week or so, where I would expect things to push up towards the 40k area. Commentary: Ignoring the Binance regulatory...

Incredible similarities here! And as with any significant volatility - expect reversion to the mean. And in this case; that's a good ROI forecast for the next month or two.

Thinking macro for a minute... where are institutions going to accumulate Bitcoin? Answer = A long term sign of strength area. Buying the bottom is for dreamers and believers. That is risky. Most corporations are not interested in such speculation. However, each time Bitcoin starts a new halving cycle, and creates new all time highs, it creates a cycle breakout...

I am a fan of SC, and long term I think this is a good buy. But if BTC doesn't pump today, I am expecting that to take a serious dip over the weekend. And looking at SCUSD; this could see some serious hurt in the short term as it drops to volume support, also high time frame horizontal support just under $0.01. Set some stops here, just in case! But that'll be...

Until the market prints a solid spring on enormous volume, don't bother buying any dips.

Expecting a second day in a row where BTC battles the impulse core at 38-39k region. If it can't power through that, and convincingly flip the diagonal resistance line of the falling wedge. Then I would expect the bears to take advantage of the low liquidity weekend, and print the spring that many have possibly miss-labelled the other day. Either way, expecting a...

Bitcoin seems to be riding the top of the previous pennant at the moment, where it's re-charging for an attack on the impulse core (1min chart) at 38-39k. The previous dip is being labelled as a 'spring' by many; but I am not sure. It was so very weak. That is either an incredibly bullish sign that the bears are exhausted, and Bitcoin is ready to fly again. Or...

The big picture on the left paints a fairly simple story... we broke out of the the horizontal range, and have retested the previous resistance for support. So after some consolidation, you would expect continuation to the upside. A 1.6 extension of wave 1 takes you to 160. And a 4.2 extension is way up there at 400+ sats. So there's plenty of potential...

High time frame view of SC/USD. On the left, you've got a simple cup formation, that seems to be mirroring the left side. We've currently returned to a strong support area, where we should bounce over some weeks. And if we go all the way up to the top of the channel, that's $0.30+ ... 15x or more your money from this point. Lovely! On the right, a multi-year...

Well my original SC buys are under water with SC taking the mother of all dumps as a result of the recent BTC price action. Creating one hell of a dip to buy! I have more than doubled down on my original (underwater!) investment here, at 41 sats. SC has fallen all the way down to 78% all time fib, 78% recent impulse fib, and an all time strong horizontal support....

We're 6 months into a 9 month bull market. The next 3 months should be the best bit, as it all goes parabolic. All the bearish chatter is just the manipulation machine doing it's magic. Buy, embrace the nerve-wracking few weeks ahead, as the market teases more downside, and then ride the elevator up to ~$170k

Looking at two previous times the 300MA daily came into play... on both occasions (bull and bear markets) it bounced back to the 100MA. So there should be a long trade here either way!

Anywhere 66 sats and under is a good place to buy IMO. I am thinking this does one more up and down within this range until the 8hr 200MA comes into play and kicks off the moon mission. Historically... in a week or so we have precedent for the all time high run from 2017. Bitcoin is also presenting much the same mid-point bull run dip / cool off that triggered...

So it seems like BTC has reached a mid bull run exhaustion climax, followed by a little upthrust, and now we're heading back to the bottom of the range for re-accumulation. The question is: What is the range? There's a few potential automatic rally points that could determine the bottom: ~48k, roughly where we are now. ~45k + wick (green box) ~40-42k falling...

Just looking at the previous SC pumps with the paraeye. We had the crossover week, then +1 red candle retracement week. Then both times we had significant continuation (3.6x and 1.6x). So... I will be looking for SC to pump to 153-310 next week. If not; take that as a bad sign, and find your nearest exit.

We have a classic wycoff distribution pattern here... The next phase is going to be an upthrust after distribution, and even if that fails, it'll typically reach the around the height of the buying climax, a full 50%+ profit from here. And if it doesn't fail, then it could take this coin into markup and onto new heights. So I would suggest a trailing stop; and...