LukeMifs87

GBP CoT is of a Sell bias for the commercial traders whilst the CHF CoT is of a BUY bias. Although this alone does not justify taking the trade, the Chart has broken its S/R levels.

- Great risk-reward profile - manage your position size to minimize risk - Never risk more then 5% of your account on a single trade - If entry is hit, might take a few weeks to reach its potential TP

Will TSLA break the $600 support ?

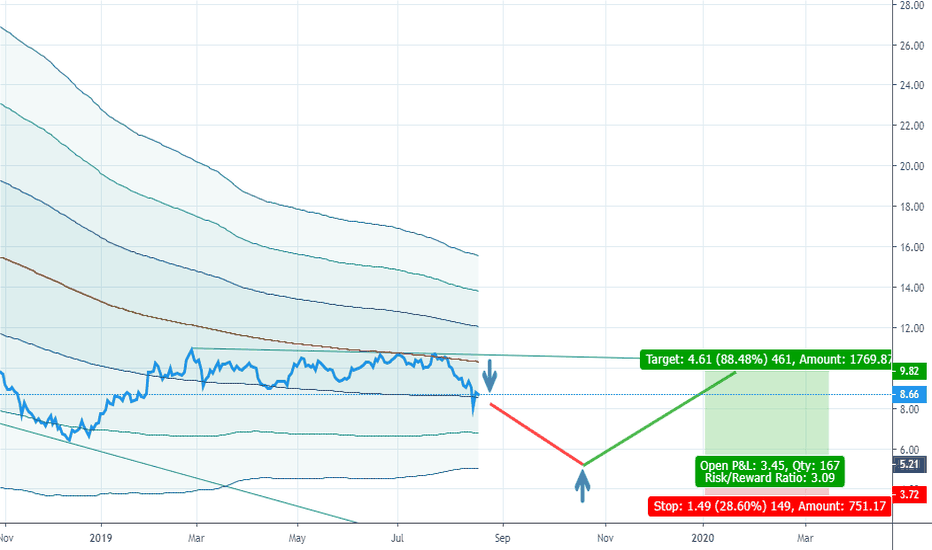

My trade strategy for this stock pick. Enter - LONG "GE" at $5.21 (if I'm lucky enough to see its price at these levels) EXIT - STOPLOSS at $3.72 & PROFIT TARGET at $9.82 Risk/Reward - 1:3

Fundamental: COT commercials are Long the NZD vs Short the CAD. This favours the possibility of an uptrend in this currency pair. Technial: The pair is very close to the 2std from the SMA. Only 6% of moves will go past this level. Profit Target: 0.9000

TLT seems to be in the overbought territory... looking to Short the TLT around the 151 level

Fundamental: AUD (COT) Commercials are long the Australian dollar vs CAD (COT) Commercials are short the Canadian dollar Technicals: Trading a 3std below 200 SMA on D1 chart Strategy: 3:1 Risk/reward ratio, Target profit around the 1std above 200 SMA Conclusion: Longterm trade