Lynx4x

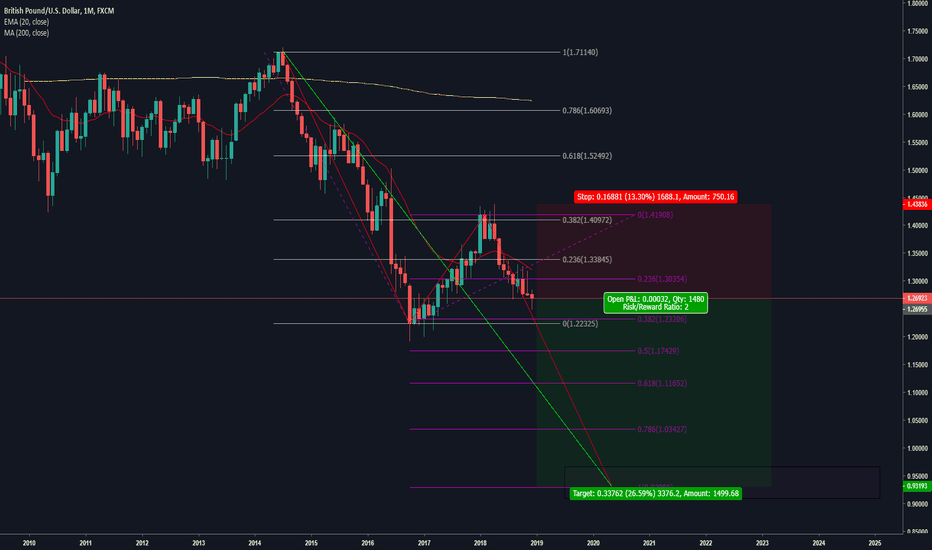

Spotted a H&S formation on the 4 hour chart. 4 hour chart is trading above a 200-MA and daily above 20-MA which is significant. Entry order is above break-line.

Fundamentally, I believe the U.K. will crash out hard from the EU causing GBP/USD to fall to parity. Coupled with weak GDP and rising levels of inflation, the economy is headed towards a recession in the coming year. Analysis was done based off a Fibonacci Retracement level from monthly swings to the downside. A further extension level was plotted, and with...

We are clearly in a bear market. All fundamentals are bearish, however we do have some over extension after a major sell off from areas as high as $1.31 to $1.276. Hence, a small retracement may be in order before the best possible price shows itself, which is when the bears will enter shorts.

So my overall sentiment for GBPUSD is bearish. For now. The fundamentals are weak, and it seems as though the USD is continuing to gain strength, as uncertainty and weakness in the GBP economy remains. For now, I expect to see a slight pull back before technical's take over and the market rally's down levels around 1.307. The interest rate decision will stay on...

hit a resistance channel fib retracement support

I don't expect interest rates to rise at all. Following technicals, I see a support zone around .618 fib level, which could be a potential target. Regardless, I see .5 fib being reached, meaning a price of 1.37047.

Seems as though a 0.5 level fib holds strongly. Bitcoin went on about 230%+ increase in this bull run and only retraced at most 33%. And the overall trend of the market is still very bullish. I believe this is a strong bull market coming on.

bearish Head and shoulder formation. Fib at 0.382 ($14,423.38) broke. Second resistance at 0.236 ($16,420.00) if zone: ($16,783.65 - $16,198.11) breaks I expect a bullish rally upto ATH of $19,000+ in New Year. Failing to break at ($16,783.65 - $16,198.11) I expect a pull back to zones 0.5 ($12,809.68) and second support at 0.618 ($11,195.98).