MAZing

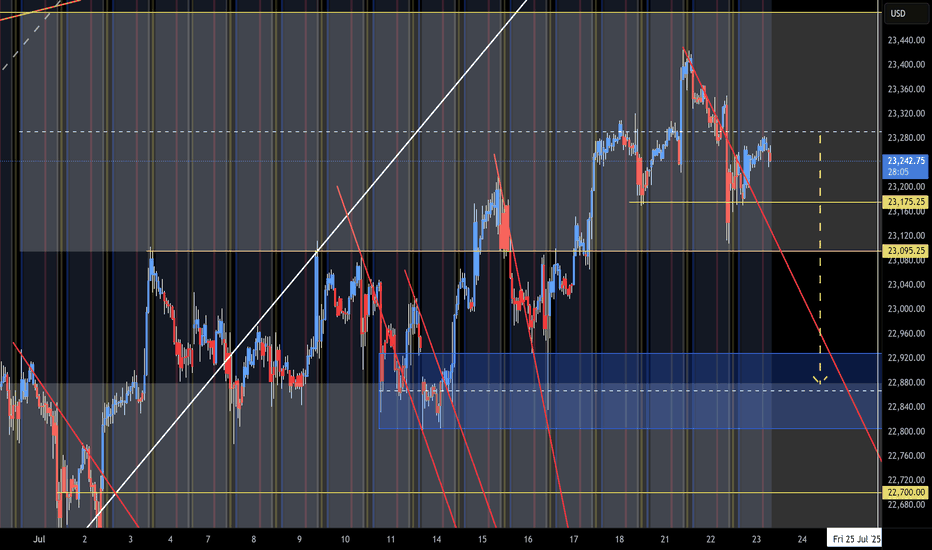

PremiumThe O/N slight lift back to Mid Level of range. The big Tweet regarding Japan, did show up after the close. Now we need to see how the Open Drive & Reg Session move today, may be snail lift higher 1st. The next bullish move would be F-M Long play. The selling just does not have much force or is part of the head fake prior to a decent drop test. Still Scalp Shorts...

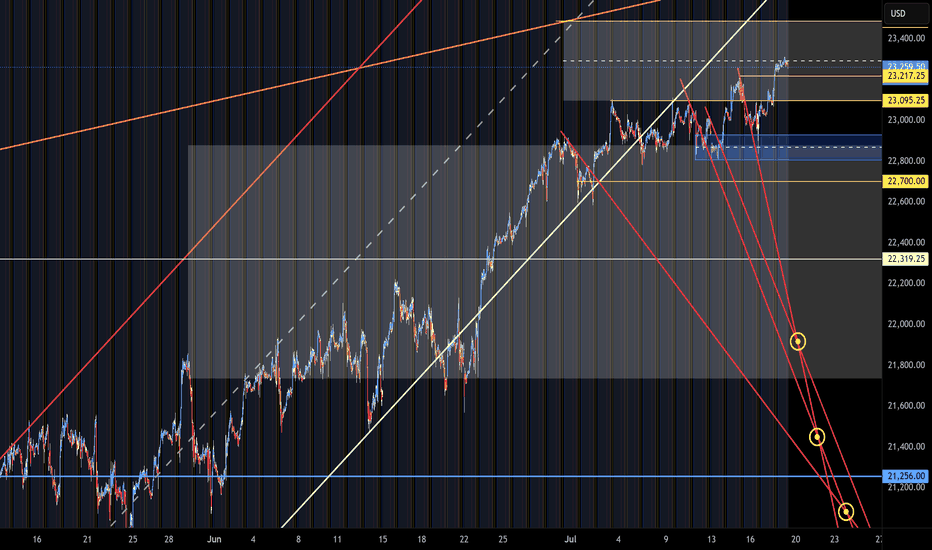

I have not posted a Target call in awhile, this one is Long to upper TZ (23,486) and Short to YTD Open level. Prior use of Diablo's to Target drop was prior to NAZ 25% drop (11/24 Post's). We are due for some drop retesting as we watch typical Long Side Tweets, Tricks and Games start to fizzle some. Today into Monday will be a key signal.

NAZ again can't hold on the Monday off session pump during the Reg Session and does hit lower zone of 22,920. Next trick is Gov't controlled news (released in off session of course) should that not lift it then KL's 881-780 may be next. The NAZ will go lower under 780 and will be a Strong Short under 22,700. The issue is with getting past the off session...

The NAZ appears to be due for a Drop Test back inside the lower range. F-M Long play and O/N lift moves seem to be loosing their effectiveness. Looking for a 22,300-200 target on drop and if not, look for U Turn under 23,300.

White arrow is stall/drop zone and yellow is strong short. The O/N continues to reset any drops that happen in most Reg Sessions. It appears to me that a weak/fake Euphoric Stage is being played out. The idea of chasing the NAZ (after the O/N redirect) is the game, no chase and the game will end. The O/N has been redirecting for about 2 years (can continue)....

NAZ will have to get some help with a Tweet or two in order to get above KL 22,881. This Post will have Monday close as end point. Look for the long weekend to use the Pop Trick into Monday and if not, we have a decent short developing. BTD/FOMO Forever, you don't even need much volume or fundamental/technical reasons.

YTD Open level is Blue line below. NAZ up 8% YTD and 40% from YTD low. We may see 8-10% range be the drop zone and retest the YTD Open Level. 22,800 -21,800 has been an extremely low volume 1,000 1 way ride up (not seeing any selling). We should see the sell side show up as NAZ should drop back in the 1,000 soft zone. 4HR YTD Chart below:

Same old plays keep repeating: Long in O/N and Dump at Open Drive then sideways to the Close. Today, look short under 881. You can Scalp Shorts or take Longs at any drop/hold. Holiday week so look Long as the volume will be light.

Going with the recent pop as: Short Cover rally or Drop Offset. We may see a decent head fake long set up as some may start to exit (up here). Give it the week with the Friday-Monday Long move to change to Short Rip lower.

NAZ U Turn #45 or Bust, we have the Friday-Monday Long Rig test on deck. The F-M trade has been working for about a year and half, the break down here may be a big dipper. Watch the Tweet stall out and Reg Session selling, otherwise to the Moon with F-M lift.

Update to prior Post and Short Call at 22,040. NAZ did drop 700 points of the 1,000 expected. Balance of drop to watch for in Reg Session or the typical F-M Long Play is on deck.

NAZ inside the range should try lower and fall through for a drop test. F-M Long Play Fizzle.

TACO Trade LONG, China will increase the US Tariffs, we reduce the China and the NAZ will increase, Bunker will spin it and you will scratch your head. Don't worry it is upside down world, just go with it and SHORT it on Tuesday. Following the white arrow until stal out or rejection near channel bottom above.

H/S playing out with drop test on deck. Short below KL 562 and Long above, expect the same tricks/games during the O/N and Dead Zone of Reg Session. Boring days as we wait for some selling to show up as the buyers are losing steam.

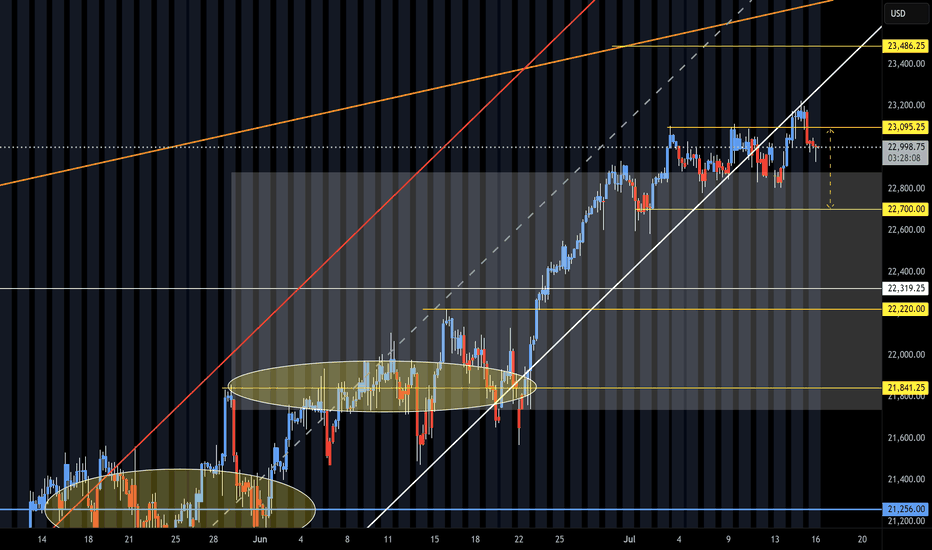

Same plan as prior Post, Short. The play is that the NAZ will try some FA's below (Shaded Zones) and then U Turn up during some late low volume Holiday session and attempt ATH retest. No U Turn, next SZ lower. Long above KL 365 and Short below. Price Action is all about Tricks, Tweets, Games and any low volume session opportunity (long side now). Still want to...

The Range of Games below will run until Tuesday 5/27. Looking for a drop between now and mid next week that will set up the Long to ATH or near 23,000. Look for the Memorial Day holiday low volume week (prior to holiday or after) to set up the lift higher in O/N or during the Dead Zone's of Reg Sessions. Should the NAZ lift prior to mid mid/late next week, look...

The move up from Danger Zone U Turn at KL 16,365 on 4/7 has been sketchy at best. These are better viewed on the NDX Daily chart. Below is YTD NDX, notice the multiple Gap moves up and away from the Danger Zone (16,790 on NDX). Looking back, gaps usually get revisited and when you have 3-4 there is higher probability of a gap fill. The NAZ 30M chart is showing...

Looks like it is "Rig in May and go Away". New range to watch would be the white arrow zone between the two orange TL's. The Channel below is a 2 standard deviation, NAZ should return to 19,750-18,750 at some point to retest. Looking for 21,256 to be next upper target for reaction. Flat NAZ YTD may do what, Run up 10-20%? or drop retest lower? Pick one. O/N group...