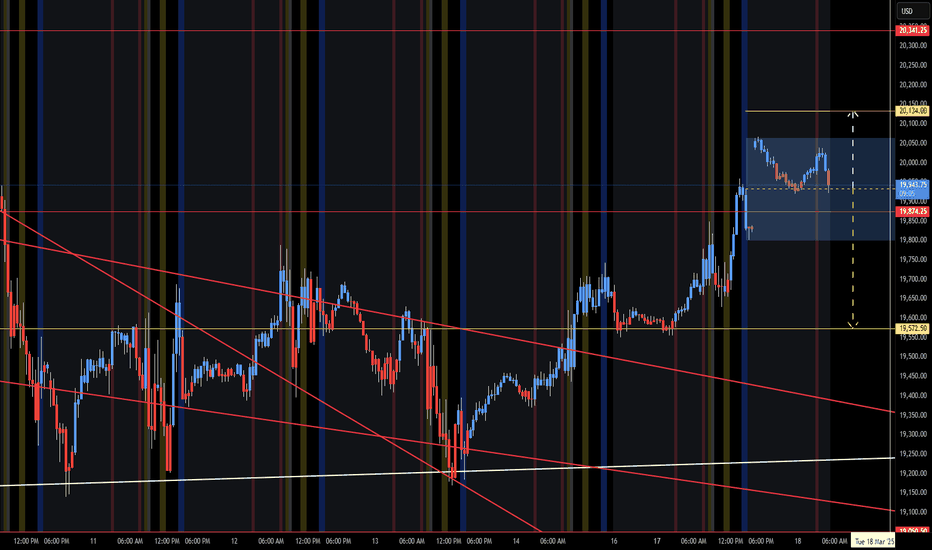

The forecast here is until the Monday Close, looking at the typical Long play from Friday - Monday. Expecting some games on this one, including some head fakes. Long to KL 19,389 and rejection would be the Short, pass hold Long. Short to any KL below will have the push/pull price action and will struggle to get lower. After Monday and should the NAZ still be...

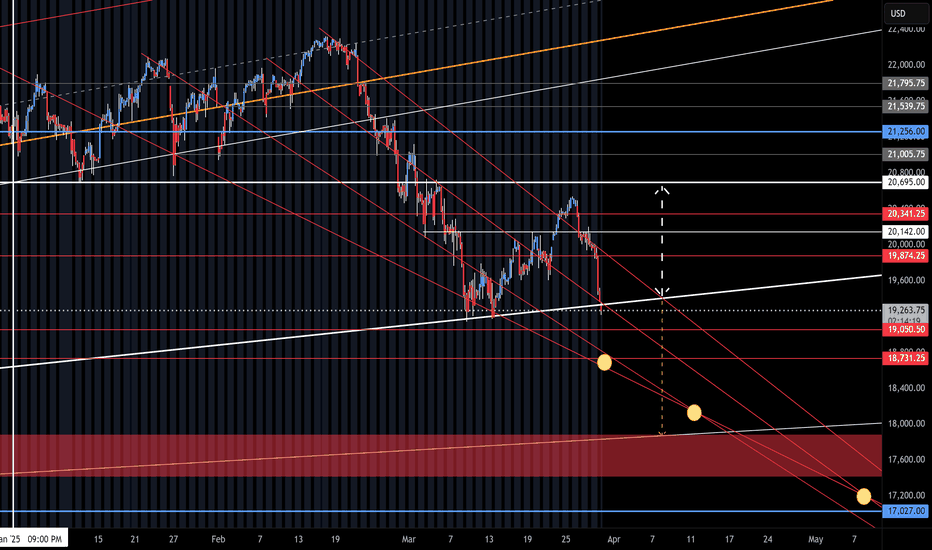

Staying with the Range 19,400 - 18,200. Looking for 18,200 retest to hold or not. Was that insider trading yesterday? Seemed like it. Anyway, we can add that to the bag of tricks, curveballs, etc. Yesterday was a major Danger Zone, U Turn, Drop Offset, Info Leak, Algo Long Only move that happened during the Dead Zone. With O/N -400 points tonight, we may be...

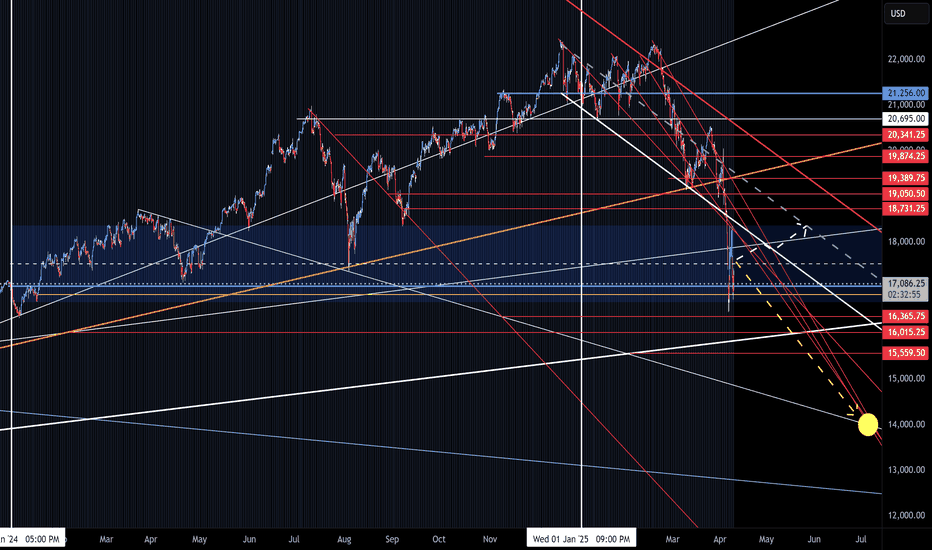

NAZ Range, again. The range to watch is 16,700 - 18,300. This chart may be viewed as 2024 being a Long Trap set up, KL 17,500 is Long above and Short below for now. Look for the NAZ to retest the KL and rotate around inside the range. Lower yellow circle, lower range break out over the Danger Zone Edge (16,500-300). Looking move sideways than lower PA today and...

Staying with the Range forecast. NAZ is inside the Yellow arrow range (yesterday post). The Box is the range to watch, NAZ may go above and drop back inside to retest KL's 17,027-16,845. You can see new declining channel above. Below is 30M chart. Watch all moves in both directions with VIX this high. Yesterday (chart below) we had a tweet, leak, comment, etc....

NAZ is likely to retest 2024 Open Level (blue line). Red Zone is previous Failed Auction zone and usually we see a bounce on these. May see drop under or gap open Sunday at blue line with slight bounce back up to FA Zone. Diablo's are all over the place and may keep the pressure with lower moves in the range/zone. Archie Bunker is feeling the Heat, back to TV...

NAZ on the edge of the Danger Zone, in the Overnight. Keep in mind that the new limit down is -7% and the NAZ is -1% now. Yellow circles are lower targets and white arrow is old range, I would expect a DZ hold to pop back up in range. O/N rig team should show up and lift it or maybe they have changed their tune (after 2-3 years) and will take it over the Edge. Out...

YTD 4 HR chart and the planets are aligned. Looks or if 20,142 is rejection zone, we may retest 19,400. Long above 20,142 and Short below. 17,027 is 2024 Open Price, FYI. Follower's, I am taking a few weeks off and will Post what I can. Do not chase, remind yourself the O/N is The BOSS and has magical powers. Why is there a -7% limit down and NO limit UP? 30M Chart

I may be early (or excited) with the call, it is on the way. O/N lift play is loosing the effectiveness, NAZ needs that for stability (and drop offsets). Anyway, should be on the way tomorrow. Any drop will have to get in front of the Friday-Monday long play (longer overnight trick). Under 19,665 is the express freight train lower and a hold will try another U Turn.

NAZ TLX 19,767 is long above and short below, Scalp inside yellow vertical arrow range until break out. Garbage Day #2 (recycle). We may need some media, spin, etc. to lift it or lower we go. O/N seems to be loosing upward rig force and Reg Session seems to sell off. Today should be interesting.

Contract change gap, notice how most overnight moves are mostly up (including contract changes). Arrows are the range for break out and next move. U Turn move from low is being held up with tricks/games, get ready for the drop. NAZ staying in white arrow range on 4 HR Chart below.

Monday and 2nd half of Long Play from Friday. Arrow is range and not expecting much. Sideways to snail move higher or Monday pop stall out and drop to lower yellow arrow or below. FYI, the weaker and slower the NAZ moves the higher is can just snail/inchworm higher into the next O/N safe zone. Careful Shorting 1st, wait for the fake/dirty move higher to fizzle out.

Wall Street will try and fix Washington Street's bad money manager (Your Fired). S/P at -10 and the NAZ was in front at -14% (from ATH). The NAZ will be used to help hold the it all together as we approach the true Danger Zone level (of NAZ and S/P). Look for the old Long side tricks to be played, starting with the Friday-Monday Long Rally and overnight weekend...

Long at 3-4am in O/N, Long still Mopping out. Under Shaded Zone is strong Short and above is Long.

Staying with the Long and U Turn Pop up retest higher. Bigger move after Pop Stall out. Yesterday's Post Scalp trades in the range did show the build or positioning for a Long move next. Will update as we go, the BTD/FOMO's showing up from Spring Break but may be hungover so give then a day or so.

NAZ is at U Turn #2 and third triangle Key Level. You would think we would see a bounce as we are 13% from ATH and 13% from 2024 Open Price. Follow KL's lower for support or look for any bounce 1st, then to stall and drop. NAZ has no strength and much of the prior strength (past few years) came in the O/N (overnight). BTD/FOMO's are on at the Tiki Bar on Spring...

Going back to Daily Post updates from weekly, during these very fun times (selling is back). I would not count of a Gap move at Sunday O/N open. No gap, look for 1st move set up with counter move as larger move. KL's to watch 20,470 Upper & 19,874 Lower. Blue shaded zone is sideways or Upper KL rejection pull back zone / Lower KL support lift zone. White SZ (near...

NAZ Triangle, things may get scary under KL 695. Looking back at previous Post's will help with the forward forecast. The NAZ has been slowly (since 11/24) setting up the drop/test to the "Turd Zone" 20,695 (1st yellow circle). The drop is a correction at -10%, the next move may be an 85% retracement back up (2nd yellow circle) and if the KL 695 rejects the NAZ...

The NAZ did hit the 20,695 "Turd" Target in last week's Post. Nearly a 2,000 point drop when you look at 2/21 (Friday) to the low of 2/28 (Friday). From late Friday we have a 500 point move up (normal), need to see if the Monday Long push (2nd half of typical Friday) takes place. NAZ is falling in a Diablo, Yellow arrows are KL's (long to and short from), Whites...