MBForex

PremiumEuro is off more than 2% from the yearly high with EUR/USD carving the weekly opening-range just above multi-month uptrend support. From a trading standpoint, rallies would need to be limited to Friday’s high IF price is heading lower on this stretch with a break below the lower parallel exposing eh 2024 high at 1.1214 and 1.1160- both levels of interest for...

Watch today's close with respect to 120.69-121.69 - region defined by the 61.8% retracement of the August decline / 100% ext if the 2023 rally. Initial support now back at the median-line / 114. Bullish invalidation raised to 104.10. A topside breach from here keeps the focus on the September 22' uncovered gap near ~126.28 and the upper parallel near ~130.

A breakout of the monthly opening-range takes Ethereum towards the first major technical zone at the August highs / 100% extension of the late-November advance at 2029/42- look for a larger reaction there IF reached. Initial support rests with the August high-day close at 1936 backed by bullish invalidation at the monthly open (1821). A topside breach exposes...

Euro is marking an intraday advance through downtrend resistance at the 75% parallel with the yearly extreme just higher at 1.1033. Watch the weekly close here. .

#AUDUSD heading into a key resistance zone here at 6791-6819. . . Key support now back at 6670/73 #RBA on tap. . . $AUDUSD Daily Chart

USOIL is testing a key resistance zone here at 74.35/49 - the 100% ext of the monthly advance / 61.8% retracement of the monthly range.

Keep an eye on 103.82 heading into US #NFP. Watch this into the weekly close. . .

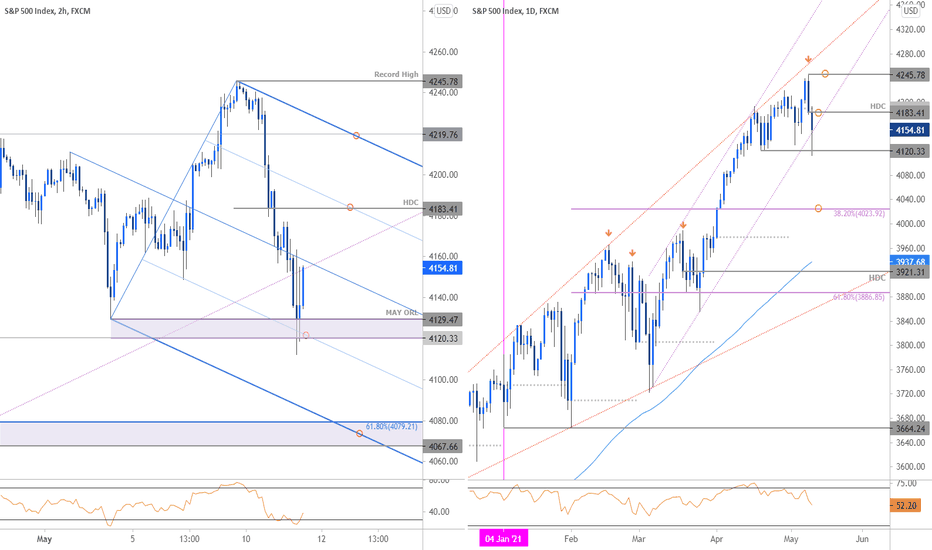

$SPX looking very different into the close. . #FOMC on tap. .

Looking for possible inflection here post-CPI. . .

The S&P 500 marked an outside-day reversal off fresh record highs yesterday – a feat achieved three times this year. In fact, all five of the previous instances of outside-day reversals in the index did extend lower with an average decline of ~4% before resumption. The decline has already marked a sell-off of more than 3.1% in early US trade on Tuesday with the...

#Gold Price Technical Outlook: $XAUUSD Rejected at Resistance - www.dailyfx.com

Testing Confluence Resistance into June ORH / 61.8% Retracement - 1204/05. .