Maikelmikkel36

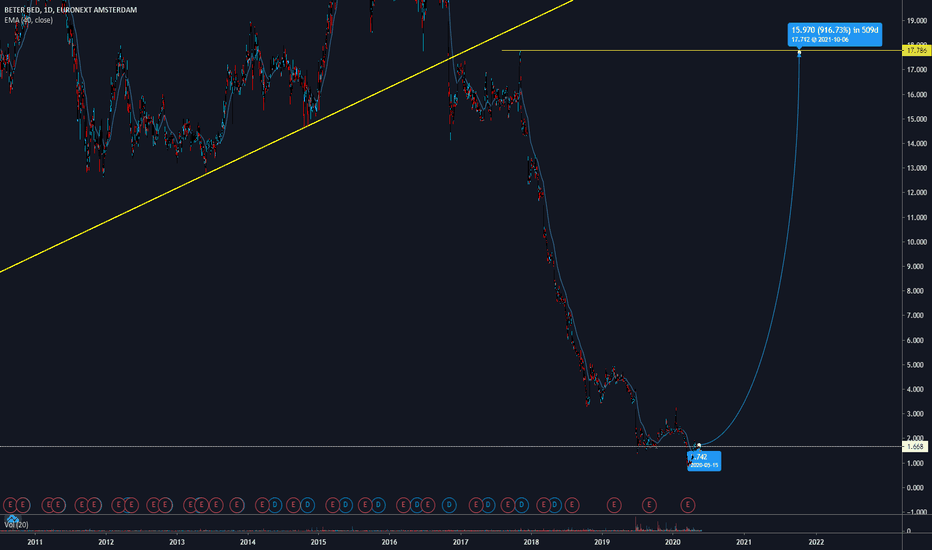

Essentialalot of demand so I excpect much growth always do your own research I am not a financial advisor

Longterm hold for me Fair value way higher in my vision DYOR Not Financial advice

with the rising prices of uranium and minerals BHP is going to benefit from this. I don't think this is reflected enough in the price yet. Always DYOR Not financial advice

Shell is already investing in green energy methods and is for me the leader oil company who can adapt quickly. I see a great future Shell. In the short term I see the oil demand coming back when corona decreas.

Q1 2020 sales increased by 8.0%, Even in corana time many orders keep coming

The construction sector has tremendous growth potential due to the large home shortage. BAM Group went through difficult times, but with a major reorganization and a new CEO Ruud Joosten who only seems to be making good choices at the moment. I see a bright future for BAM GROUP. I have drawn two levels where I get into position.

I think China will recover, they are still really behind, I can smell opportunities. I will increase my position in the following places

Not completely recovered from corona, the figures seem to be getting better, I think this will also be reflected in the price

The outlook for the longer term is favorable. For me this share is fair priced around 8 euros. Technically it looks good if we get a positive confirmation at the noted 6.7 level then I think we can even go a little higher.

Wait for a positive afirmation on the 0.318 fib level. Risking a small part of my portfolio.

Even though at & t's streaming service (HBO) is not yet a great success compared to netflix and disney. The company is currently heavily undervalued, as a result of which the dividend % has also been increased to 7%. The best thing about at & t is that it keeps its wireless and cable customers when they also can leave. Also the new eco system with which they...