MarthaStokesCMT-TechniTrader

WizardThere are Buy Side Institutions, aka Dark Pools, and there are Sell Side Institutions, the Money Center Banks and Giant Financial Services companies. These two groups dominate the market activity and move price in entirely different ways and for entirely different reasons. Sell Side Institutions are short-term TRADERS. They are not allowed, nor do they wish, to...

There are 6 primary upside Market Conditions. Currently the stock market is in a Velocity Market Condition where price and runs are controlled by retail investors, retail swing traders, retail day traders and the huge group of Small Funds Managers using VWAP ORDERS to buy shares of stock with an automated systematic buy order trigger when the volume in that stock...

EOD /FOD is an acronym for End of Day buy or sell short entry that holds overnight and the First of Day sell the ETF or stock at Market Open. This is a strategy for experienced to Elite aka Semi-Professional Traders. Beginners need to hone skills and practice in a simulator. Professional Traders use this strategy all the time. They rarely intraday trade aka...

There is far more opportunities to make higher profits BEFORE a CEO announces the Earnings Report on the public exchanges. In this lesson, you will learn about how the Buy Side Dark Pools consult with the CEO and CFO to determine weeks ahead of the earnings season whether the report will be stellar, average, or weak. Retail Analysts do not have access to this...

Dark Pools hide their accumulation during their buying of stocks over time that are at bargain price levels. When a stock price drops below its fundamental levels, Dark Pool TWAP orders trigger and begin the bottom formation to completion phase. This can take weeks to months to complete. Some bottoms are short term, and others are long term. Once the Dark Pools...

In this discussion you will learn more about how Dark Pool Buy Side Institutions actually work and how they buy stocks in a slow steady accumulation mode based on where fundamentals are in relation to the stock price. Dark Pools are the Alternative Trading System Venues that are unlit, meaning there are no Market Makers. It is a Peer to Peer Transaction mostly or...

The SPY is the most widely traded ETF in the world. Its price or value movement reflects the S&P 500 index value. It doesn't reflect the buying or selling of the SPY. You must use volume indicators and accumulation/distribution indicators that indicate whether the Buy Side Institutions are in accumulation mode, rotation to lower inventory to buy a different ETF...

The professional side of the stock market has undergone massive infrastructural changes in the past 5 years. These changes are unknown to most retail traders and that can pose major problems for you success and profitability no matter what trading style you use. A trading style is a type of trading that has specific parameters to which strategies can be applied...

The most important professional side group you need to learn to trad with are the professional traders. Many work for the Sell Side Institutions on huge trading floors or from their home office. Some work for the Buy Side Institutions and trade for the Giant Pension funds companies, Mutual funds companies and Derivatives Developer companies. There are also...

Hybrid Leading Indicators use all 3 data sets from each transaction that occurs in the stock market. Today this lesson talks about Chaikin Oscillator and Chaikin MFI. Both are used on the same chart as the volume oscillator reveals the volume and price correlation to what the Dark Pool Buy Side institutions are buying or selling for long term holds. The...

There are two primary Order Types that the Professional Side of the market use. 1. Time Weighted at Average Price, aka TWAP , is used extensively by the Dark Pool Buy Side, Derivative Developers, and Sell Side Banks of record for Buybacks for corporations. The TWAP can be set at a penny to few pennies spread and pings and transacts on a specific TIME to PRICE....

VWAP orders are used by Independent Small Funds Managers. IF a Small Fund or Small Asset company has 3 billion or less assets under management, the SEC classifies them as NOT a professional side entity. This is because most independent Small Funds Managers have no Financial Degree, no professional certification aka CMT, CFA etc. These managers often know less...

High Frequency Trading Firms provide liquidity to the public stock exchanges and have been around for more than 20 years. HFTs are called "maker/takers" as the make liquidity by selling shares of stock when there is a high number of buyers but fewer sellers. They take the market and sell short to provide the buy to cover to fill the orders during a panic selling...

XAUUSD is a Futures Spot contract. it trades similarly to a stock or ETF or any stock market derivative. When the stock market is stressed as it is right now, then this futures spot offers potential swing to platform position trading opportunities. Trade Wars are creating a very stress stock, bond, ETF, and commodities markets situation at this time. Gold is...

A downtrend starts with Dark Pool Buy Side Institutions slow rotation to lower inventory of a stock or ETF. The rotation bends the trend into a rounding pattern that is visible on the stock or ETF chart. The goal of the Dark Pool rotation is not to disturb the uptrend while they are slowly selling shares of stock over several months time. The bending of the price...

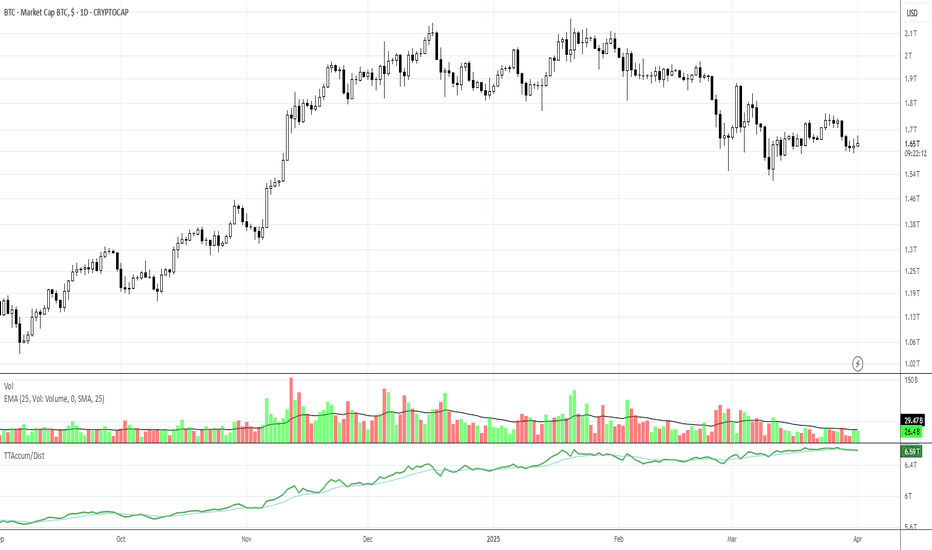

There are now over 40 Bitcoin ETFs that you can use for long term investing, trading for monthly income, to diversify, to mitigate risk, or for safe-haven investments. BTCs are a Stock Market Derivative. There are numerous derivatives that are available in the stock market. Every other financial market has derivatives that have been developed by Dark Pool Buy Side...

Yes, you can see fundamental levels using your technical analysis in your charts. Dark Pool Buy Side institutions buy a stock incrementally ahead of its earnings season often weeks ahead. The fundamentals are right in your charts and are easy to see and recognize once you understand the dynamics of the Dark Pool Buy Zones and how and why these form in most...

Most Traders use the indexes to try to understand whether they should buy long or sell short. However, the ETFs impact the index components prices not the other way around. Most traders do not realize that they should be studying the ETF of an index rather than the index to determine how to trade the next day. Also ETF trading can be highly lucrative. Using the...