MassineFariss

Ever since the news on Covid vaccine made headlines, the yellow metal’s appeal as a safe haven has diminished. With an increase in risk appetite, investors and institutions are opting for riskier assets like equity markets, hoping for a faster economic rebound. With prices trading around $1,850 per troy ounce at Comex and Rs 49,000 per 10 gram in India, gold...

Toronto-based Cronos Group has always played it safe by not aggressively going after acquisitions, instead using cash to focus on research and development with its products. With steady revenue numbers, it has kept its balance sheet strong enough to at least survive the COVID-19 storm. At the moment, Cronos's business is predominantly in Canada, though its...

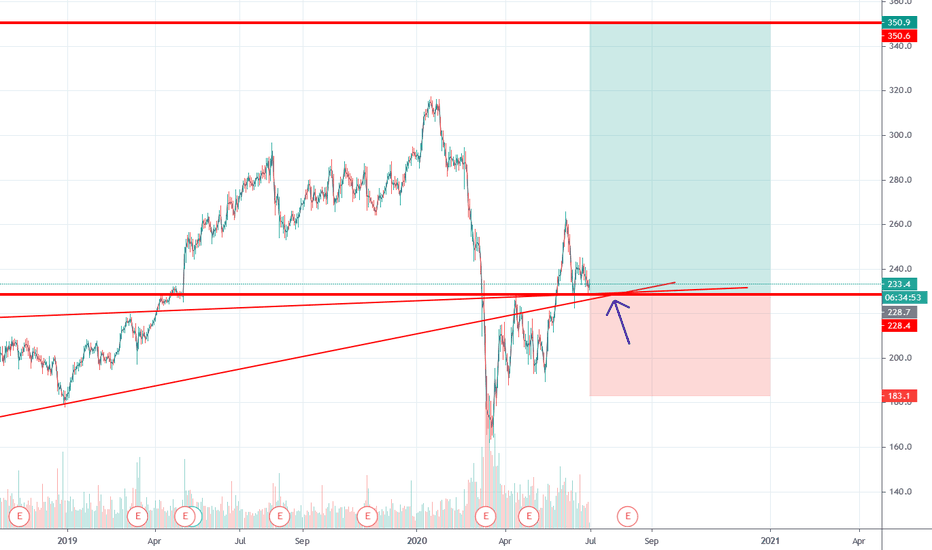

Waiting For The Price to come to My Zone To go Long . Good Luck

3 Tops with euro Fundamentally a sell. the break of the channel and the trend lines is giving a short signal . GOOD LUCK

2 Zones to buy. it will buttom if we got lucky . GOOD LUCK

The price action suggests that gold traders are a little more locked on the U.S. Dollar this week. After a promising start, the greenback has drifted mostly sideways to lower, and is in a position to post a slightly lower close for the day . Meanwhile, gold has mirrored the move in the dollar. With the dollar’s early spike to the upside, gold plunged, but when...

When Technical Analysis Says Start Worrying and go short there where you shoud be smart and find Zones where big Players are waiting to buy . Good Luck .

Two Zones To Sell , The stock is gonna collapse soon or latter , its just a matter of time. Good Luck

The curve for Adidas shares has been upwards since mid-May. At first, it seemed as if buyers were running out of Amo in the area of the € 220 mark, but in the past few days the share has regained momentum. In the meantime, investors have caused the price to rise to EUR 241.10. Until the pre-crisis level of 282.45 euros was reached, however, more than 17 percent is...

The recent optimism in oil markets has left many analysts scratching their heads, with no real fundamental reason for the shift in sentiment. Demand projections that suggest Asia or the world economy will be moving back to pre-pandemic levels anytime soon are laughable. The only justifiable optimism for oil markets at the moment is the optimism surrounding...

The analysis is based on FA , any second wave of Covid19 , u should consider the Stock as a sell . for now we buying from the zones i have posted in the chart . Good Luck

we will enter the Market little bit late , but its okey i was waiting for a good confirmation . Good Luck

I am short in the pair since 1 month now,closed the first position,and trying to get in the second wave , Dollar is getting weak ,it just a time matter untill the pair breaks down . Targeting 90,98 Zones.

My whole view for Index is short , there can be a Pullback but it wont last too long , Two zones to sell , please Note >: all the Analysis is Based on FA . All the mouves that happend in the Stock/Forex Market in the last 4 Months were fundamettaly based ,from QE to keeping Interest rates near 00 untill the end of 2020 , all this is in favor of my short position...

i am waiting for a strong Mouve to the up side ,please manage risk . if the SL was Hit , see my sec entry . i wont sell gold, and i wont advice anyone to do so ,any good or Bad news are in the favor of gold now . TP : 1791 , 1800