Based on my analysis, the Trend Trading indicator continues to signal a bullish outlook, with a strong support level at 22,150. However, if Nifty Spot closes below this level on a weekly basis, the next potential support could be around 20,241. Considering the influence of the time factor on price movements, market bearishness may persist until the end of June...

According to my Trend Analysis, on 7th Nifty Futures is likely to bounce back and the raise will not sustain on April 8th. The levels provided in the chart are calculated without taking Gaps into account. In the first 15mts on 7th April, there is a bullish candle formation. Trade with Stop-Loss.

Overall trend looks bearish for the day with a strong resistance at 7753. The Buy Signals is confirmed with SL at 7651. Any fall from resistance may take this index down to 7665 and 7622. The Market Timing line is also bearish for the day.

This Forex pair is in a strong bullish trend with a confirmed buy signal with SL at 1.1. There is potential run towards the target of 1.12622. Trade with Stop-Loss.

USDJPY is bearish with a short signal confirmation with stop loss at 146.29. Further downtrend will take the support level at 144.435.

It is in a bearish trend. Sell signal has confirmed the Stop Loss at 83382. This pair has a strong support at 82074 and 80900.

Trend is bearish. These are the support levels if the bearish trend will continue for the day. Trade with Stop Loss

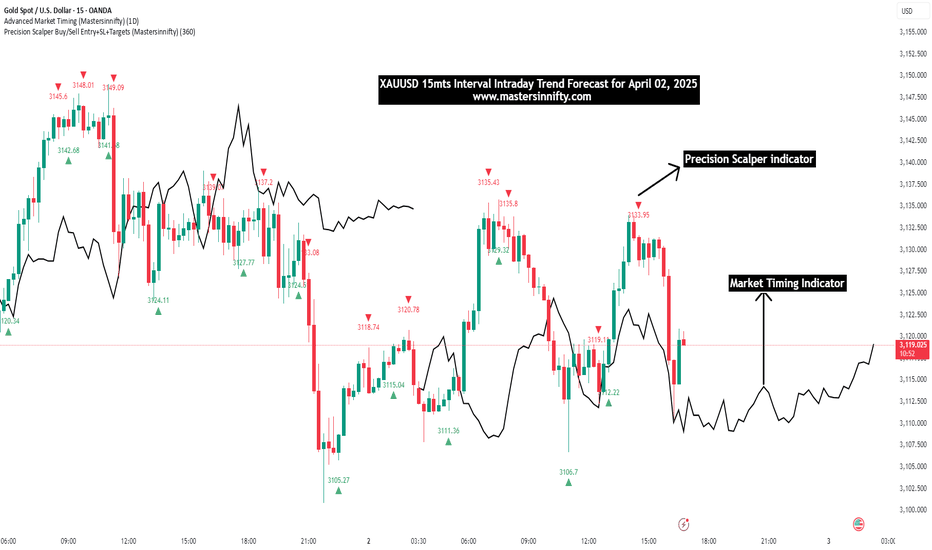

XAGUSD is likely to be bearish since Market Timing Indicator is indicating its bearish view for the rest of the day. We are waiting for the signal confirmation from Precision Scalper to take short entry.

XAUUSD is likely to close on a bullish note for the day. Once it hit the target lines given, there is a possibility of bounce back. However, the range for the day may not be convincing.

The intraday trend confirmed Sell signals with a stop loss at 5650. It may take support at 5613 and 5575 on the lower side. The support levels are in degrees of Square of 9.

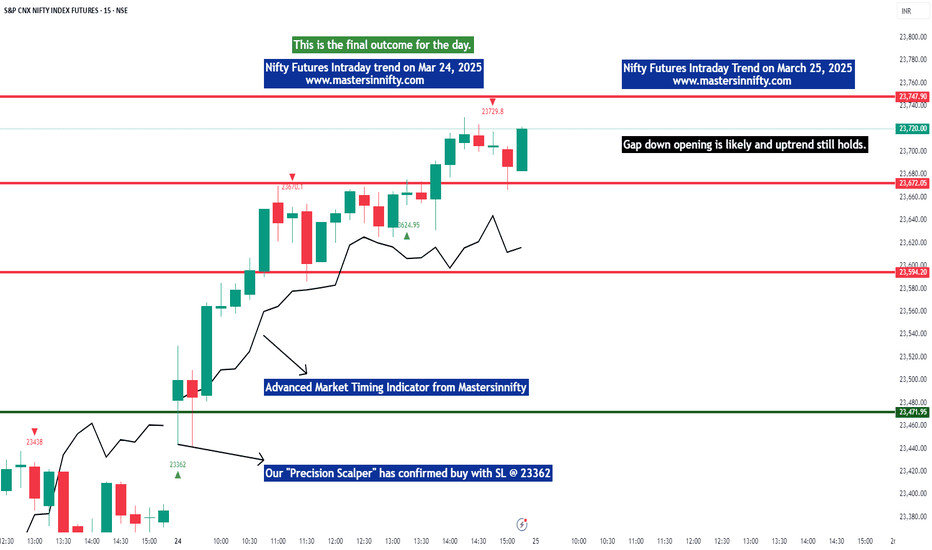

Our Precision Scalper accurately identified the sell entry for Nifty Futures two days in advance, providing traders with a strategic edge. With minimal risk per trade, this powerful tool effectively captures trends and sustains them until completion. To maximize risk management, ensure a stop-loss is set for every entry.

I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull...

XAUUSD (Gold Spot/USD) has reached its 360-degree target of 3128. A breakout above this level could push it toward the next target of 3241. Our Market Timing projection indicates a bullish trend continuing until April 3, 2025.

BTCUSD looks bearish with the given Support and Resistance levels. Once the Dynamic Signal confirms the sell entry with stop loss and targets, that makes the best point to enter into the trade.

I anticipate a bearish trend for tomorrow. 23719 looks like a strong resistance and the support levels are at 23441 and 23198 (If breaks 23 441). I foresee a good bearish trading opportunity and I avoid all Buy Signals and Focus on my PUTs. Ready to trade? Trade with proper stop-loss.

This Forex pair is still bullish. Support at 150.534 and 149.556 and Resistance at 151.264 and 151.650. Our "Precision Scalper" indicator has confirmed Sell with a SL @ 150.94.

Nifty Futures broke the key resistance at 23623 and closed higher and the further uptrend is anticipated to take resistance at 23825. Nifty futures may begin with a gap down opening tomorrow ie March 25th and a down trend in the morning may give us an opportunity to enter long.

I foresee a bullish trend for the day with a strong support at 23472. The Nifty Futures likely to see the resistance at 23594 and 23672. If breaks 23672, then will move to 23748. Small traders always trade with Stop-Loss.