Mihai_Iacob

PremiumWhen traders talk about discipline, they often refer to following rules — sticking to a plan, being methodical, and avoiding emotional decisions. But there's a subtle and powerful difference between being rule-based and being blindly mechanical. And even more, there's a moment in every trader’s process where discipline demands adaptation. Let’s look at a recent...

This is already the third article I’ve written about Strategy (formerly MicroStrategy), and for good reason. You don’t need to be a financial expert to ask: why buy a stock that simply mirrors Bitcoin’s price — but at a massive premium? No matter how sophisticated the explanations may sound, or how many times you’re told that “if you don’t understand it, it must...

📌 What happened yesterday? During the Asian session, Gold printed a fresh local low at 3268, continuing the downtrend that already dropped over 1700 pips in just one week. However, that move quickly reversed, and we saw a natural corrective bounce. 📈 Resistance holds firm The correction took price back up into the 3310 zone, which acted as confluence...

📘 This market moves like a textbook chart SP500 is acting like a perfect case study from a trading manual. Back in early April, the index dipped just below 5,000, right into a confluence support zone ( I had spoken about this at the time ) – formed by the long-term ascending trendline and the 2022 all-time high. Just like other U.S. indices, the market reversed...

📈 The crazy run since April NASDAQ100 has had a spectacular run since early April, when the index dipped to 16,300 amid rising tensions caused by Trump’s tax war. From that low, we’ve seen a mind-blowing rally of over 7,000 points, which translates to a 40% gain in just 4 months. Such a rise is not just impressive— it’s overextended , especially by historical...

1. What Happened Yesterday After an anemic correction that formed a bearish flag, Gold finally broke below 3300 and even dipped under the 3280 support zone — which was my primary downside target. While the move during the day didn’t have enough momentum to reach my second sell limit, I was already in a low-volume short position, so I didn’t miss the move...

As mentioned in my previous posts, I’m been bullish on EURUSD in the medium term, targeting 1.20 and even beyond. But no pair—especially not EURUSD, which tends to move more steadily and rationally—goes up in a straight line. ________________________________________ 🔹 Last week, the pair stalled just below 1.18, and I decided to close my long trade with a +150 pip...

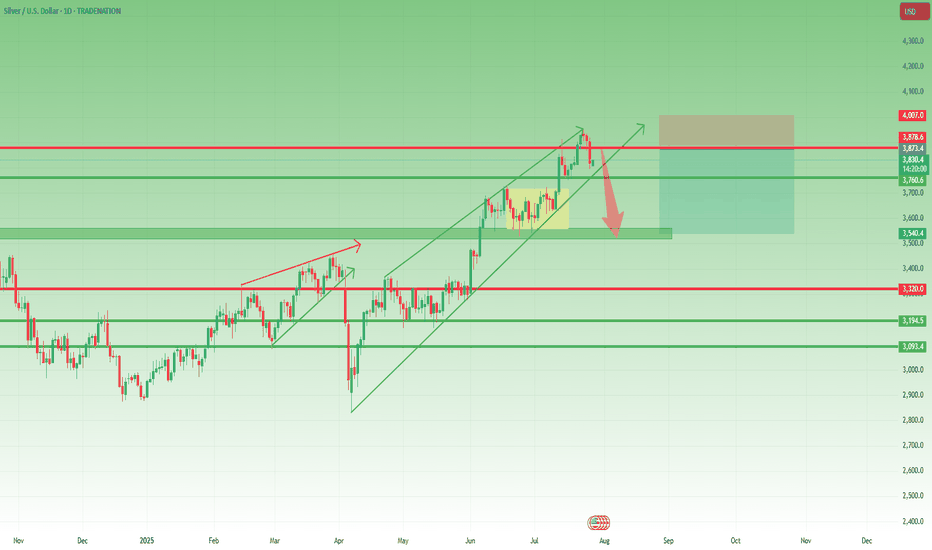

Lately, I’ve been a strong advocate for a Silver rally toward $40, and indeed, we got a solid move, with price reaching as high as $39.50, not touching 40 though... Just like with Gold, the last 3 days of last week turned bearish, and now it looks like we may be entering the early stage of a correction. 📉 Current Setup: - The rejection from $39.50, right below...

In my previous analysis on TOTAL3, I mentioned the high probability of a correction, but also noted that I didn’t expect the 925–940B zone to be reached. And indeed, price reversed early — finding support around 975B before moving higher. However, after a push up to 1.07T, the market has started to pull back again. 📊 Current Outlook – Two Scenarios I’m...

Exactly one year ago, the JPY Currency Index broke above the falling trendline of a falling wedge, signaling the end of a bearish cycle that had lasted nearly five years. As is typical after long-term reversals, the reaction was sharp and fast, and the price quickly reached the first resistance target of the pattern. Since then, the index entered a lateral phase,...

Yesterday was a quiet and choppy day for Gold. Although price managed to recover a small portion of last week’s 1400 pip drop, the rebound remains anemic — price barely reached the 23% Fibonacci retracement. To make things worse for the bulls, the recovery from around $3300 is starting to take the shape of a bearish flag, a continuation pattern that typically...

Yesterday, after a small bounce from the ascending trendline, Gold broke down and printed an intraday low around $3300. Right now, the market appears bear-dominated, and further downside continuation is likely in the coming days. ________________________________________ 📉 But there’s a catch: From last week's top, Gold has dropped over 1400 pips without any...

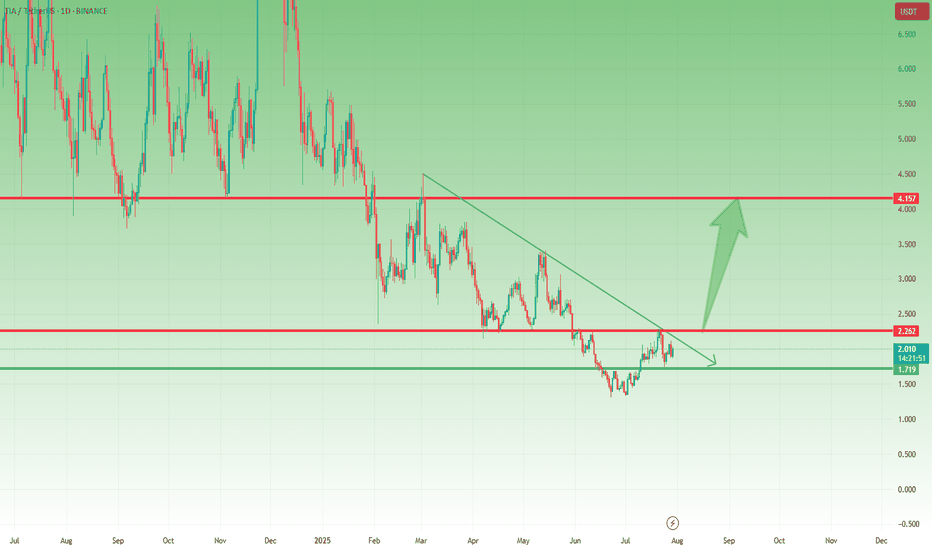

Last week, I mentioned that TIA could be preparing for a move and that buying dips around $1.75 might be a good opportunity. Well, price dropped exactly into that support zone, bounced slightly, and is now consolidating, which could be the calm before the next wave. ________________________________________ 📌 Here’s what I’m watching: • The $2.10–$2.20 zone is...

Yesterday, Bitcoin dipped and recovered again, following last week's sharp spike down, triggered by the $9B Galaxy Digital sale on behalf of a Satoshi-era investor. ________________________________________ 🧠 Why is this important? Despite being one of the largest BTC sales in history, the move only caused a temporary spike down. That’s a clear sign of market...

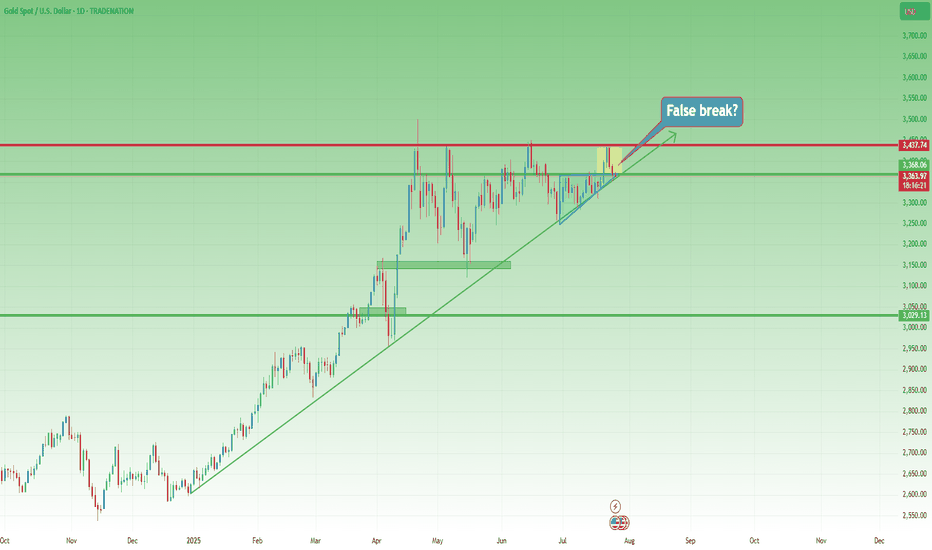

Last week was both interesting and revealing for Gold. After breaking above the key $3375 resistance—which also marked the upper boundary of a large triangle—price quickly accelerated higher, reaching the $3440 resistance zone. However, instead of a bullish continuation, we witnessed a false breakout and sharp reversal. What initially looked like a healthy...

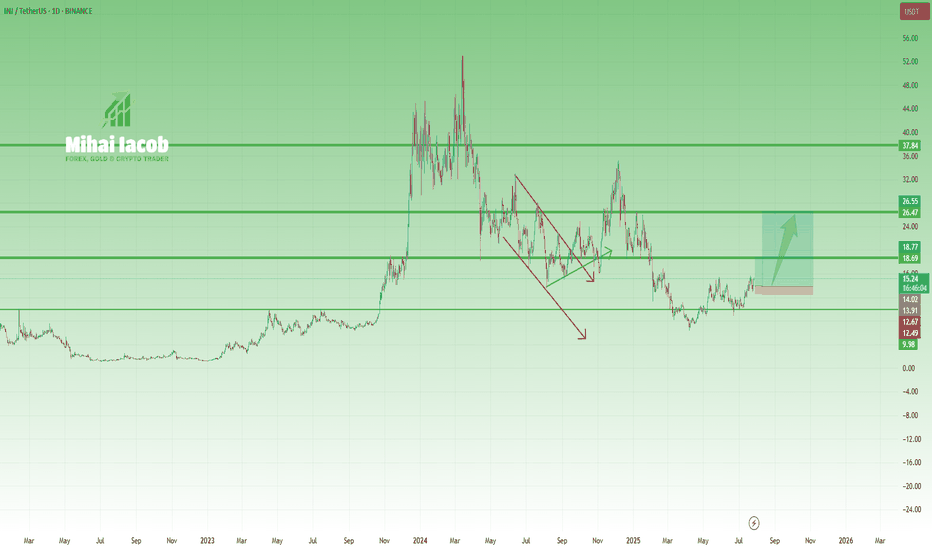

A year and a half ago, INJ was in full hype mode, with fantasmagorical predictions of $200+, even though the coin had already done a 40x move. (And not to brag—but at that moment, with INJ trading around $40, I said that $10 was far more likely than $200. It actually dropped to $6.5...) Fast forward to today, and things are starting to look more constructive—at...

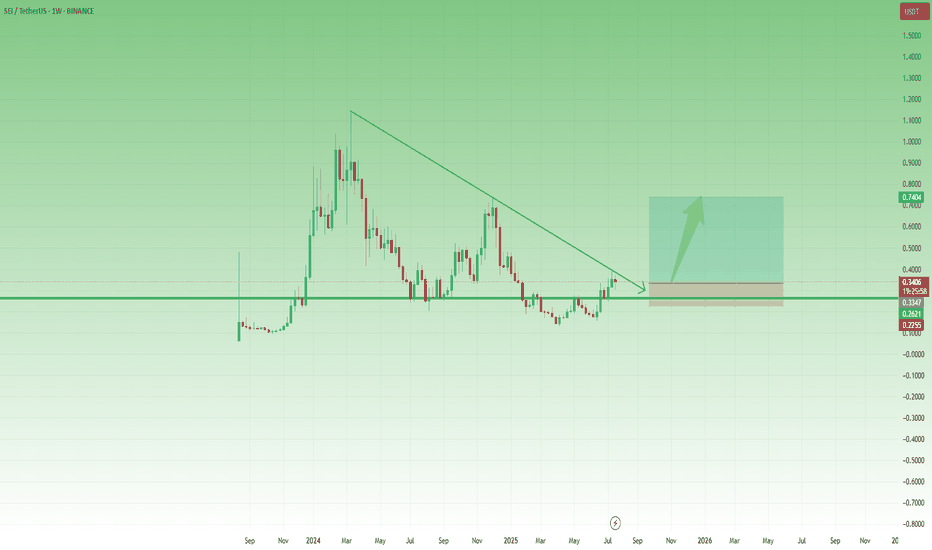

After the low around 0.13 in April, SEI started to recover, and although the first attempt to reclaim the 0.25–0.26 zone failed in mid-May, that key area—a former support from last year—was finally broken at the end of June. Now, this previous resistance has turned into support, and even though gains have so far been capped by the falling trendline, price is...

📌 In yesterday’s analysis, I mentioned that although Gold corrected deeper than expected, dropping below 3400, the bullish structure remained intact — and I stayed true to that view by buying dips. 🎯 The trade didn’t go as planned. Fortunately, the New York rebound from 3350 helped me exit at breakeven. 🧭 So now the big question is: Is Gold reversing to the...