MoppetTraders

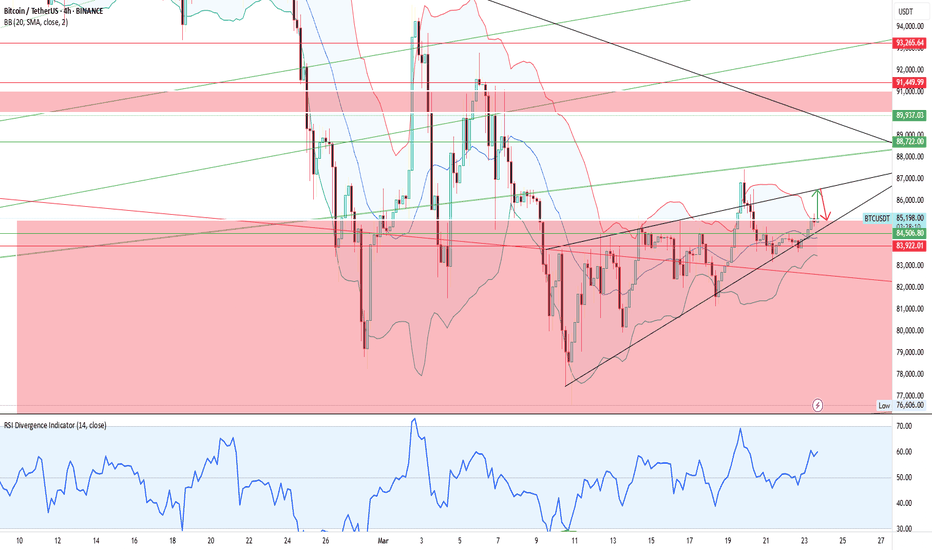

They are playing consecutive bear flags if you measure the poles, next bear price is down near 72000 usdt. Beware of tomorrow GPD and friday CPE. But BINANCE:BTCUSDT looks more promising than SP:SPX with EMA's. The SP500 index in the bearish side it affected by 50EMA crossed both, 100 and 200 in a bearish sign. We are all looking at 200 bounce back to know...

It is BTC ready for a pump with the today broke of dangerous levels? If 85k levels are confirmed we are ready for 86500 and 90000 walls. RSI are still cold for BTC levels If 84300 are broken down, the bear narrative will survive.

FED ready PUTs and throw a hand to markets yesterday. I will be with caution about this. If BTC enters again the red square this means that yesterday volatility was emotional. Volatility is just that, emotions not reasonably trading. Wait for higher highs and the broke of +90k usdt mark

Completely filled GAP, and now we are completely in a red zone, take care about that. If ranges from here, maybe we can see upside to 83.000 / 90.000 next month. If not, bears will push price to lower lows thru 76.600 lower bollinger bands. This band depends on movements of next weeks. If next weeks comes bullish, this band will push higher the low, but expect...

Let's look at the "big picture" of $BINANCE:BTCUSDT. We are on our way to touching the important resistance near 70,000 again. I encourage you to also look at the chart of FXOPEN:XAUUSD gold, which this year does not stop marking new ATHs. It has the same graphic pattern when it was heading to break the 2,000 mark again and again. BTC has been fulfilling the...