ECONOMICS:GBINTR March/2025 source: Bank of England - The Bank of England voted 8-1 to keep the Bank Rate at 4.5% during its March meeting, as policymakers adopted a wait-and-see approach amid stubbornly high inflation and global economic uncertainties. The bank highlighted that, given the medium-term inflation outlook, a gradual and cautious approach to...

ECONOMICS:JPIRYY February/2025 source: Ministry of Internal Affairs & Communications - The annual inflation rate in Japan fell to 3.7% in February 2025 from a 2-year high of 4.0% in the prior month, amid a sharp slowdown in prices of electricity (9.0% vs 18.0% in January )and gas (3.4% vs 6.8%) following the government's reinstatement of energy subsidies....

ECONOMICS:USINTR March/2025 source: Federal Reserve - The Fed keep the funds rate unchanged at 4.25%-4.5%, but signaled expectations of slower economic growth and rising inflation. The statement also noted that uncertainty around the economic outlook has increased, but officials still anticipate only two quarter-point rate reductions in 2025.

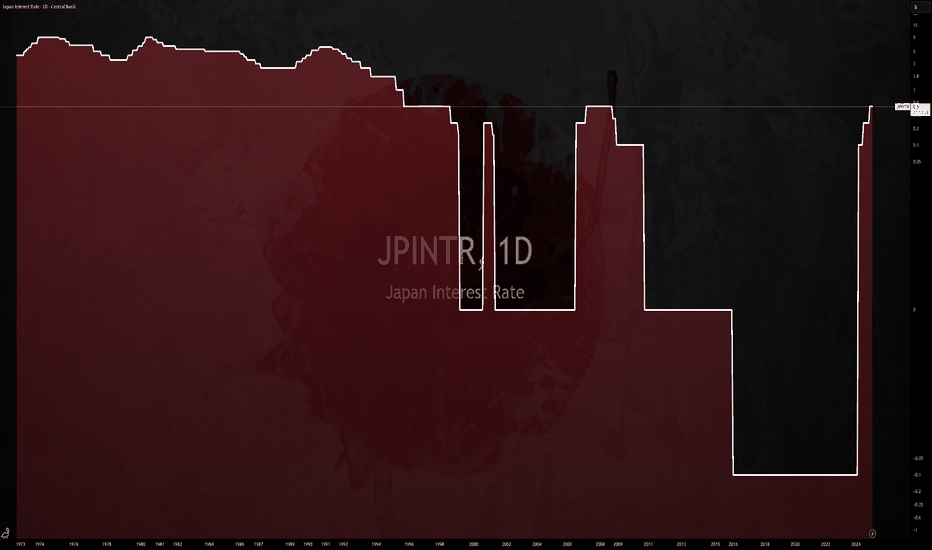

ECONOMICS:JPINTR March/2025 source: Bank of Japan -The Bank of Japan (BoJ) kept its key short-term interest rate at around 0.5% during its March meeting, maintaining it at its highest level since 2008 and in line with market expectations. The unanimous decision followed the central bank’s third rate hike in January and came before the U.S. Federal Reserve’s...

ECONOMICS:USIRYY 2.8% YoY (February/2025) source: U.S. Bureau of Labor Statistics - The annual inflation rate in the US eased to 2.8% in February below 3% in January and market expectations of 2.9%. On a monthly basis, the CPI rose by 0.2%, slowing from 0.5% rise in January and below market expectations of 0.3%. Core CPI also rose 0.2% on the month and was...

ECONOMICS:CNIRYY -0.7% (February/2025) source: National Bureau of Statistics of China - China's consumer prices dropped by 0.7% yoy in February 2025, surpassing market estimates of a 0.5% decline and reversing a 0.5% rise in the prior month. This was the first consumer deflation since January 2024, amid fading seasonal demand following the Spring Festival in...

ECONOMICS:EUINTR (March/2025) source: European Central Bank - The ECB lowered the three key interest rates by 25 basis points, as expected, reducing the deposit facility rate to 2.50%, the main refinancing rate to 2.65%, and the marginal lending rate to 2.90%. This decision reflects an updated assessment of the inflation outlook and monetary policy...

ECONOMICS:USPCEPIMC 0.3% (January/2025) source: U.S. Bureau of Economic Analysis - The US Personal Consumption Expenditures (PCE) price index increased by 0.3% month-over-month in January 2025, the same pace as in December, and in line with expectations. Prices for goods increased 0.5%, following a 0.1% rise in December and prices for services rose at a...

ECONOMICS:USGDPQQ 2.3% Q4/2024 source: U.S. Bureau of Economic Analysis - The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and in line with the advance estimate. Personal consumption remained the main driver of growth, increasing 4.2%, the most since Q1 2023, in line with the advance estimate....

ECONOMICS:JPIRYY 4% (January/2025) source: Ministry of Internal Affairs & Communications - The annual inflation rate in Japan climbed to 4.0% in January 2025 from 3.6% in the prior month, marking the highest reading since January 2023. Food prices rose at the steepest pace in 15 months (7.8% vs 6.4% in December), with fresh vegetables and fresh food...

ECONOMICS:USIRYY 2.9% (January/2025) source: U.S. Bureau of Labor Statistics - The annual inflation rate in the US likely held steady at 2.9% in January 2025, matching December’s figure, which was the highest since July. On a monthly basis, the CPI is expected to have risen by 0.3%, slowing from 0.4% in December, with food and energy prices continuing to...

ECONOMICS:CNIRYY 0.5% (January/2025) source: National Bureau of Statistics of China - China’s annual inflation rate surged to 0.5% in January 2025 from 0.1% in the prior month, above consensus of 0.4%. This was the highest figure since August 2024, driven by seasonal effects from the Lunar New Year. Meantime, producer prices fell by 2.3% yoy, keeping the...

ECONOMICS:USGDPQQ 2.3% (Q4/2024) source: U.S. Bureau of Economic Analysis - The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and forecasts of 2.6%. Personal consumption remained the main driver of growth, but fixed investment and exports contracted. Considering full 2024, the economy advanced 2.8%.

$EUNITR (January/2025) source: European Central Bank - The European Central Bank lowered its key interest rates by 25 bps in January 2025, as expected, reducing the deposit facility rate to 2.75%, the main refinancing rate to 2.90%, and the marginal lending rate to 3.15%. This move reflects the ECB’s updated inflation outlook, with price pressures easing in...

ECONOMICS:USINTR (January 2025) source: Federal Reserve -The Fed kept the funds rate steady at the 4.25%-4.5% range as expected, pausing its rate-cutting cycle after three consecutive reductions in 2024. The Fed showed more optimism about the labor market and noted that inflation remains somewhat elevated, removing the reference to ongoing progress toward the...

ECONOMICS:JPINTR 3.6% (December/2024) source: Ministry of Internal Affairs & Communications - The annual inflation rate in Japan jumped to 3.6% in December 2024 from 2.9% in the prior month, marking the highest reading since January 2023. Food prices rose at the steepest pace in a year (6.4% vs 4.8% in November), with fresh vegetables and fresh food...

ECONOMICS:JPIRYY 3.6% (December/2024) source: Ministry of Internal Affairs & Communications - The annual inflation rate in Japan jumped to 3.6% in December 2024 from 2.9% in November, marking the highest reading since January 2023 as food prices rose the most in a year. Meanwhile, the core inflation rate climbed to a 16-month peak of 3%, in line with estimates.

ECONOMICS:CNGDPYY Q4/2024 - The Chinese economy expanded by 5.4% yoy in Q4 2024, topping estimates of 5.0% and accelerating from a 4.6% rise in Q3. It was the strongest annual growth rate in 1-1/2 years, boosted by a series of stimulus measures introduced since September to boost recovery and regain confidence. For full year, the GDP grew by 5.0%, aligning...