Musarrat_karamat

PremiumThe pair is showing early signs of bullish structure with a clean higher low (HL) to higher high (HH) transition. An instant buy entry is considered valid based on the breakout above a key resistance zone. 🔹 Entry: Market Buy (Current Price ≈ 0.65038) 🔹 Stop Loss (SL): 0.64496 🔹 Take Profit (TP): 0.65523 📌 Structure Shift Noted The break above prior highs...

A bullish breakout setup is forming on GBPJPY, presenting a potential swing trade opportunity: 🔹 Buy Stop: 197.122 🔹 Stop Loss (SL): 196.001 🔹 Take Profit 1 (TP1): 198.206 🔹 Take Profit 2 (TP2): 199.297 Price is consolidating just below the 197.122 resistance zone, which aligns with a supply area. A breakout above this could signal trend continuation, targeting...

A potential long setup is identified on USDJPY based on current price action and structure: 🔸 Entry (Buy Stop): 148.236 🔸 Stop Loss (SL): 146.980 🔸 Take Profit 1 (TP1): 149.441 🔸 Take Profit 2 (TP2): 150.559 📊 Price is currently consolidating below the 148.236 resistance zone. A break above this level would confirm bullish continuation, targeting previous supply...

Trend & Structure: Overall Trend: Bearish, confirmed by the consistent series of Lower Highs (LH) and Lower Lows (LL). Downtrend Line: A blue diagonal trendline is drawn connecting recent LHs, acting as dynamic resistance. Indicators & Tools Used: Alligator Indicator: Comprising three smoothed moving averages (13, 8, 5) – the lines are wide apart and aligned...

Gold is showing a bullish divergence on the 1-hour timeframe, signaling a potential reversal from recent lows. The trade plan suggests a buy entry at 3341, with Stop Loss at 3320 to manage downside risk. 📈 Targets: TP1: 3360 TP2: 3380 The price is holding near the 1hr fair value gap zone and aligned with Fib retracement levels, supporting a bounce. Watch for...

SOL has completed a strong bullish leg and is now reacting from the 0.236 Fibonacci retracement level at 188.63. A sell setup is developing based on this resistance zone and weakening momentum. 🔻 Trade Plan: Sell Stop: 188.63 SL: 209.49 TP1: 176.93 (38.2% Fib) TP2: 166.53 (50% Fib) 📉 RSI at 61.02 shows early signs of a bearish divergence. If price loses...

@ Eth/USDT Daily time frame A potential Bearish Butterfly harmonic pattern is unfolding on the daily timeframe. Price is currently approaching the D point completion zone, projecting a reversal area near 4896. 📌 Trade Setup: Buy Limit: 3450 Stop Loss: 2870 TP1: 3894 TP2: 4896 RSI is approaching overbought levels (currently 79.57), suggesting caution as price...

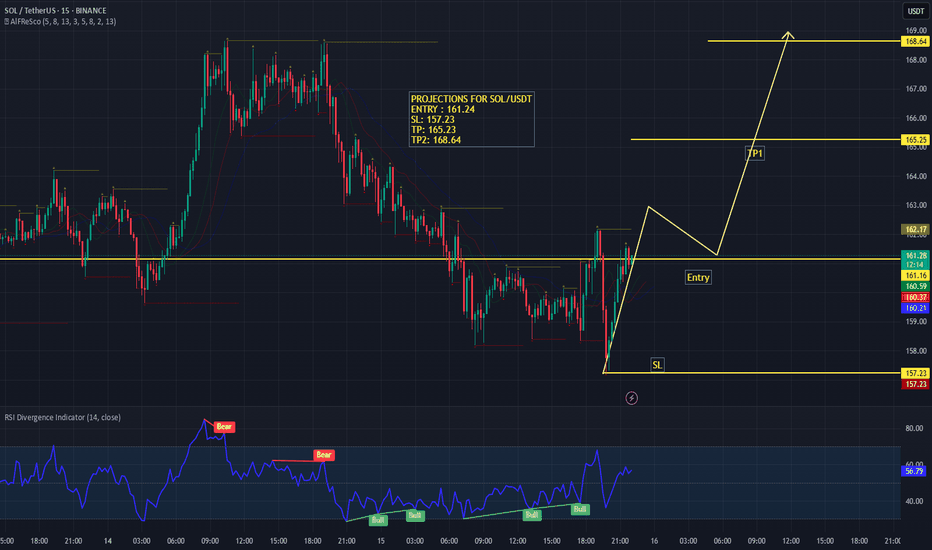

Solana (SOL) is showing signs of a potential bullish reversal on the 15-minute timeframe after a sharp downtrend. Price has reclaimed key support levels and is preparing for a possible breakout. 📈 Projections & Trade Plan: Entry: 161.24 (above immediate resistance) Stop Loss (SL): 157.23 (below recent swing low) Take Profit (TP): TP1: 165.23 (near previous...

SUI is exhibiting a potential bullish setup on the 1-hour timeframe as price begins to build momentum after a period of consolidation. 📈 Current Setup: Price has formed a minor ascending trendline and is trading above the short-term moving averages, indicating growing bullish strength. A buy stop is placed slightly above the immediate resistance at 2.9222,...

#FLOKI is showing a clear bullish structure on the 4-hour timeframe, aligning with its upward momentum on the daily and monthly charts. The price has formed a series of higher lows (HL) and higher highs (HH), indicating strength in the current trend. 📈 Breakout Zone: The pair has successfully broken above the key resistance zone around 0.00008300, confirming...

Ethereum is currently trading within a broad consolidation range between $2,387 (support) and $2,657 (resistance) on the 4H timeframe. After a sharp pullback from range highs, price is retesting the mid-range and Fibonacci levels, offering a potential bullish setup. Trading Plan: Buy Stop: $2,501 (confirmation of upward momentum) Stop Loss: $2,363 (below key...

The price is currently retracing after a recent upward move and is testing the 38.2% Fibonacci level (≈107,805). The entry zone is defined around 107,546, marked in yellow, suggesting a possible support area where buyers may step in. The stop loss is placed slightly below at 105,267, around the 78.6% Fibonacci retracement level, to manage risk if the market...

The chart represents a Fibonacci retracement-based setup for a potential bullish continuation, provided key levels are respected. Current Price: PKR 1,094.77 The price is hovering between the critical Fibonacci levels of 0.618 (PKR 1,178.21) and 0.786 (PKR 1,138.38). If the stock closes two consecutive weekly candles above these Fib levels, the bullish bias...

Pattern: Bullish Harmonic Reversal – BAT Pattern Bitcoin has completed a harmonic Bullish Bat Pattern, suggesting a potential upside reversal from the D point. Current price: $107,186 The harmonic structure follows ideal ratios: AB retraces 30.2% of XA BC extends 118.1% of AB CD completes near 88.6% of XA – confirming the Bat pattern Trade Plan: Many...

The chart displays a well-defined Bullish Harmonic Bat Pattern, with the final leg (D point) now complete, suggesting a potential reversal to the upside. Current market cap is at $3.25 trillion. Based on the harmonic completion at point D, the market shows bullish potential from here, with the next projected move toward $3.5 trillion. If momentum sustains, the...

BRUSDT is currently forming a potential bearish divergence while trading in a tight consolidation range near resistance. The RSI is elevated at 76.96, indicating overbought conditions and signaling a potential reversal setup. A short position is suggested with a Sell Stop order at 0.07472. Stop Loss: 0.08847 (above resistance zone) Take Profit 1 (TP1):...

The chart shows Ethereum forming a bullish flag pattern after a strong upward rally, indicating potential continuation of the bullish trend. The recent price structure reflects a consolidation phase in a downward-sloping flag, following a significant impulsive move. Key highlights: The sequence of Higher Highs (HH) and Higher Lows (HL) suggests a shift in trend...

Buy Position Setup (Breakout Upside) Buy Stop Entry: 3,405 Stop Loss: 3,365 Take Profit (TP1): 3,451 Rationale: Price is consolidating in a symmetrical triangle (highlighted in purple). A breakout above 3,405 will signal bullish momentum continuation. RSI supports potential bullish divergence, shown by rising momentum. 🔸 Sell Position Setup (Breakdown...