ASTS surged 10.82% last week, closing at $26.42 on May 2, 2025. The stock traded above its 50-day ($22.68) and 200-day ($19.24) SMAs, confirming a bullish trend.

Not financial advice for buy or sell. you are at your own risk. ULCC closed at $3.36, up 8% from $3.11, breaking a short-term downtrend resistance (~$3.15–$3.20) on May 2 with rising volume. A bullish RSI divergence (higher RSI lows vs. price lows on Apr 21 & Apr 30) signals weakening bearish momentum. Bullish One White Soldier pattern suggests 8–16% upside...

Longeveron Inc. (LGVN) offers a strong bullish opportunity as it nears a potential breakout from its prevailing downtrend. The stock has been consolidating with increasing volume and tightening price ranges, indicating accumulating buyer interest. A decisive break above the critical resistance level of $1.92, coinciding with the downtrend's upper trendline, could...

Not financial advice. There is a clear positive bull divergence with RSI and any breakout of this downward triangle we shall expect a reversal and increase of the price upward fast. Thanks 🫶

Not financial advice I like this breakout of this downtrend for the first time in very long period which i think it will reverse hopefully. Thanks🫶

HMR stock is currently forming a promising cup and handle pattern, a bullish technical setup that signals potential for a significant upward move. This pattern, characterized by a rounded “cup” followed by a consolidating “handle,” suggests accumulation and growing momentum. With the stock approaching a breakout level around $4.79 a decisive move above this...

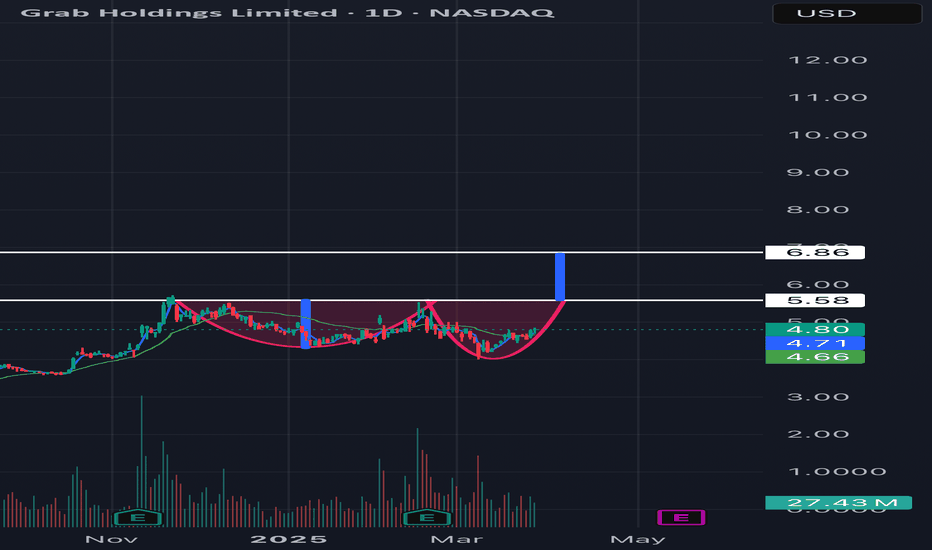

Grab Holdings (GRAB) stock is currently developing a cup and handle pattern on its daily chart, a bullish technical formation indicating potential for a significant rally. This pattern, marked by a rounded cup followed by a consolidating handle, suggests building momentum. A breakout above the key resistance level of approximately $5.58 could trigger a sharp...

AST SpaceMobile (ASTS) stock is shaping a bullish cup and handle pattern on its weekly chart, with a breakout confirmation requiring a close above $35.51. This could propel the stock to $47, a target backed by analyst consensus, hinting at a strong upward surge.

AST SpaceMobile (ASTS) stock is shaping a bullish cup and handle pattern on its weekly chart, with a breakout confirmation requiring a close above $35.41. This could propel the stock to $47, a target backed by analyst consensus, hinting at a strong upward surge.

ASTS ended trading at $26.12 on March 13, 2025, and is now hovering near $26.50 in pre-market activity on March 14. My analysis from yesterday indicates the stock hit a key support at $25.42. Should it hold above this level, it might trigger a rebound and pave the way for a bullish trend. On a monthly timeframe, another vital support is located at $17.66....

QBTS price is going to breakout as shown in the chart 📈💪🏿. Not financial advice.