Continuing the previous gold analysis It seems that wave-(b) is turning into a normal zigzag and wave-c has started from the zigzag. Wave-c of this zigzag could end in the range of $3200-3216 or $3104-3118. After the zigzag ends, we will have another upward movement in gold.

As I said in the second paragraph of the previous analysis, wave-(a) ended at 3500 and the gold price fell by 7% (over 2000 pips) and now wave-(b) has started. 1M Cash Data Chart I think that a neutral triangle or a reverse contracting triangle is forming, with the completion of wave(b) we can somewhat understand which pattern is forming.

The higher degree diametric wave-(E) is expanding and we can consider the recent price correction that started at $3167 as a small X-wave, as a result, gold can grow as a combination pattern to the range of 3600-3800 and even gold can touch $4000. The second triangle pattern will probably be a neutral triangle or a reverse contracting triangle, where the wave-(a)...

BIST100 (XU100) In the monthly Cash Data, we see that a Reverse Neutral Triangle has formed and the post-pattern movement (the downward movement after wave-(e)) has also confirmed it and it seems that BIST100 is preparing for at least a 20-25% correction. If the beginning of wave-(b) is broken, i.e. the number 7189, the correction of this index can continue to 5705.

Cash Data 6M In the 6-month cash data for Bitcoin, it appears that a Running Neutral Triangle is forming and we are currently in wave-D of this triangle. Based on the previous mid-term Bitcoin analysis, as long as Bitcoin’s price remains above $70,000 there is potential for the price to rise to $150,000. Therefore, wave-D of the neutral triangle could expand...

The SSE Composite Index, the primary index of the Shanghai Stock Exchange, reflects the performance of diverse companies across various industries and serves as a gauge of China’s economy. It is calculated based on the market value and stock prices of these companies. According to daily Cash Data (1D), the SSE Index, after a 36% rise from September 18 to 30,...

We can almost say that 4800 has been touched and given that the downward movement was very fast, this wave is most likely the A-wave of a triangle and the upward waves that are forming after the 90-day suspension of the stalls are considered as a corrective wave. Previous SPX Analysis

1M Cash Data Chart Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times. Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C...

While many analysts thought that the NIFTY50 correction was over, the index is still moving towards the specified targets. The reason I did not update the index was that we had not yet received confirmations of the end of the correction. It seems that the minimum target for the NIFTY50 index is the same number as I mentioned earlier and after reaching the target,...

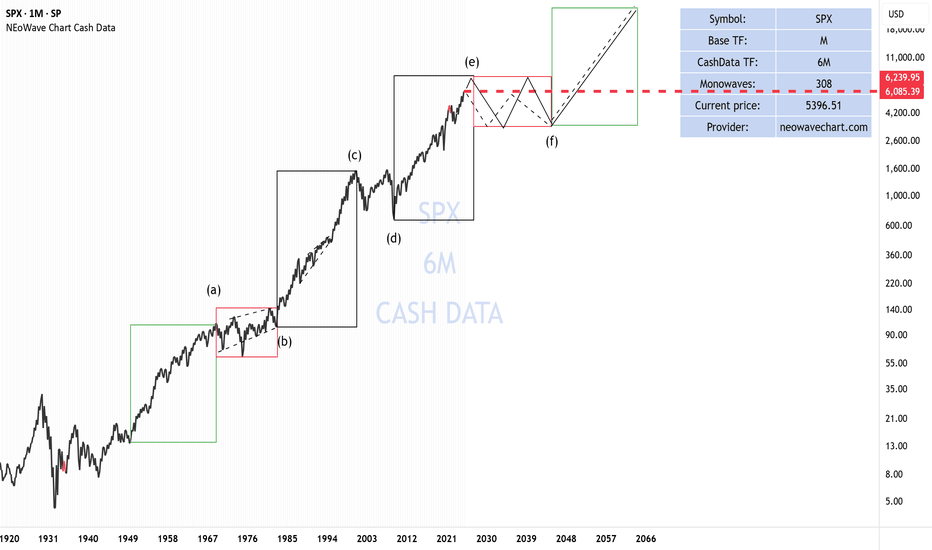

#SPX Upon observing the 6-month cash data of the S&P index, it becomes clear that this index has reached significant resistance levels. However, it is still too early to proclaim the beginning of a major correction in this index. That said, it can be anticipated that a potential price correction might extend to the range of 4800 to 4500. When comparing the wave...

On the 2H timeframe, the recent price correction appears to be a diametric one. When a Diametric Zigzag forms, it usually forms a combination pattern, so we consider 2 scenarios: Scenario 1 Diametric wave-(g) ends in the range of 21050 – 21473 or even higher and the upward movement begins Scenario 2 a- Wave-(g) continues to the range of 21050 – 21473 and...

In the previous analysis, I said that we seem to be in wave-(e) of D. We considered wave-D as a diametric, which seems to have ended with the drop in Bitcoin price and we should consider the diametric to be over and change the labeling a little. Currently, considering what happened, we have two scenarios: Scenario 1 In this scenario, if the Bitcoin price is...

In the previous Toncoin analysis, I said that TON is in a long-term upward trend and is forming a triangle, but considering that the last wave moved more than we expected, the analysis needs to be updated. Looking again at the chart, we conclude that the long-term trend of TON has not been violated and will continue, and we can consider two scenarios for the...

The PEPE currency first rose to 0.00000437 and then its price correction began. The price correction of this currency was in the form of a Reverse Contracting Triangle. Then, a good demand for PEPE was formed and the price of this currency grew by 873% and again we saw the price correction of this currency in the form of Contracting Triangle. Considering that...

it seems that Toncoin has a special interest in the neutral triangle and constantly forms this pattern in the chart. Currently, we seem to be in wave f of (D) neutral triangle, and after reaching the price of 7.361, we will see a price correction to $6, and then Toncoin's price growth will begin. I have a special interest in Toncoin and I think it will shine a...

In this scenario, gold has completed a reverse triangle pattern and is ready to grow. This scenario is confirmed if the price can cross the beginning of wave (c) in less time than the formation time of wave (c).

Scenario 1: Gold is forming a diametric bow tie pattern and we are currently in wave (e) of this pattern. The diametric pattern can end at $2200 and then we expect the price to rise above $2400.

It seems that the market is forming a diametric pattern that we are currently in wave (D) and it is not yet completed. Wave (D) will probably be a neutral triangle pattern, wave d of this triangle is almost over, but it can move up to $2206 and end. It seems that 2024 will be a good year for gold and those interested in it . Good Luck