NaranjCapital

PremiumU.S. stock markets were under pressure on Tuesday after new inflation data came in higher than expected. This has made investors rethink how soon the Federal Reserve might cut interest rates. What Happened? ● The Consumer Price Index (CPI) recorded its biggest monthly rise in 5 months. ● Core inflation (which excludes food and energy) jumped by 2.9% compared to...

Short Term Trading Advice by Naranj Capital Buy Agnico Eagle Mines Limited ● Buy Range- 108.5 - 112 ● Target- 116 - 118 ● StopLoss- 104.5 ● Potential Return- 4-5% ● Duration- 14-15 Trading Days

◉ Abstract Our latest analysis focuses on the booming U.S. utility and energy sector, set to hit a massive $1.1 trillion! Learn about the key drivers fueling this growth, from our increasing electricity needs and the electric vehicle revolution to the exciting rise of clean energy. We have also given a “Buy” rating on Primoris Services Corporation NYSE:PRIM ,...

Short Term Trading Advice by Naranj Capital Buy Agnico Eagle Mines Limited ● Buy Range- 116 - 119 ● Target- 125 - 126 ● StopLoss- 112 ● Potential Return- 5-6% ● Duration- 14-15 Trading Days

◉ Abstract Sterling Infrastructure (NASDAQ: STRL) is a top pick to benefit from America's digital infrastructure boom, with the sector expected to grow 26% annually through 2034. The company specializes in data centers, 5G networks, and smart city projects, supported by a $1 billion backlog and improving profit margins. While risks like regional market shifts and...

● Gold prices have recovered from a 6.5% fall and are now trading above $3000 per ounce. ● Tariff developments and US President Trump's comments are influencing market sentiment and gold prices. ● A record $21 billion inflow into Gold ETFs was recorded in Q1 2025, indicating strong interest in gold as a safe-haven asset. ● Technical analysis suggests a key support...

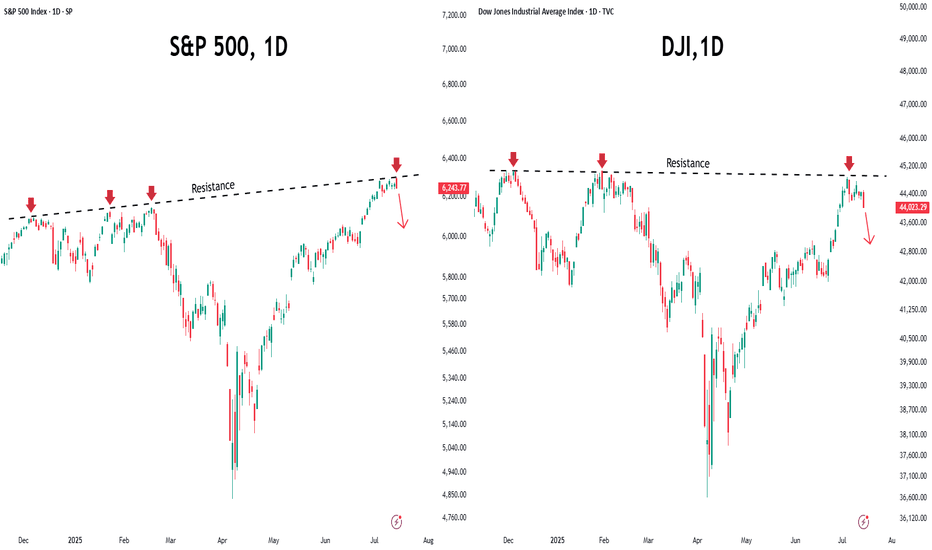

● The S&P 500 has experienced significant volatility recently, mainly due to President Donald Trump's announcement of new tariffs. ● On April 3, 2025, the index saw a nearly 5% drop, its worst single-day loss in five years. ● The recent price action suggests that the index has broken below the neckline of the Head and Shoulder pattern, indicating a potential...

The euro climbed above $1.09, showing unexpected strength after President Trump announced 20% tariffs on all EU imports. ◉ Fundamental Rationale ● The currency got a boost because the U.S. dollar weakened. Trump’s tariffs made trade tensions worse and worried people about slower economic growth. ● Also, new numbers showed Eurozone inflation fell to 2.2% in March,...

Short Term Trading Advice by Naranj Capital Buy Brinker International ● Buy Range- 151 - 156 ● Target- 166 - 169 ● StopLoss- 145 ● Potential Return- 6-8% ● Duration- 14-15 Trading Days

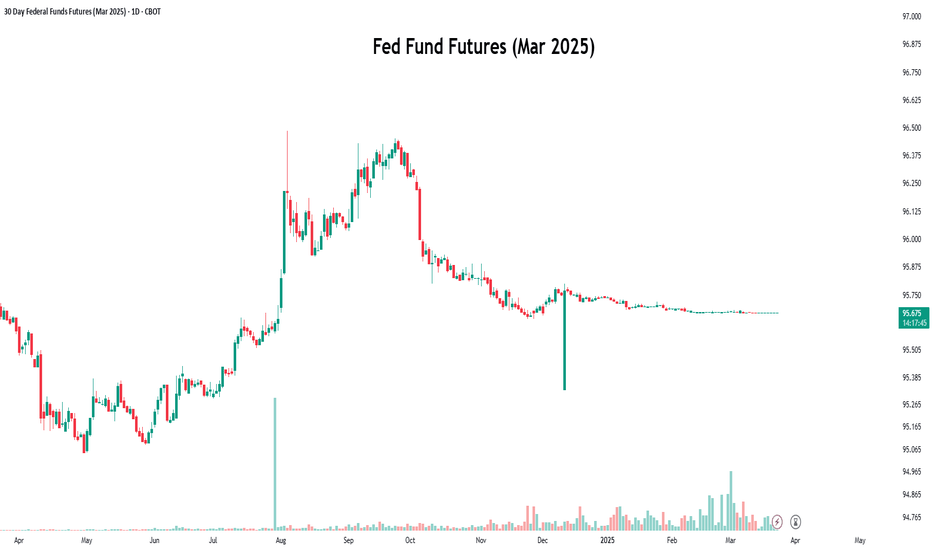

◉ What Are Federal Funds Futures? ● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other overnight). ● Purpose: These futures reflect the market's...

● Gold prices fell after hitting a high at $3057.59 due to a stronger US dollar, making it more expensive for overseas buyers. ● Despite this, gold is set for its third consecutive weekly gain, up 0.7% this week. ● Market participants expect at least two US Federal Reserve rate cuts this year, supporting gold's long-term bullish outlook. ◉ Technical Observations...

◉ Fundamental Rationale ● Gold prices remain steady despite a strong US dollar, supported by a softer-than-expected US CPI report. ● The US CPI report showed a 0.4% rise, lower than the forecasted 0.5%, easing inflation concerns. ● Weaker US inflation data reduces the likelihood of a rate hike, making gold more attractive to investors. ● The strong US dollar,...

📉 Nvidia’s Technical Breakdown: ● Nvidia’s stock has been caught in a storm of selling pressure over the past month. ● The recent breach of critical trendline support levels suggests the downward trend could gain momentum in the days ahead, opening the door for savvy traders to capitalize on the bearish momentum. 🔄 NVDS: The Perfect Inverse Play for Nvidia’s...

Oil prices took a hit after Trump's tariffs were announced, and it's essential to understand the reasoning behind this drop. When US imposed tariffs on Chinese goods, China retaliated by placing tariffs on US goods, including oil. This move led to a decrease in oil demand from China, which is the world's largest oil importer. As a result, oil prices plummeted. ...

◉ Abbott Laboratories NYSE:ABT ● The stock previously faced strong resistance near the $134 level, leading to an extended consolidation phase. ● During this period, a Rounding Bottom pattern emerged, signalling a potential continuation of the upward trend. ● Following a recent breakout, the stock has surged to its all-time high and is expected to maintain its...

Short Term Trading Advice by Naranj Capital Buy Visa Inc. ● Buy Range- 347 - 351 ● Target- 361 - 364 ● StopLoss- 342 ● Potential Return- 3-4% ● Duration- 14-15 Trading Days

◉ Overview ● Gold prices have risen for eight consecutive weeks, driven by safe-haven demand and a weaker US dollar. ● However, with US inflation data scheduled for release, investors are becoming cautious, leading to a decline in gold prices. ● The US inflation data will provide insight into the Federal Reserve's future monetary policy decisions. ◉ Technical...

● The EUR/USD pair tried to climb above 1.0530 but got pushed back, slipping lower. ● However, the charts are hinting at a potential breakout with an Ascending Triangle pattern forming. ● If the pair can finally break through 1.0530, it could spark a rally toward 1.0600. ● Stay tuned; the next move could be explosive! 🚀