NeonLight

ExpertSPY has completed a bullish impulse thus far this week. On a weekly perspective, we've almost engulfed the bar from two periods ago; almost. I expect a 3 wave sequence cool off period heading toward the weekend before deciding the nexrt direction.

SP Futures appear to be rangebound for the better part of 2 days. This is to be expected following the impulse from 12/20. However, I am looking for a pullback after one more attempt into supply around 4995+. Targets denoted. Primary 1.618 target lines up from a structural, volume profile, and trend line-break projection of 4700-4730. Trade at your own risk.

ES is approaching resistance in the 4770s. Look for a pullback at resistance / trendline break. Always wait for confirmation. Expecting a retrace of 50% of the previous leg. *** The opinions expressed above are mine and are not to be construed as financial advice ***

ES/SPX is seemingly extremely bullish, having rejected resistance around 4140 and having a subsequent bullish rally off the lows since then. However, RSI divergence continues to limit upside. Broad market indicators, such as market breadth, are lagging. Volatility looks poised for upside. Bonds are looming for a breakout as well. Watch for the overthrow top

I expect a retest of prior support on the spuz for the Asia/Euro session overnight, prior to an early morning rally to the value area with overshoot prior to consolidation through the middle part of the week ahead.

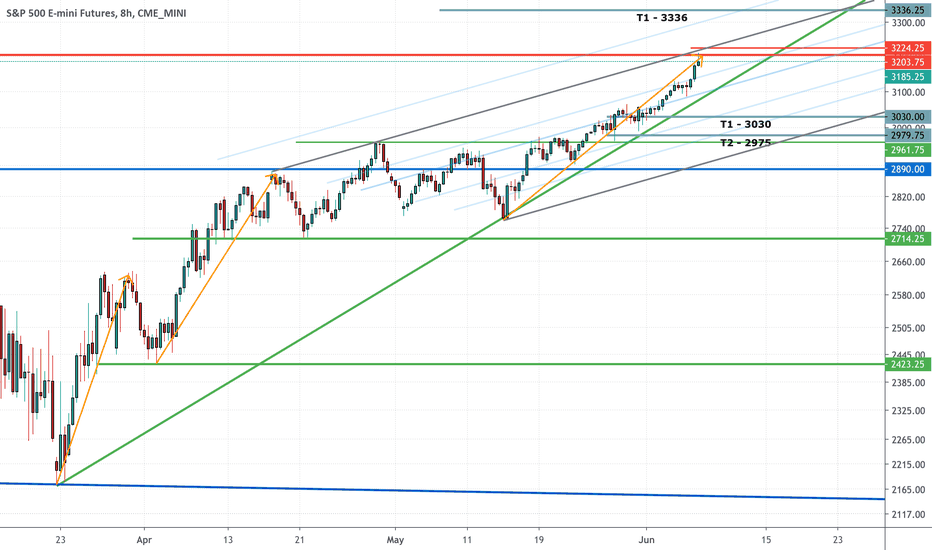

Prices have soared for the last month and a half. Only now have we experienced a stutter in the trend. Looking at the daily stochastic, there was a crossover that occurred yesterday to the downside. Technically speaking, we failed to breach Feb highs today, while creating daily stochastic and MACD bearish divergence. There is also a trend line which was broken...

Price has been consolidating between 3060-3140 since last week in an ascending triangle pattern. However, technically, we are in a downtrend and coming off an island reversal. Furthermore, bulls are unable to breach upper resistance to backfill the gap left from the reversal. Each time frame that goes by that this does not happen adds to the bearish...

Triple range expansion Approximately 440 ticks Just completed another range expansion Expecting to hit lower T1/T2 this week ES/NQ has entered a hidden channel similar to the 2018/2019 market correction rally. We are at the top of the channel, expecting a technical pullback. Alternative scenario would be range expansion higher to T2 - 3538 Looking to short...