We are definitely going to find out which is the case. If you've been following my updates, you know I mainly focus on Macro. So it is hard for me to get caught up in short-term movements, especially in such a downtrend, but something I MUST acknowledge is you can NOT stay biased when signs point to the opposite. The market doesn't care about your convictions....

As the title says, BTC has lost a few important supports over the last few days . Because of these lost levels, I expect a restest of them before most likely deciding what's next. These are roughly the paths I expect, barring any extreme movement. It is a very interesting week for the stock market and will lead to more volatility. Supports and...

Alt Coins are in total free fall. A massive Head & Shoulders pattern has been completed and the measured move down from the break is 49.43%. That puts the Total 2 Cap around 483 Billion. Short-term relief is possible, but the general direction seems clear.

As the title suggests, XRP has lost all significant support. Alt Coins are being absolutely obliterated today and this one is no exception. Support currently sits around $0.30 Cents. Maybe the price bounces around a bit before reaching this target, but it ultimately will hit it. Trust the process! Here is the Macro View for Reference:

As the title suggests, ADA has lost all significant support. Alt Coins are being absolutely obliterated today and this one is no exception. Support currently sits around $0.30 Cents. Maybe the price bounces around a bit before reaching this target, but it ultimately will hit it. Trust the process! Here is the Marco View for Reference:

Here is the ALT Coin landscape, from my perspective, as we navigate through 2022. Three things I would like to focus on are the ALT Coin Chart, as well as BTC Dominance and ETH/BTC Chart for support. Some very important things to consider from both past and future perspectives. First, Let's take a look at the Alt Coin chart, and ill give a brief explanation as...

BTC is currently the equivalent of hanging off the edge of a mountain. One wrong move and Drop. Anyone who has followed me for some time has seen this chart and most likely knows its significance . These levels are extremely important and have proven this over a long period of time. Here is the Marco perspective for reference: One thing I will touch on...

Despite the recent carnage we are seeing RECORD Longs from people attempting the catch the falling knife. BTC has dropped so much that surely it can't possibly continue, right? Well, the RSI on the Monthly tells a different story. Clearly, there is room to drop further before establishing a strong bottom. NEVER before in BTC's history has Price tested the...

Im here to tell you although darkness has forsaken the market, there will still be opportunities. I believe we are approaching just that. It's coming time for a relief bounce and a Bearish retest of these lost levels. Here is the Macro view for reference: If the market doesn't reverse to retest these levels, the market is very wrong. The recession...

Seems like BTC is in a Falling Wedge pattern since December 2017 . Price touched the bottom of it in March 2021. BTC bounced around for a bit forming a nice bottom reversal around November 2021 . Now price is headed for the top of the wedge .

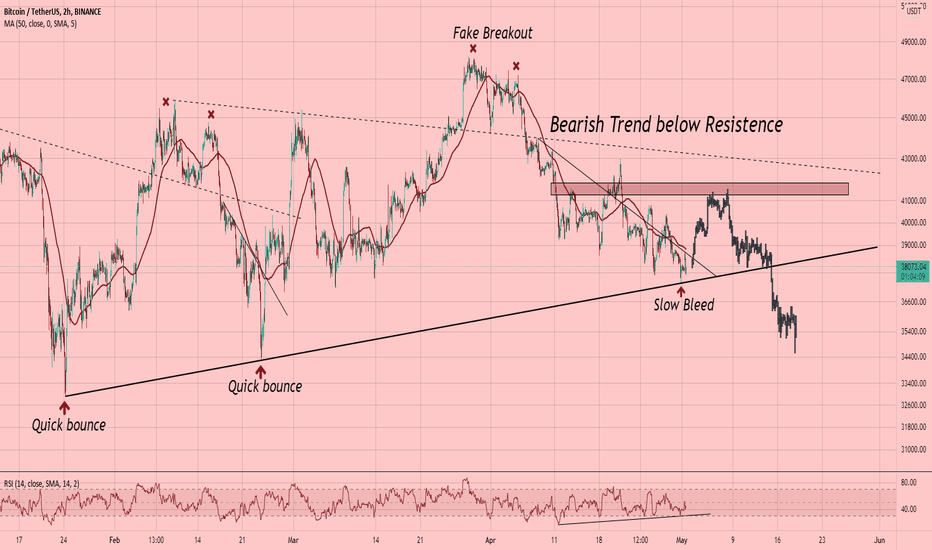

Someone somewhere is still trying to figure out how this is Bullish. All their favorite influencers promised 100k in 2021 and now they promise post FOMC meeting Pump . It's easy to get caught up in these short-term swings and FOMO naturally kicks in. Just zoom out 7 months and you will realize the trend hasn't changed. Today it was continued. ...

The amount of bidders here surprises me, to be honest. These wicks are showing clear accumulation. Seems like there are many who are expecting some insane reversal to regain all this lost ground. From a TA perspective, this is what I would consider very wishful thinking and is commonly known as "Catching the falling knife" . I mean just look at the number of...

Ahead of incredibly important CPI data to be released tomorrow, we are seeing yields steepen in a very dramatic fashion. In comparison to each of the last 3 inversions, this one is not even close to the past. It is important to understand that when yields steepen , it systematically leads to downside in the SPX/NASDAQ. It has been the indicator of almost...

In the chart we can see a clear Cup & Handle Pattern has formed at a very key point. Price is hovering right above the Daily 200MA and RSI looks ready for a breakout . At worst we can see the price go to retest the 200MA but from there I expect a bullish rally. Gold is set to thrive in this environment. There is no short path to controlling Inflation ...

Watching closely as we head into Monday, this is a probable outcome before any more strong selling. Liquidity needs to be sparked again so it can be taken, and the trend can continue. The reason for the bounce is the RSI Divergence . To further support this analysis, BTC just closed its worst Monthly Candle on record: As well as a decoupling of BTC/USD...

BTC closed a very critical 3 day candle today. It is expressed on the 3 day MACD where todays candle closed a Bearish Cross . This has proven to be a consistent warning for downside ahead! Lets take a look at the previous 3 Day Bearish Crosses: What is most interesting here is that BTC has only found itself testing the 3 Day 200MA only 4 times ...

Not going to go in-depth on this one. Just letting the chart present the analysis. Heading for a Bearish Cross on the MACD 3 Day chart. This historically has proven to be significant and has already crossed on BTC. As well as the Stoch RSI being very overextended. DOGE is currently trending under all major Moving Averages. This is not a place to be...

In terms of price action and the trend towards the close of this monthly candle, this was decisively the worst close on record . Every other monthly close showed signs of seller exhaustion by producing that lower wick on each of the previous red candles . Not only does this close show the strength of the Bearish Trend , but it also closed beneath the last...