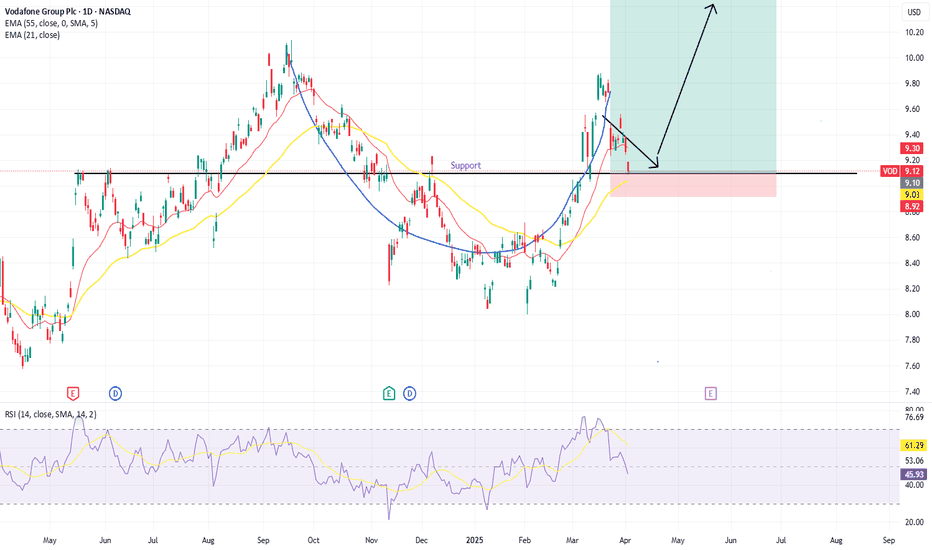

There appears to be a cup and handle pattern forming in $NASDAQ:VOD. It had strong push upward last summer and has drifted back down through the end of the year, with another strong increase back near its highs. We are now seeing a retraction following the handle portion of the pattern and today reached a significant support line. I would expect to see a little...

Since June of last year NASDAQ:NVDA has been developing a $113 support level. Today we saw a retest of this level with strong momentum in accordance with a weakening market. I believe the Stock will break this level and continue down to its next significant support level at $96. Technically, the stock is bouncing off of a return to its 21 EMA below the 50 EMA...

NASDAQ:AMD AMD has been in a strong downtrend for the last 5 months staying within a defined channel. It has reached a key support level at $100 from the end of 2023 and is down over 50% from all-time highs. I believe we will see a little bit of consolidation here over the next week or two then a breakout of the channel. I have started a long position at this...

I believe NASDAQ:TSLA is entering a key support level here that will lead to a strong bounce back up. TSLA is down nearly 50% from all-time highs and is reaching a support level that had strong resistance for much of the last half of 2024. The RSI is also hanging out below 30 which could also indicate it as a strong candidate for an RSI play as well. I entered...

Between January 2023 and July 2024 NASDAQ:MSFT had a nearly 100% expansion showing aggressive growth. For the last 8 months however, MSFT has been trading sideways in a channel between ~$455 and ~$400. During the last earnings report future growth guidance came in under expectations. Technically, there was large gap down following earnings and a retraction to...

I posted an idea on HG1! COMEX:HG1! last year where I identified a channel that futures were trading in and made a plan to trade the copper index fund AMEX:CPER while it was in the channel and trade the Copper miners ETF AMEX:COPX when it broke out to capture asset appreciation as well as dividends. I got long last March in COPX and have been holding. Price...

A little late posting this idea but I believe I identified a cup - and- handle pattern on the daily chart in ABT. I was able to enter the trade in the pull back of the 'handle' when volume was starting to dry up at $113.25. Prior to the formation of the pattern there was a ~29% run up on the stock. Playing this conservatively I am setting my price targets at 12%...

Right now copper futures (HG1!) are trading sideways in a well defined channel. With the growing demand for elecrtic vehicles and government pledges to decrease their carbon footprint copper should become a valuable commodity for building this new infastructure. While copper is trading in this channel I am going to be trading with the CPER ETF that tracks copper...