Ocean98

EssentialHello Traders Here's a breakdown on GBPAUD: Daily Timeframe 1. Overall trend is bullish; price has been consistently forming HH & respecting HL. 2. Current price is in corrective phase, meaning we should be focusing on sells until we reach our discounted level, and price will be following bearish order flow (Forming LL & respecting LH) 3. Using the...

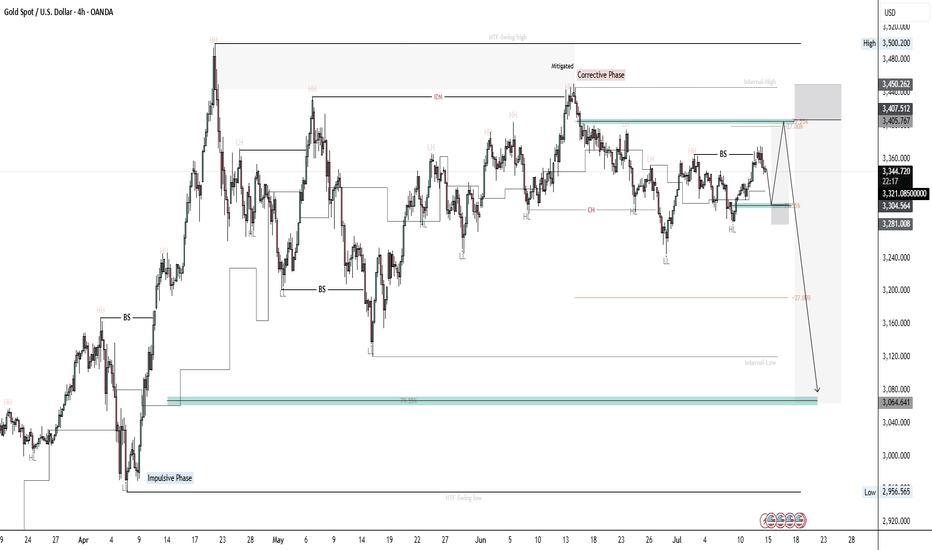

Hello Traders! Here's a breakdown on XAUUSD: H4 Timeframe 1. Overall trend is Bullish; Price has been forming HH and respecting HL. 2. By using the identified swing points, we can highlight discounted levels where we expect price to resume the bullish trend. (Impulsive phase) 3. Gold in currently in a (Corrective Phase), and within that corrective structure...

Hello Traders! It's been a while since my last post on the market. Here's a breakdown of GBPUSD. Daily Timeframe: 1. We have been in a bullish trend, price forming HH and respecting HL. (impulsive phase) 2. By dragging our Fibonacci level from swing low to swing high, we can clearly see potential discounted levels where we can look for buying opportunities...

Hello Traders! I am currently watching GBPNZD for possible longs. Price is in a Bullish trend. Using the last swing low and high i can identify discounted prices where i can potentially look to take longs. Price has tapped into my 71% fib level and had a fractal shift in market structure, we are currently visiting the OB the resulted into MSS, hoping to see a...

GBPUSD H4 After a Bullish BOS, Currency Pros Indicator can identify Discounted price for possible long positions targeting the newly created swing high. Strange enough EU did this before making a new high, but GU made the new high first then went for this LQ grab. Makes it hard to have confidence on the trade but looks valid.

Hello Traders USDCHF - H4 is Bearish After a Bearish BOS, i can identify Premium price for possible short positions targeting the newly created swing low. *Again the 50% level could provide strong resistance. There's valid IMB, Swing point has a clean LQ sweep.

Hello Traders GBPUSD-H4 is Bullish After a Bullish BOS, i can identify discounted price for possible long positions targeting the newly created swing high. *Following EU analysis, in this case i have also outlined how price grabbed LQ in the rising wedge and continued to the upside without tapping into either equilibrium level or extreme levels. The best...

Hello Traders EURUSD is Bullish on H4. After a Bullish BOS, I can identify discounted price for possible long positions. targeting the newly created swing high. *Price doesn't have to go back into extreme levels to form a potential HL. it can use the equilibrium level, if there's valid POI/IMB around it. alternatively there's enough LQ generated by the...

Hello Traders EURUSD-H4 Bullish After a bullish BOS, i can identify discounted price for possible long positions targeting the newly created swing high. Internal structure the swing high is not solid yet, but for a confirmed swing high, i do expect M15-MSS then H4 pull back will start

Hello Traders USDCHF-Daily After a Bullish BOS, I can identify discounted price for possible long positions targeting the newly created swing high. (Not saying POI will hold-But i will be looking for MSS within the POI on 1H)

Hello Traders XAUUSD-Daily TF After a Bullish BOS, I can identify discounted price for possible long positions targeting the newly created swing high. H4>below (Internal structure-After a Bearish MSS, i can identify premium price for possible short positions targeting the newly created swing low)

Hello Traders BTCUSD on 4H Timeframe *After a Bullish BOS,I can identify discounted price for possible long positions targeting the newly created swing high.

Hello Traders What i am looking for in USDCHF After a Bearish BOS, i can identify Premium price for short positions targeting the newly created swing low.

Hello Traders Swing Structure - Bullish After a Bullish BOS, I can identify discounted price for possible long positions targeting the newly created swing high. Internal structure - Bearish After a Bearish BOS, i can identify premium price for possible short positions targeting the newly created swing low.

Hello Traders Swing structure is Bearish After a Bearish BOS, I can identify premium price for possible short positions targeting the newly created swing low. What are your thoughts?

HTF (Higher Timeframe) - GBPUSD is Bearish -Price is above discounted level, tapped HTF-POI, in premium level. -Look for confirmed entries on LTF LTF (Lower Timeframe) -GBPUSD is Bearish -Price after mitigating HTF-POI, it resulted into MSS. -using the last internal high and low, premium and discount, Imbalance and momentum, i can identify a possible POI...

Hello Traders Today I am Looking at GU for potential short positions. Swing structure remains Bearish for me and Internal structure is still Bullish. Price is trading within Premium levels and has tapped into my HTF POI, I am now looking for MSS on internal structure to align with HTF trend. I wouldn't be interested on BUY's on LTF for now until the HTF-POI has...

Hello Traders Swing Structure is Bullish on HTF Price made a retracement to form a HL, on a HTF-POI and resulted into a MSS which is more clear on internal structure. Internal Structure is Bullish After the recent bullish BOS, I was able to identify Discounted prices for possible long positions targeting the newly created swing high. Detailed (Focusing on...