Stan Weinstein wrote a classic investment book in the 1980's Basically, it's based on recognising the rotation in the market between stage 1,2 3 and 4 - instead of inserting loads of waffle about it check out this link - the7circles.uk So going by Stan’s rules in relation to this stock I get: 1. General Market shows an uptrend. 2. The present best performing...

First post for a while, been a long year. Stan Weinstein wrote a classic investment book in the 1980's Basically, it's based on recognising the rotation in the market between stage 1,2 3 and 4 - instead of inserting loads of waffle about it check out this link - the7circles.uk Stan’s general rules on buying are: 1. Check the major trend of the overall...

Up Global Sourcing Holdings PLC (LSE:UPGS) Sector: - Consumer Cyclicals (so volatile with the market) How found: - Screener for possible growth stocks using a Greenblatt approach, based on the book “little book that beat the market”. Also searching for consumer cyclical affected by Coronavirus. Company Background: - Incorporated April 2005, listed March...

Sector: - Consumer Cyclicals How found: - Filtering for stocks like Lord Lee of Trafford’s recommendations (he was the first ISA millionaire). Company Background: - Incorporated May 1899 (yes, old co.) public since Jan 1986. Walker Greenbank PLC is an international luxury interior furnishings company that designs, manufactures and markets wallpapers and...

M & G PLC (LSE:MNG) Sector: - Financials How found: - Looking for companies under 10 years old, strong dividend pattern and dividend cover with PE below 10, just to see what would be thrown up for further analysis. Company Background: - M&G is a UK based investment and savings company, it invests on behalf of others under the brands Prudential and M&G...

Strix (LSE:KETL) Sector: - Industrials How found: - Strix appeared in a steady dividend filter and momentum filter, it’s a steady away company no Star or YOYO – more a Clydesdale Horse. This is a long-term hold. Company Background: - Incorporated July 2017 (though has been around as an organisation since the 1950’s), makes kettle controls (main market)...

Please note on TradingView the chart shows the firm has been listed longer than July 2018, I think this is a "ghost in the machine". Sector: - Industrials (?) Legal Accident Managment Firm How found: - Anexo keeps cropping up in my various feeds and forums from time to time. Looking at the chart it has been a steady rise in share price since inception. ...

SCS Group PLC – SCS Sector: - Consumer Cyclicals How did I come across it: - I was also looking for firms that may benefit from the up tick in estate agent enquires and their outlook reported in the FT 16th January 2020 (Estate agents eye better times but Brexit could still dampen market). I then filtered for dividend stock with a low PE, dividend history,...

Sector: - Energy How Did I Come Across It: - Basically the forums and it was recently the most popular pick for 2020 stocks in a Stockopedia competition. Background: - Incorporated Jul 2015, public listed Jan 2016. Rockrose Energy PLC is a United Kingdom-based oil and gas production and infrastructure company. The Company focuses on onshore and offshore...

Industry Sector: - Basic Materials How did I come across it?: - I was performing research on Hybrid car market and then came across Rhodium (it’s a platinum group metal). Platinum's main use is in diesel vehicles, whereas palladium tends to be used in petrol engines. But rhodium is the most effective catalyst for nitrous oxide (N2O) emissions in petrol...

Industry Sector - Energy, not exploration (so plus point). Rough Technical - Presently support 96p and resistance around 110 - 120p, though the stock ranks low for general momentum and quality. Present Presently 103p at 20200116. Price peaked at 125p in Jul 18 and 19. I am thinking of entry between 90-100p. Jan 2020 it is trading on future earnings of 8...

Metro Bank (MTRO), I have ridden this piggy on a number of shorts for some time, basically based on the odd behaviour of the management (Particularly the doggo loving ex-Chairman Vernon Hill). I have to admit I have been nervous about continuing a short position and actually got out quick on my last position and adopted a long position on Friday 15th November...

I have dipped in and out shorting WPCT for a while, and I am having another dip in for a short position. WPCT is still stuck trying to sell illiquid holdings from a position of financial distress, the board has just released the NAV at 58.10p (6th November 2019) a month ago it was 64.67p (4th October), 11% drop. When you look at the monthly NAV drops over the...

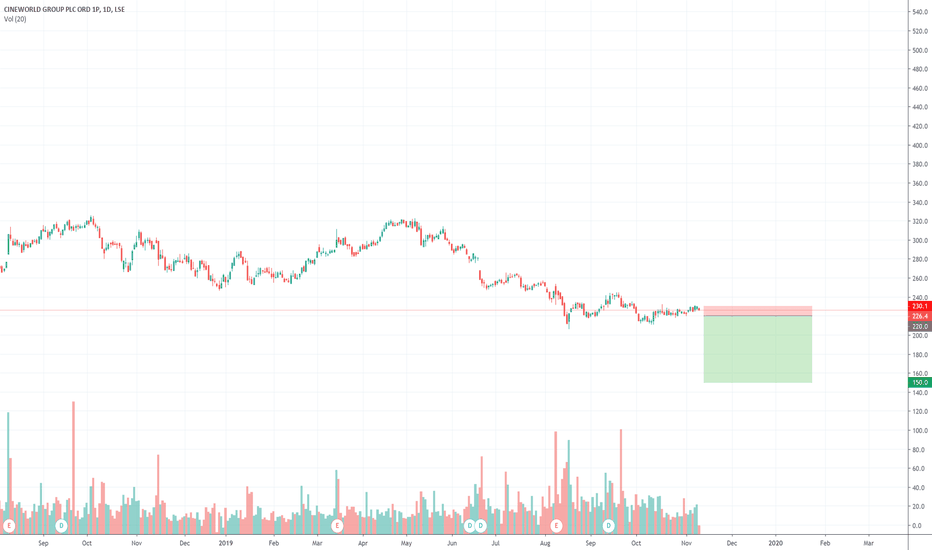

Cineworld (CINE) has 10% of disclosed short positions (this has been slowly increasing over the last 6 months). CINE in brief. Y/E 2018 - T/O $4.1bn, Operating Profit $493m, Net Profit $273m, Operating Margin 12%. Debt $7bn - Yes $7bn - with its $3.6bn acquisition of US-based Regal Entertainment, CINE is now the second-largest cinema chain in the world –...

I meant to publish this Friday, but got tied up with other things. I was originally looking at this share as a long position early last week, it appeared in one of my stock filters for long positions. Standard Chartered (STAN) is supposed to be the 3rd most shorted stock on the UK index by the big players (one being Steve Eisman from the "Big Short"). If you...

M&S Been the back bone of UK retail store fronts for a life time, has been in general decline for the last 15 years. It has many of the features of an attractive short: legacy, disrupted (not disruptive) business model shrinking revenues not much evidence of any economic/competitive moat low margin capital intensive financially geared (financial net debt £1.5...