Ombabibi

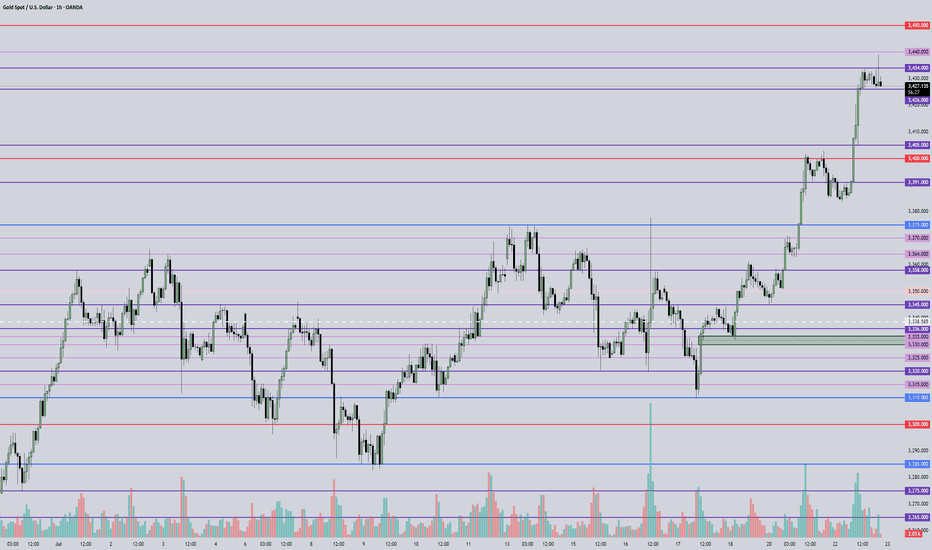

PremiumSummary: Price is hovering near a key inflection zone. 3388 acts as the current bull-bear dividing line. If price holds below it, bearish momentum may continue. If price breaks above 3395, bulls could regain control. Until then, watch for rejection near resistance and possible long setups near the lower support band. Patience is key — wait for confirmation around...

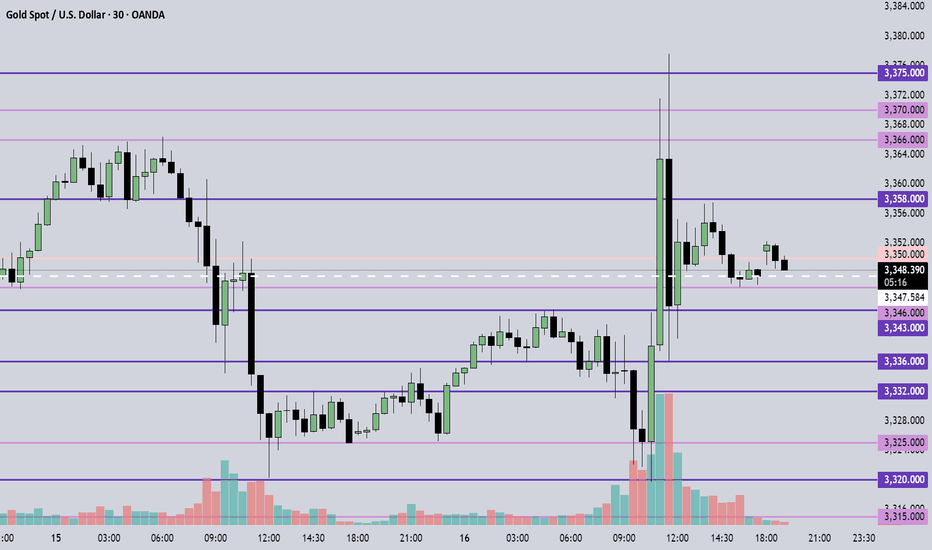

Summary: Price action today is likely to stay within the 3358–3385 consolidation zone. Inside this range, the strategy is to sell near the top and buy near the bottom. Watch 3365 — if it breaks, look for short opportunities on pullbacks; if 3375 holds, look for long setups on dips. Overall, the support and resistance levels are cluttered, suggesting potential...

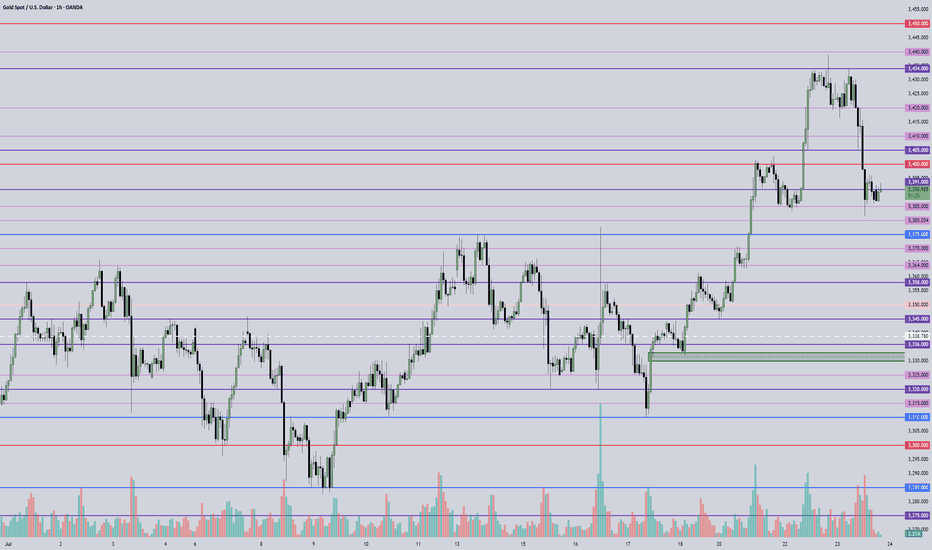

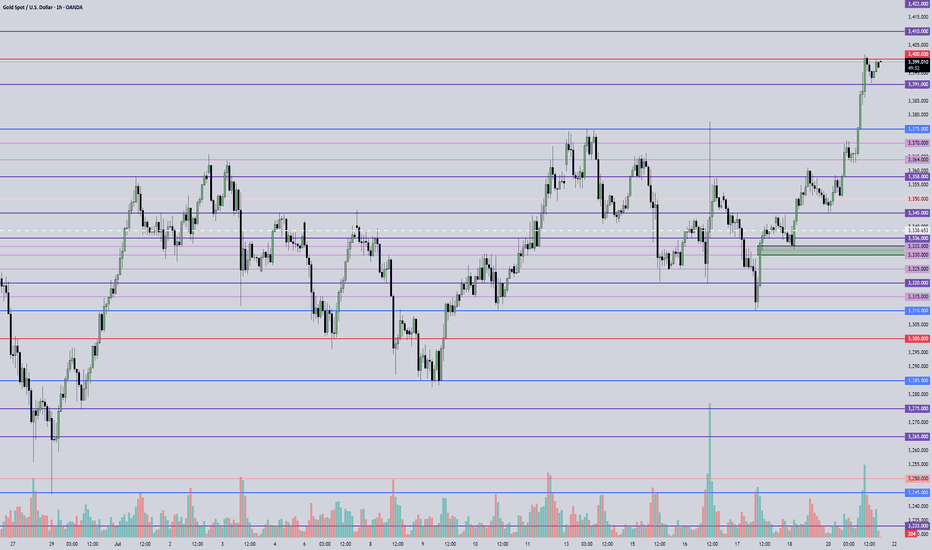

Summary: We’re still in a bullish market, with no signs of a major reversal and last month’s low still holding. The overall strategy remains buying on dips. On the upside, 3390 is the key resistance to watch today — if broken, the next target is the 3400 psychological level. However, if 3400 is rejected again, it may offer a high-risk-reward short setup. On the...

Summary: Price action has been choppy and indecisive, with no clean signals or clear levels. In the absence of a solid short setup, the main idea for the Asian session is to buy on dips. Watch the 3385 resistance zone closely — if price breaks and holds above, look for long opportunities on a pullback. If 3385 is rejected, it may offer a good risk-reward short...

Summary: Gold is currently in a sideways-to-bullish structure. Strong resistance remains around 3440–3450; if this level fails to break, it offers a high-probability shorting opportunity. Near-term focus is on the 3350 support level — if it breaks, bearish momentum may pick up and selling the pullback becomes ideal. If 3350 holds, consider buying the dip and...

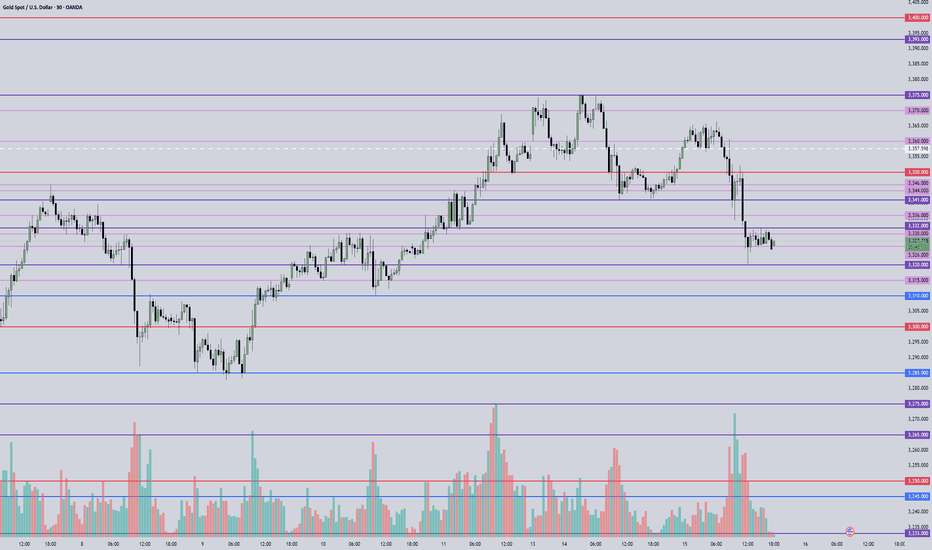

🔍 Key Levels to Watch: • 3323 – Resistance • 3309 – Resistance • 3300 – Psychological level • 3295 – Resistance • 3283 – Key support • 3268 – Short-term support • 3260 – Support • 3245 – Major support • 3233 – Support 📈 Intraday Strategy: • SELL if price breaks below 3283 → target 3280, then 3275, 3268, 3260 • BUY if price holds above 3286 → target 3289, then...

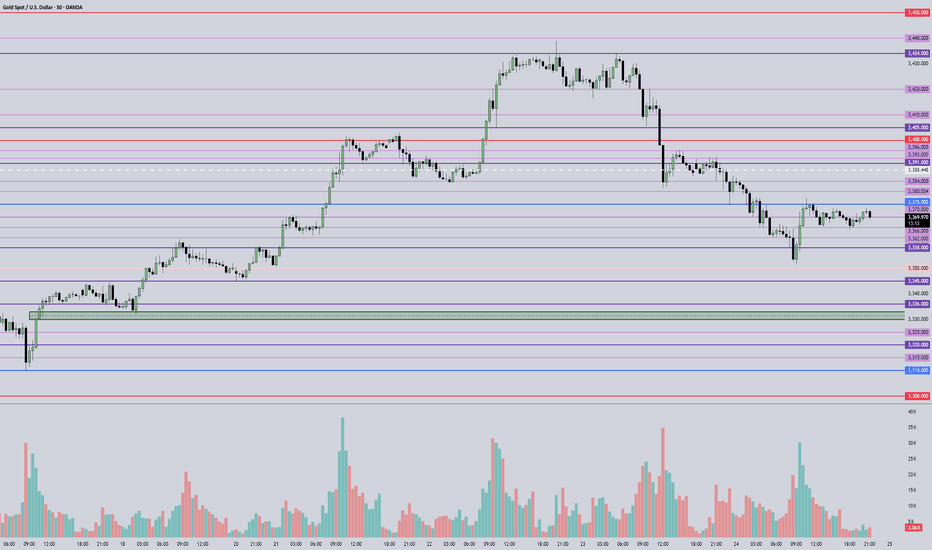

Summary: The Fed held interest rates unchanged, and Powell’s remarks reduced the likelihood of a rate cut in September — this is fundamentally bearish for gold. Until new fundamental developments emerge, the strategy remains: sell on rallies into resistance. After reviewing the 4H chart, I see two possible scenarios: Price continues down to 3245, pulls back to...

🔍 Key Levels to Watch: • 3384 – Resistance • 3375 – Key resistance • 3365 – Resistance • 3345 – Resistance • 3336 – Resistance • 3325 – Key support • 3310 – Support • 3300 – Psychological level • 3283 – Major support • 3275 – Support • 3265 – Support 📈 Intraday Strategy: • SELL if price breaks below 3325 → target 3320, then 3315, 3310, 3300 • BUY if price holds...

Summary: The downtrend continues, but a technical rebound is possible today. Keep a close eye on the 3310 level — if price holds, bulls may fight back and we look for long setups on pullbacks. If 3310 is broken, the bearish momentum is likely to extend, and we shift to selling on failed rallies. The next significant support lies at 3283. 🔍 Key Levels to Watch: •...

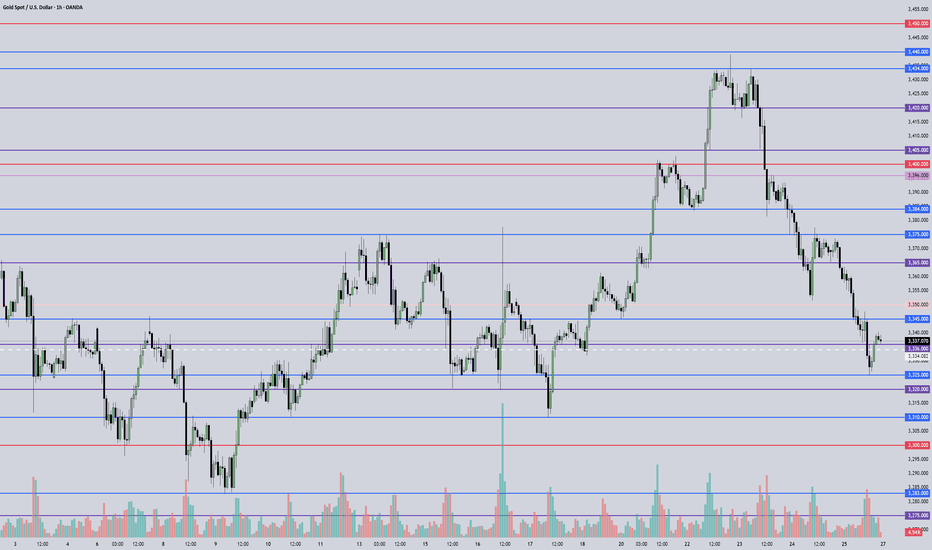

Summary: Price action remains weak after last week's bearish close, with 3440 acting as a clear resistance level. While bulls have lost momentum, bears have not yet taken full control — 3310 and 3283 are key support zones to watch. Price is currently reacting near 3339, • Above 3345, the plan is to buy on pullbacks. • Below 3332, switch to selling rallies. Expect...

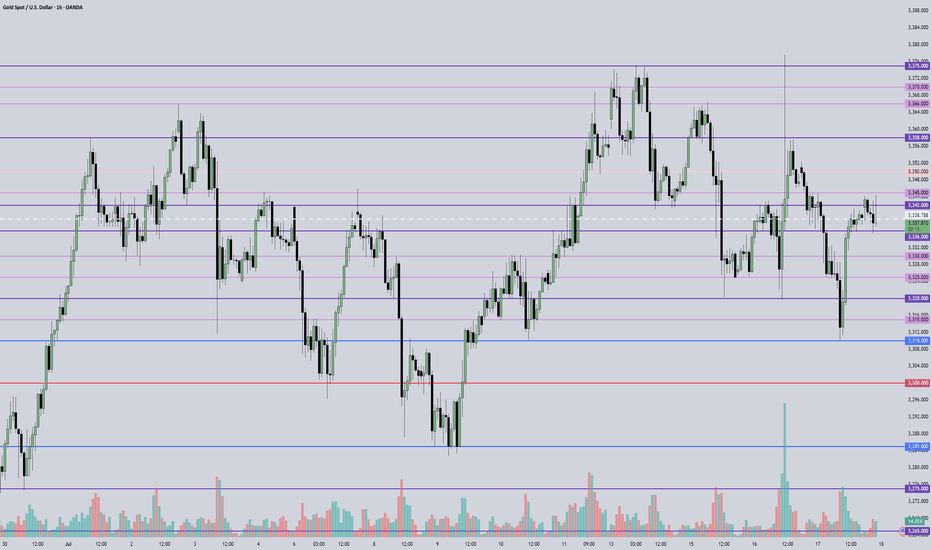

Summary: The downtrend continues, with 3350 providing some support — though not strong enough to indicate a solid reversal. Watch for a retest of this level; if 3350 breaks, bearish momentum may resume. For now, price is ranging between 3365–3375. Continue to trade the range with a sell-high, buy-low mindset. • Break below 3365 → look to short on pullbacks. •...

Summary: After yesterday’s sharp drop from 3420 to 3385, today may bring a corrective rebound. Watch the 3385 level closely — if price breaks below, bearish momentum could increase, and the strategy shifts to selling on pullbacks. If 3385 holds, consider buying on dips, targeting a retest of 3400. A sustained move above 3400 may strengthen bullish momentum, but if...

Summary: Currently watching the 3450–3452 zone closely — a key resistance area. Strategy remains to buy on pullbacks, but if price fails to break this resistance, short setups become more favorable. Keep an eye on 3426 support — if it breaks, bearish momentum may strengthen. As always, observe price action at key levels and adjust accordingly. 🔍 Key Levels to...

Summary: Bullish momentum is clearly in play — strategy remains to buy on pullbacks as long as key support levels hold. 🔍 Key Levels to Watch: • 3435 – Resistance • 3422 – Resistance • 3410 – Resistance • 3400 – Psychological level • 3375 – Support • 3364 – Support • 3358 – Support • 3345 – Strong support 📈 Intraday Strategy: • SELL if price breaks below 3391 →...

Summary: Gold remains within a 3310–3375 consolidation range — continue to treat it as range-bound: sell near resistance, buy near support. From a narrower perspective, the 3330–3333 support zone is holding, but stop-loss costs are high in this area, so caution is advised. Overall, stay flexible and monitor key levels closely. React to price action and manage risk...

🔍 Key Levels to Watch: • 3375 – Top of range • 3366 – Resistance • 3358 – Resistance • 3350 – Midpoint • 3345 – Resistance • 3336 – Support • 3330–3332 – Support zone • 3320 – Intraday key support • 3310 – Key support • 3300 – Psychological level 📈 Intraday Strategy: • SELL if price breaks below 3336 → target 3332, then 3330, 3325, 3320 • BUY if price holds above...

Summary: Although price pierced above 3375, it failed to hold. The market remains range-bound between 3320 and 3375 — treat it as a range for now, favoring shorts near the top and longs near the bottom. On a narrower view, 3358 is a key resistance — shorting near 3358 offers good risk-reward. Watch the strength of support around 3346. Stay flexible, respect key...

Summary: As long as 3332 holds as resistance, the early session plan is to sell on pullbacks into resistance. An update will follow before the Asian session opens to confirm or adjust the plan. Stay flexible and watch price behavior at key levels — follow the trend and manage risk carefully. 🔍 Key Levels to Watch: • 3366 – Previous high resistance • 3357 –...