Opulent_FX

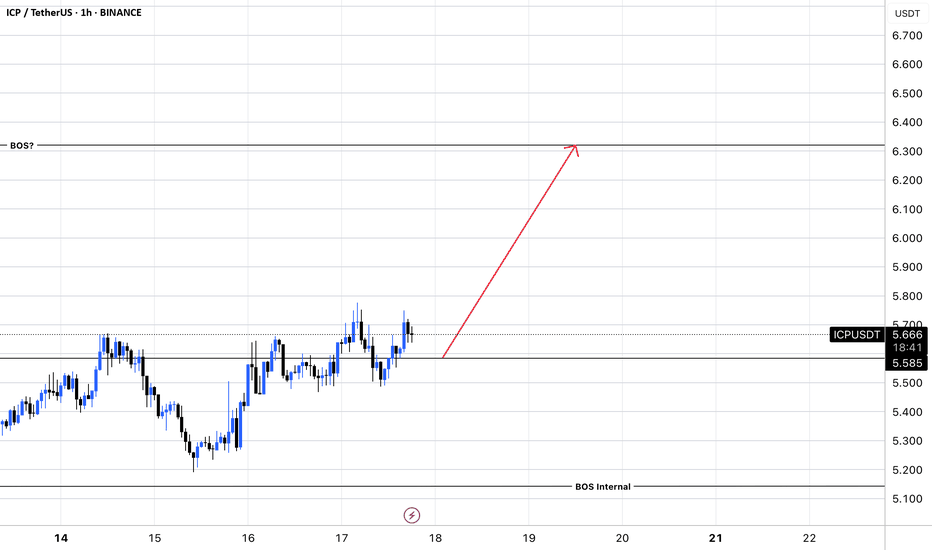

With the Bullish momentum ramping up on FWB:ICP , my next target will be 6.300 for partials. I will leave a runner for as long as possible. Let me know below what your thoughts are.

If this is the case of a trend continuation, then this current price provides a decent opportunity for a little medium-term swing. We would need to await further sell confirmation for entries. Targets would be the previous swing low at +-1.21000 I will update accordingly.

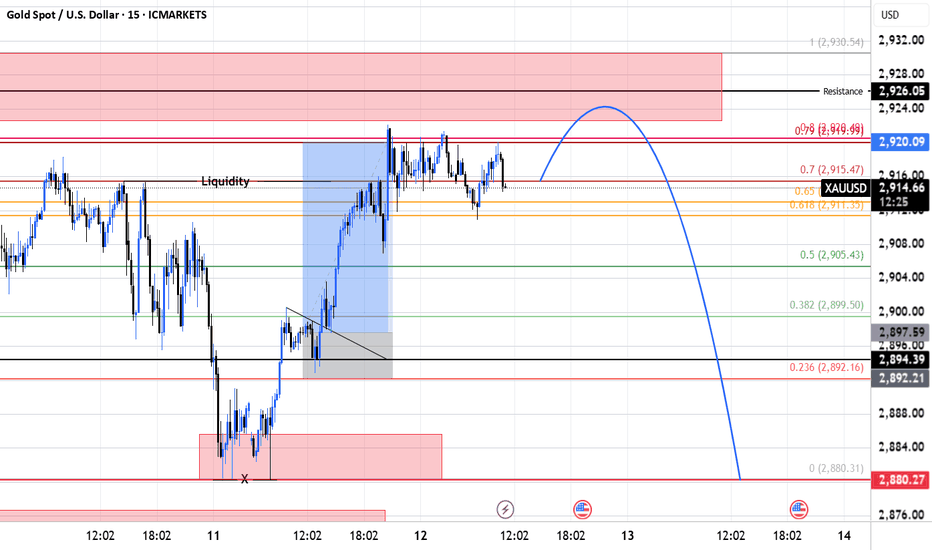

An update from my last idea. We have in fact seen the week start with some bullish momentum, however I think that will end during the course of today and tomorrow as Gold price is approaching the area I will look to short from 2925-2926 area. Once price enters that area I will then await clear sell confirmations in the form of high volume breaks of structure to...

Depending on the moves we see during London session, there is a possibility we could see bullish momentum for the day, and a sweep of various levels of liquidity (equal highs as marked, as well as the previous Asia Range High) and market could potentially only sell off again from higher FIB Levels, being .79 - .80 area. This would also close a previous inbalance...

I am expecting a sweep of Asia Range High liquidity, followed by a quick fall to the 1820 price area. This will serve as a correction/retracement for further bullish momentum. A potential market reversal can only be expected on Friday during NFP. This is counter trend so use correct Risk Management. It is a 1:9 Risk/Reward Ratio trade.

Price has traded into a 15Min TF point of interest. Consolidated, then swept liquidity tapping the 0.79 Fib Level. Once price breaks structure to the upside the trade will be valid. Target is set at 0.86043

XAUUSD has been trading in an ascending channel as of Friday 13 October 2023 as displayed on my chart. Currently we are trading against the lower trendline, so there is potential for either a break-out from this level OR we can potentially expect a bounce and some bullish momentum to re-test the 2080 level. Another possibility is a fake-out and a bounce from the...

Price reacted perfectly from my marked 0.79 FIB Level. Next week we are looking for short entries for a decent swing position.

reluctant to look for short porsitions from this area due to the optimal retracement not met. Perhaps short term yes, but long term I still see further bullish price action. 146.754 level would be premium, so be cautious with your shorts from this level. PROTECT YOUR CAPITAL.

We created a new low last week, so XAUUSD has shown no clear sign of buyer strength. Short-term long positions to the 1930-1932 area are on the cards, then we shorting to 1864 for a conservative exit.

Due to the clear Change of Character on GBPCHF I have the following limits in place. Price has shown good orderflow and seems to be sticking within the range I am looking at trading. I will be entering from a 1Hour OrderBlock and targeting the very next unmitigated OrderBlock (my SELL zone).

I am looking at this potential Short to Long on EURUSD particularly because structure was broken to the upside, however price has yet to sweep Friday's Asia High Range.

AUDCAD reacted from my Daily POI and broke structure to the downside. I caught a good 1:13.55 RR trade, and I am looking at capitalizing from the second leg of the sell off. I will be entering from a 45Min Orderblock, and targeting my next POI.

After a bearish 2 weeks we had witness a substantial break of structure on 10 February 2022. Structure broke to the upside, creating higher highs after reacting from a daily chart demand zone. I will be looking at a double confirmed entry from an order block that was created from the mitigation of the order block that caused the initial break of structure. I will...

AUDUSD presented a clear Wyckoff Distribution Schematic on the 1H chart, followed by a high volume drop that broke several levels of structure. I will be looking at entering from the re-test of the Last Point Of Supply as displayed on my chart.

GBPJPY mitigated a 4H Order Block and broke structure to the downside. I will be looking at entering from a 15min Order Block and targeting the Equal Lows in the 153.023 region.

EURUSD showing substantial sell-side momentum. I will be looking to enter from a 5min Order Block and targeting the bottom of the Imbalance left by the a high volume push to the upside.

Several levels of structure broken to the upside after the mitigation of a daily POI. I will be looking at BUYS from this zone. This is a MASSIVE trade guys 🔥