Orriginal

PremiumI don't meed to say to much ehre, the charts tell the stiry. All are 4 hour BITCOIN - GOLD DXY $ - S&P500 And BITCOIN has the highest Rise in this time. Gold was rising as safety seemed sensible but now, Risjier asset are safe for 3 months. ( for now) The DXY dained against other currencies, taking back gains maybe And the S&P riases though the NASDAQ has...

I have used this chart often and have posted it here on a number of occasions with out the Bull Power Bear Power Histogram by CEYHUN active. This is how the chart Looks when it is active. This indicator calculates trading action to determine if a Candle is Bullish or Bearish and is VERY ACCURATE And, Currently, Today's candle is GREEN, for the first time in a...

Following on from the sharp drop in the beginning of the week, where PA dropped Below the 50 SMA ( RED) , PA has recovered and, as you can see, the candle Body is currently sitting ON the 50 SMA We may need to remain in this area to bring back the Bullish Sentiment and then move higher. It can be said that a bullish sentiment remains with Bitcoin as its did...

I have not posted this chart for a while. For me, I find it an excellent way of looking at the general Market sentiment. And I see determination to NOT fail. And interestingly, It is the $ that won out yesterday ( Monday 7 April 2025 ) The charts are 4 hour. The DXY got a Boost as other currencies fell in value against the $, so making the $ the winner. Also...

In a week where I am still expecting the beginnings of a bounce, we saw a Major Drop overnight. This has pushed PA below the 50 SMA that I was hoping PA would bounce off, as it had previously. So, Whats Next ? It is not as bad as it may appear but CAUTION is a Very Very good idea. There are a number of lines of support below and if we do not find any soon, 73K...

Just a Quick Idea - But the 50 SMA has been a Good Lauch pad previously in 2024 - Is it about to do so again ? We also have the MACD ( Weekly ) nearing Neutral, It also bounced off this level in 2024 We will know by tomorrow or Tuesday, Just what is happening HANG ON

I first posted this idea on 19 March ( link at end of this post ) The idea is that because MACD on the weekly is still Falling bearish and is likely to remain doing so till at least Neutral is reached. This would Mean that PA had to Range in a region to allow that Drop Things Excellerated though and that date of Mid Late April has now been pushed forward...

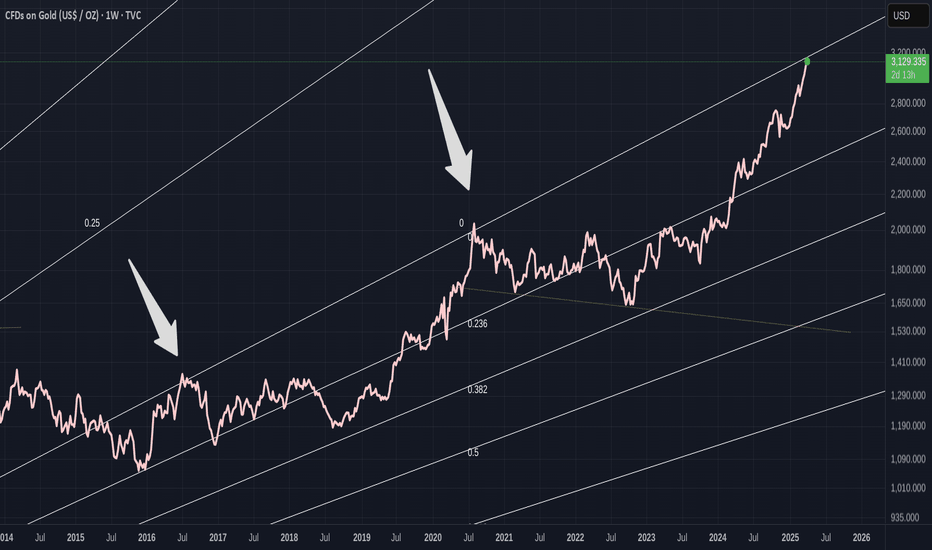

As you can see, GOLD has come to a point where it has been rejected twice previously. And on each of the previous occasions, PA ended up back on the lower trend line., taking around 2 years to do so on each occasions GOLD MOVES SO SLOW - mostly due to its HUGE market cap..... But thats another story Has the recent rise of Gold come to a line of defeat ? The Daily...

The daily chart shows the line of resistance we now hit This is the line that has rejected PA since january It is Strong. We May break through but we have to wait and see but it is certainly Wise to be prepared for rejection Even more so when you look at the Apex we are coming to with in the next 7 days PA ALWAYS REACTS BEFORE THE APEX The Volume profile on the...

We got the expected RED March close but it was a close thing. but, this creates better Odds for a continued push to ATH. We have had only 3 occasions when we had a Green Jan, Red Feb, Red March ( arrows) 2 of those went on to an ATH the following Year ! The other one was entering a Bear Market. Of the previous 7 RED March Closes, 5 were followed by a Green...

First off, this maybe the last time I post this chart. Binance are Stopping USDT use from tomorrow morning. I have used this chart since around March 2020 and it is my most trusted,. A sad day for me. This chart saw me through Bulk Run, Deep Bear and now this Recovery and Bull run. ANYWAY, the Arrow points towards a time in 2023 when we were so close to dropping...

As we come to the end of the week, we see the potential for further drop as PA slides along that 236 Fib circle. ( Red) It NEVER ceases to amaze me how PA reacts to Fib circles and yet, as if by magic, there is some Macro News at exactly the same time On this occasion, It seems the US inflation figures on Friday caused this Drop in price. This Chart is the daily...

Chances are we will see PA Drop over the weekend if what has happened today is anything to go by As mentioned in apost this morning, Pa fgot rejected off the upper trend line of the descending channel and currently Sits on the POC ( point of control ) on the VRVP ( Vivible Range Volume Profile ) The Drop if we loose this support could be swift but we do have...

In a slight contradiction to my previous post - as I like to consider ALL options and present them to you, so YOU can make up your own mind. I saya SLight contradiction, as 73K is Still the target here. See this channel AP is in? The descending channel we been in for a while. We seem to be getting rejected off the upper trend line. The lower line crosses the 1...

In this cycle, since the push up from the Low in Jan 2023, we have had 2 other Major pushes. Each of these came off the Rising line of support that we are currently heading towards again, with the date of "Touch" currently in Mid June. If we rise and stay back in the higher Range Box, that date is even later in the year ( around Mid Q4 ) As I have talked about...

Bitcoin is certainly looking Bullish on the lower time frames and, in my opinion, continur to fall in the Flag till we get near that lower Trend line of Ascending channel we been making since the Low around 76K The 4 hour MACD is falling Bearish and support the idea of a continues Drop to lower Trend line I think the Margins are too tight to do any day...

I am hearing so many people shouting about "This is it, we are on the way" It may turn out to be right BUT for me, It seems people are looking at the smaller Time Frames only. Sure, the main chart here is a 4 hour chart, has been climbing from around 76K ( Told you we would go there ) Looks Lovely and Bullish, though a return to 80K is very possible on the lower...

Due to price rise in Bitcoin over the weekend, we have just opened up a new Bitcoin CME Gap. ALL previous Gaps are Filled. CME GAPS ALWAYS GET FILLED So, we may see PA return to fill this gap. the only time Gaps do not get filled is when in a Major Bull Run We are not in one yet. These are excellent places to put buy orders.