OutlierTrading

PremiumOn August 1st, USDJPY experienced a massive 304-pip drop after a strong impulse into the daily order block. From there, the daily order block was respected, and the retracement was induced by the USD Non-Farm Payrolls news release, leading to a sharp move down to a four-hour liquidity void, hitting the 75% Fibonacci retracement level. This move highlights the...

I found a "reaper" block today. Were Bullish. The Rejection block is measured from High to Low. Tp to 1 Standard deviation. Price knocks out buyers back into reaper FVG. Price enters zone on top of a 1hr Orderblock at 10am. A reaper is a Fair value gap in a discount of the impulsive price leg of a bullish breaker along with a Bias.

Been waiting for WEEKS to see GBPAUD Trade into a Daily Orderblock. Now, Usually, we wait to see how price reacts at this level. However, The reason I say this could be a great buy is because - Dollar Correlation - Old weekly and Daily Lows Swept -Liq. Swept into Daily OrderBlock - London Killlzone - Its my girl GBPAUD

GA Win. Check last/attached post for the reasons why, but here is the outcome. 35pip win, 6pip drawdown. Get out and Got out completely.

Live watching the Federal Reserve Chair Jerome Powell News Conference (FOMC Conference) and at the same time, Dollar just swept liquidity, Hit EQ, Filled 1hrFV Array, Sent to buyside. This is crazy. Its all a game. Its not real.

But I Have been in the market to trade some potentially new markets. In my search, I found XAU goes with a price action. Also Tradeable during Killzone. (check screenshot of Daily Fair value gaps and LV being hit, for a reversal and Confirmation and retest in London.) Although I am not sure if it is tradeable on a higher frequency, Ill add it to my list of...

Hi everyone, this is why I see a sell based off #ict concepts. 1. News (CPI) 2. Wednesday Reversal 3. GBP Pair in London Killzone 4. Liquidity hit (PDH) Entry: Above Asia Market Structure Break Re-test of LTF PD Arrays Risk is half a percent. Godspeed.

Insane Trade Today. Drawdown:3.8pips TP: 81 Pips To start the week, we have price reach and hover at a daily Luquidity Void. From there, During London came a entry - Below Asia Low. We would look to enter here being a bit bullish on the DLV. To reinforce this buy idea, (if you didnt enter at asia low) Price then broke a near high. Retraces to the 15min...

Hello everyone, I hope you won, stayed out, or learned something form the market today 😂. Today was a easy grab. Drawdown: 17. Tics TP: 111. Tics Grabbed (out of 438) Spooz Open Manipulation, Broke near high, Retraced to 15min Order Block, TP Hit at 3 equal Highs (volume). If you found this inciteful, join our group discussion! (link in bio)

Hey guys, Ray here, and I just entered a trade here. Doesn't matter buy or sell, or what currency your trading. We all enter the market and none of us can ever know the "perfect price". Therefore, our Stop Loss is inadvertently a key factor in our entries, lot sizes, and psychology. In this video I explain what I mean... Please comment if you found this insightful!

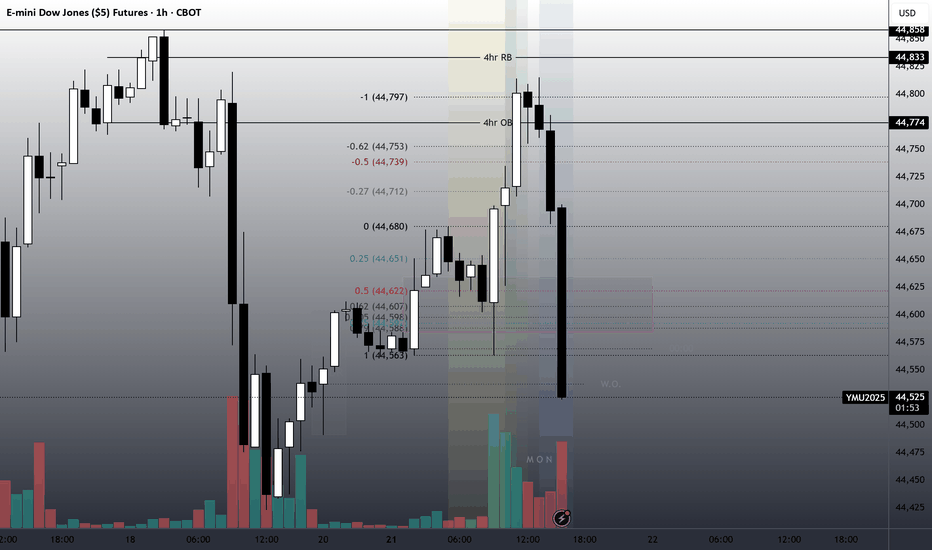

You could throw a Fib on Yesterdays expansion. The equilibrium lands right on the 4hr Liquidity Void. I cant make that up, it also cant be coincidence. It also coincides with this bullish retracement this week. Best of luck!

All Stocks are down (due to tarrif and inflation fears), But I see this as a healthy pullback. This also means there are buying opportunities available. MVST is one of those opportunities I see.

All Stocks are down (due to tariff and inflation fears), But I see this as a healthy pullback. This also means there are buying opportunities available. KOPN is one of those opportunities I see.

All Stocks are down, But I see this as a healthy pullback. This also means there are buying opportunities available. IONQ is one of those opportunities I see.

Yesterday on our weekly call, I had no idea how to approach trading down to fill this Liquidity Void. This morning, its fascinating but no surprise we see price action; trade lower to create that break in market structure, Come back the the 4hr Order block (OB), to reject and see the trade come to fruition.

With certain factors, GU could be a nice buy. 4hr rejection block Below Asia Judas swing Time killzone Liquidity ran If I see all these take place, I'd say that's valid. Godspeed!

We took the Sell - 2am EST - 4hrLV - Above Asia Tp at 43 pips. There was then a buy in NYK, From Old Low to 4hrRB.

I can see a Weekly Down close for GU. I'm looking for the 4hr PD Arrays to be hit, before using LKZ News to push price lower.