This is a newly formed real estate investment trust (REIT) which says that its strategy is to, "...invest in yield-enhancing assets and areas that offer consistent, long-term rental growth...". The company said, "The investment properties comprise of three properties held by way of leasehold for 40 years, which has been independently valued ahead of the intended...

Tharisa (THA) is a mining company that mines and beneficiates platinum group metals (PGMs) and chrome. The company is listed in London and on the JSE. The Tharisa mine on the south-west limb of the Bushveld Igneous Complex (BIC) is an open pit operation with an estimated life of 17 years. The company owns a subsidiary, Arxo Metals, which beneficiates chrome to...

Purple Group (PPE) is a trading platform and asset management company that is aimed mainly at the private investor and offers the cheapest costs of dealing in shares on the JSE. The company has three divisions: (1) Easy Equities which enables investors to buy very small quantities of shares with very low dealing costs. For example, buying R100 worth of a share...

Life Healthcare (LHC) is the second-largest, JSE main-board listed, healthcare company with private hospitals, same-day clinics and surgeries and healthcare companies in South Africa, the UK (Alliance Medical), and Western Europe. The out-going CEO, Shrey Viranna, says that the group is trying to diversify away from conventional hospitals more towards day-clinics...

Murray and Roberts (MUR) is a large South African construction company which has suffered from the sub-prime crisis and then the slump in construction spending following the 2010 World Cup. This brought the share down from a massive double-top formation at around R100 per share to a low below R5 in May 2020. The company has been consolidating and reducing costs....

Purple Group (PPE) is a trading platform and asset management company that is aimed mainly at the private investor and offers the cheapest costs of dealing in shares on the JSE. The company has three divisions: (1) Easy Equities which enables investors to buy very small quantities of shares with very low dealing costs. For example, buying R100 worth of a share...

Trematon (TMT) is an investment holding company with subsidiaries, joint ventures and associate companies, mostly in the Western Cape. The company also invests in listed and unlisted shares. Originally most investments were related to property, but its investments have moved outside that. The company owns Club Mykonos. In a trading statement for the six months...

Sirius (SRE) is a real estate investment trust (REIT), listed on the JSE and the London Stock Exchange (LSE), which specialises in office, manufacturing, and warehousing properties in Germany. The company owns 141 assets with a book value of about 2bn euros. Obviously, this is a well-managed and growing rand-hedge which was benefiting directly from the recovery...

Purple Group (PPE) is a trading platform and asset management company that is aimed mainly at the private investor and offers the cheapest costs of dealing in shares on the JSE. The company has three divisions: (1) Easy Equities which enables investors to buy very small quantities of shares with very low dealing costs. For example, buying R100 worth of a share...

Orion Minerals (ORN) is an Australian exploration company which is listed on the JSE (September 2017) and on the Australian Stock Exchange in Sydney. It is trying to find funding for its copper and zinc mine in Prieska. The Prieska mine was previously operated by Anglovaal, but stopped operating in 1990 after 20 years during which it extracted more than 1 million...

Previously Chrometco. Chrometco (CMO) is a company involved in the exploration and mining of chrome. Chrometco is obviously dependent on the international price of chrome and has all the risks associated with a mining company and a commodity share. In its results for the six months to 31st August 2021 the company reported revenue down 43,6% and a headline loss...

This is a newly formed real estate investment trust (REIT) which says that its strategy is to, "...invest in yield-enhancing assets and areas that offer consistent, long-term rental growth...". The company said, "The investment properties comprise of three properties held by way of leasehold for 40 years, which has been independently valued ahead of the intended...

African Rainbow Capital (AIL) is a BEE investment company that was formed in 2015 and listed on the JSE in September 2017. Since its formation, AIL has invested in more than forty listed and unlisted investments across a wide range of industries, including telecommunications, mining, construction, energy, property, agriculture, insurance, asset management, and...

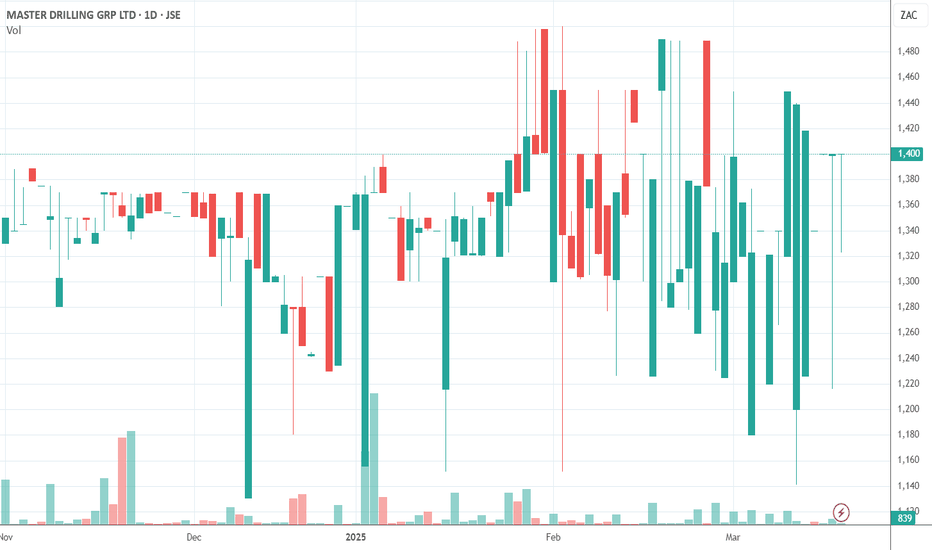

Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry. It has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe, and elsewhere. Master...

Johann Rupert's Remgro (REM) is an investment holding company that owns 28.2% of Rand Merchant Bank Holdings (RMH) and 3.9% of FirstRand. However, Remgro's investments extend beyond banking. It also owns Mediclinic, an international healthcare company with operations in Switzerland, Southern Africa, and the United Arab Emirates, which has now been delisted from...

The Resilient group of companies (Resilient, Lighthouse - previously Greenbay, Rockcastle, and Fortress) used to be the high-flyers of the property sector until the beginning of 2018 when a damning report was produced by 360ne Asset Management. The report claimed that the high prices enjoyed by the shares of these four real estate investment trusts (REITs) were...

Schroder European Real (SCD), Sereit, is a real estate investment trust (REIT) which invests in properties in Europe. The company listed in London and on the JSE on 9th December 2015. It owns a range of properties in high-growth cities across Europe, especially in London, Paris, Frankfurt, and Zurich. Its properties are logistics, office, retail, and leisure, and...

Super Group (SPG) is a large international logistics group offering transportation to the industrial sector. The company has a policy of not paying dividends, preferring to undertake share buy-backs and investing in organic and acquisitive growth. Its policy of diversifying outside South Africa has paid off with as much as 51% of operating profit now coming from...