Seeing a 3-3-3-3-3 Expanding Triangle corrective structure developing on the Silver ( XAUUSD ) Daily chart for long term upside. Corrective structures on this time frame can take up to 2.5 years, and this one is certainly tracking towards that kind of duration. We are currently progressing upwards within Wave D of the Triangle, while completing a Running Flat on...

Parking most of my ETH into USDC as I'm seeing short term downside of about 50% nominal going into the New Year.. This should close out the Daily timeframe correction, which started in mid-May.. Expecting us to see ATH again and beyond after the sell-off is completed.. Seeing the same thing for BTC so perhaps now is a good time to try out ETH3S and BTC3S.. The...

I believe we are nearing the end of the 2nd wave of the current long term 3-wave correction, which started in mid-April. Currently, we can see a reversal pattern forming. I expect this reversal pattern to terminate around $72 nominal before the start of the 3rd leg down to around $35K nominal. This would be an amazing buy opportunity as my longer time frame...

Just an update to my post from Sept 30th. Based on the movements in Silver since then, I still believe we are in the last leg of a long term 3-3-5 Flat Correction, which started early August. I still believe we are in Wave 4 within Wave C (5 waves) of this Flat. I have zoomed in on this portion. This Wave 4 itself seems to be playing out as a 3-3-5 Flat. It has...

Just an update to my post from Sept 30th. Based on the movements since then, and the fact that we have reached the previous high of about $3430, I no longer believe we are in a 3-3-5 Flat type correction. Instead, based on my updated count, I believe we are in a 5-3-5 Zigzag correction. So, I am still expecting downside on the larger time frame as I still believe...

I believe we are at the tail end of a 3-3-5 Running Flat correction in the S&P500 on the 4hr time frame. We have already reached the upper maximum on the Schiff scale at a price of $3385, so the downside can come at any time now. If the price tags or breaches the last local high of $3430, I will have to reassess on what kind of correction we are really in. On the...

Just an update to my previous post from Sept 14 regarding XAGUSD Silver. Movements since then seem to continue to confirm to me that we are indeed in a 3-3-5 Flat correction for upside on the larger time frame. I have zoomed in here on Wave C of this Flat, which needs to play out as 5 waves to complete the Flat correction. Right now, within this Wave C, I believe...

Here is my wave count for the current structure developing within XAGUSD Silver. Speaking strictly in terms of Elliott Waves, with respect to the longer weekly time frame, I believe we are in a 5 wave Impulse which started around $11/oz in mid-March and will head up towards the previous All Time High of around $50/oz. Within this longer term Impulse, I believe we...

Decided to brush up on my Elliott wave theory. Here are my thoughts as it applies to the S&P500 as it stands currently and where it can be headed strictly applying the established rules and counts. This is purely for visual purposes. Prices and targets not calculated. Please let me know your thoughts.

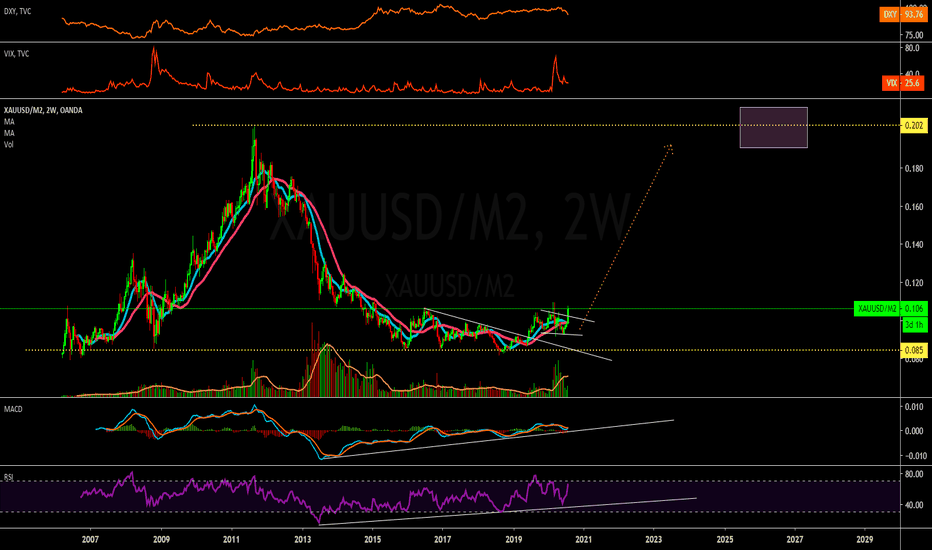

Just making an observation that the total amount of currency in circulation (Physical + Bank Credit) has increased an unprecedented 20% in the last 4 months. I believe, when we are looking at this chart, we are looking at a Credit Bubble. Something that bothers me. Current National Debt is around $24.2T, however, we have $18.4T in total dollars in circulation. So...

This chart (XAUUSD/M2) is why I believe Commodities are going to rise in price for some time. I do not believe they have fully accounted for all the excess of currency supply we have accumulated in the last 4 months (from $15.4T to $18.4T USD), which has risen an unprecedented 20% from March until now according to the M2 chart. I believe we are now only at the...

Seeing a nice Buy set up forming in Silver.. looks like the corrective structure is almost complete. RSI is also entering under bought zone so this gives me a bit more confidence in the upside. I have loaded up on Buys already at C. Hopefully this turns out to be a continuation of a longer term play towards the previous high of around $47.

I am excited to say, GOLD has reached my target of $1900USD/oz!!! Thought this warranted a post. It is merely dollars away from its ATH made about 9 years ago. My expectation is that we should be looking for Sells now. The old me would look at this and say that this is playing out to be a 'cup and handle' pattern. These days, I strictly look at everything as wave...

Looks like Bitcoin is gearing up for some upside. We could see a retest of the All Time High in the long term.

I am seeing an Ending Diagonal develop in the Crude oil chart for an upcoming Sell opportunity. This seems to line up with this week's EIA data indicating an oversupply. If this plays out, we should be hearing more about over supply over the next week or more. I will look for a sell when we get to the end of the 5th leg of the ED as indicated by my Sell zone box.

Just making an observation that DXY has come back to its bottom of around 94.6.. At this point we can expect a bounce, which would indicate the USD is about to get stronger and people are going to be more in Cash (so pulling out of investments).. Can be an indication of a Sell coming in the Gold.. RSI is already in under bought zone so this gives me more...

This corrective structure that we have been in since the end of March is one of the messiest I've seen.. I'm still Bearish.. I believe we are completing an Ending Diagonal pattern (for downside) which may take until the end of this month to play out.. Possibly even tag the ATH before going down.. I would start loading up on Sells around there.. This seems to line...

Just making an observation that VIX has come back to it's bottom of around 24.3.. At this point we can expect a bounce, which would indicate there is volatility coming in the market.. Can be an indication of a Sell coming in the S&P500.. If not, I would expect it to continue it's run down to it's next bottom of around 12.9 and see if will bounce from there..