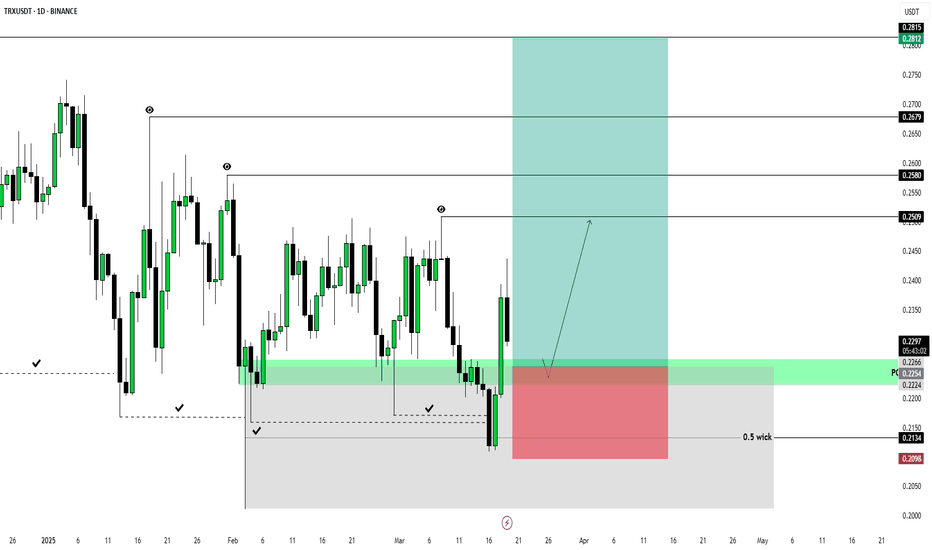

In line with the expectations I outlined in my main TRXUSDT 1D LONG review the price interacted perfectly with the key liquidity block and turned around confidently. To feel safe in this position, I move the stop order to breakeven and continue to wait for my targets to be reached! Targets: $0.2509 $0.2580 $0.2679 $0.2815

In line with expectations of a decline in GBPUSD, the price interacted with the primary order block. To feel safe in this position, I move the stop order to $1.29620 I expect the downward trend I mentioned in the main review to continue to my targets: $1.28609 $1.28030 $1.27534 $1.26722

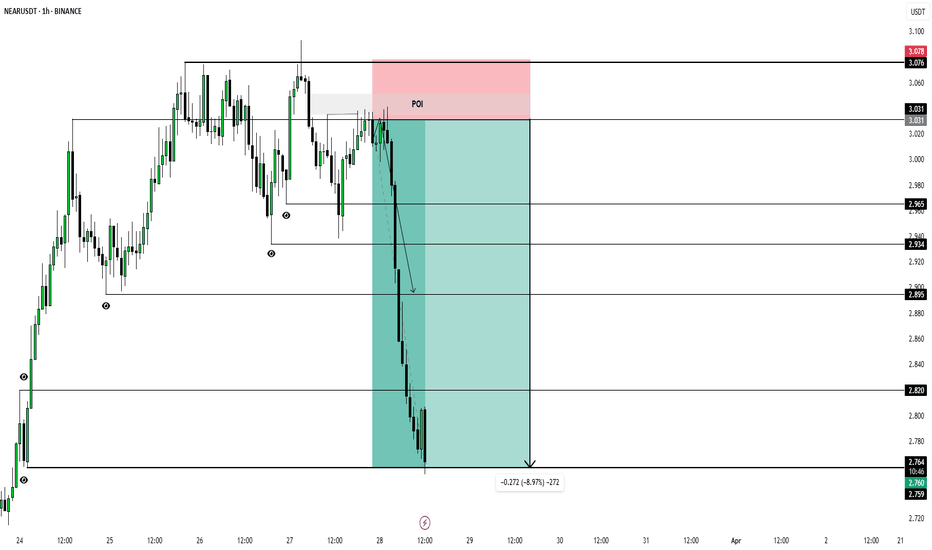

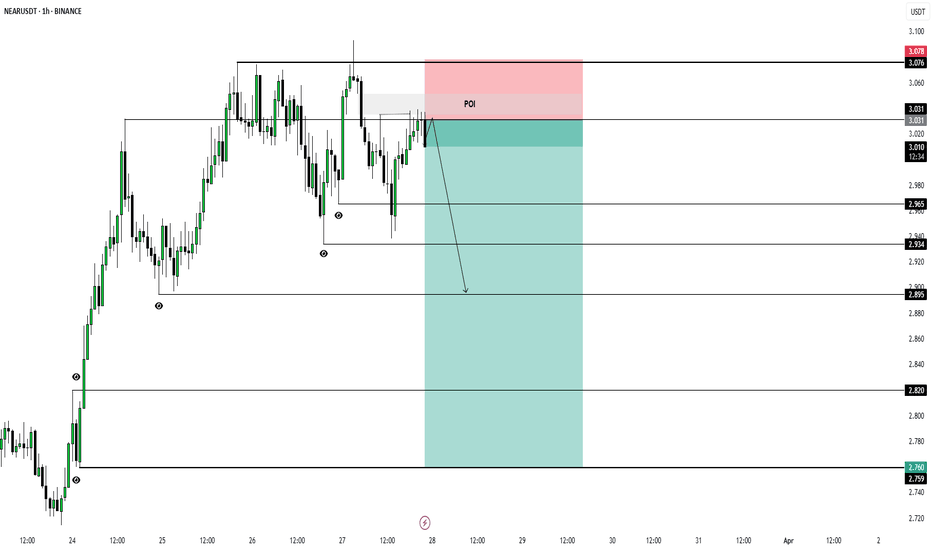

Targets: $2.965 + $2.934 + $2.895 + $2.820 + $2.759 + Decline took place strictly according to the designated trading plan!

Opened a short position NEAR Since in the short term, the first signs of a decline are visible. The position was opened at a price of $3.023 Targets: $2.965 $2.934 $2.895 $2.820 $2.759 Risk management - 1% on stop order

At the moment, GBPUSDT the asset is being marked down. There was a price reaction to the POI range from which a reaction was received instantly. I missed this moment due to personal matters, although there was a reminder. I understand that the risk of not opening, or the receipt of new variables from the market, can break the trend, but I will try to open a short...

Studying the market, I have not traded much lately. Daily manipulation, as daily news very often breaks formations and trends within the day. Therefore, I decided to look at 1D TF and I really liked the situation with TRX Most likely, the price is in the final stage of reaccumulation before aggressive growth. I am waiting for the testing of the bullish POI to...

I fix the 1st take at $80,913 and move the stop order to breakeven . 1- the position itself is correct, but such manipulations with the news background and constant volume shift do not allow to correctly assess the moment of price reversal 2- Key markings before opening the position also took the format of price manipulation and should not have reached the...

This position worked perfectly. Now it is important to wait for the correction structure, as it was indicated in the previous update post: Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a...

At the moment, the BTCUSDT trading pair is experiencing a distribution moment. Taking into account the liquidity collected at the top, I open a position in SHORT from the POI and FGV m15 I indicated with the target: 80,607.65$ 79,058.00$ 76,606.00$ Risk for stop order -1%

Re-opening in the specified block after confirmation of the level of $1.03744 brings 3 targets for the position. Considering the current formations on the 1D TF, the probability of price growth to the current maximum increases multiple times. Locally, I expect to see a price correction (a rollback next week) and preferably with a depiction of a bullish imbalance....

Based on the obtained market variables , most likely the BERA coin will continue its downward movement towards the designated targets on the chart. I want to wait for the local price return in blocks OB 4H and FGV 4H to search for potential entry points. If the reaction is positive and the 15th TF is confirmed, I will apply a short position as indicated on the...

This position received new variables from the roar on this fall , generating EQL values of $5.04 Accordingly, the POI range test as a basis for personal expectations is confirmed : -volume -retention rate -confirmation of the structure. At the moment, 2 targets are fixed and the stop is moving to breakeven . A more detailed review can be seen in this replay:

I expect the APT price to decrease in the POI 4H block, in which I will work out a long position with the goals indicated on the trading chart : Targets: $5.77 $6.44 $7.34 $8.23 Risk management - 1% on stop order

ENA LONG performed excellently according to all expectations and met all target marks from the provided review Congratulations to everyone who took part in this position. Basic review: Update:

An excellent situation from the trading plan. The second goal has been achieved and the stop is at breakeven. I would like to emphasize that the $320-322 block (break block) confirmed the retention level. You can move the stop order to this level and calmly wait for new variables from the market UPdate: 1-st target:

In this position, the first target from the update has been achieved. The stop order is moved to breakeven and new variables are expected to arrive from the market. Initial review: Update:https://www.tradingview.com/chart/TAOUSDT/tLc5vyIX-TAOUSDT-LONG-1H-Update/

The position opened perfectly, as expected from the trading plan: In connection with the resulting market variable in the form of the hh structure, I change the first target and move the stop a little higher. Critical level 321.95 - 322.00$ If it is tested again and is not held, I will close the position at breakeven. The market is manipulative, you need to...

All key targets were achieved, the position was 101% justified Congratulations to everyone

![TRXUSDT 1D LONG [UPdate] TRXUSDT: TRXUSDT 1D LONG [UPdate]](https://s3.tradingview.com/k/KIRe44bl_mid.png)

![GBPUSD 4H SHORT [UPdate] GBPUSD: GBPUSD 4H SHORT [UPdate]](https://s3.tradingview.com/v/VpyaAHph_mid.png)

![APTUSDT LONG 4H [2 Targets Done] APTUSDT: APTUSDT LONG 4H [2 Targets Done]](https://s3.tradingview.com/1/1MSbn9K0_mid.png)