PM_TAE

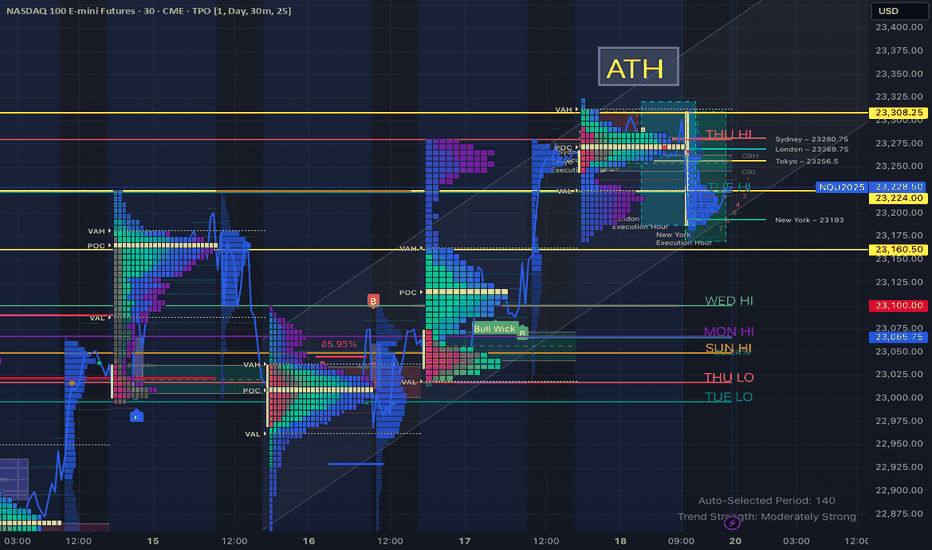

PremiumDescription: The Nasdaq-100 (NQ2025) is showing signs of strength after reclaiming a key value area around 23,224, with price now consolidating above the New York execution low (23,193) and the weekly value area low. Volume structure and price action suggest potential continuation toward the all-time high. Key Technical Notes: Range Reclaim: Price reclaimed a...

📌 Waiting for High-Probability Levels to Engage Right now, price has been stuck in a multi-week range, coiling just beneath major resistance and above strong demand. I’m not forcing trades — I’m waiting for price to reach the key gap zone and confirmed strong support near 22,781.75. No reason to act until the market gives me a clear setup. The real move will...

📍 Weekly Outlook – NQ (NQU2025) Week of July 8 | 30-Min Chart | HTF Trend: Bullish 🔼 Key Resistance Zones ATH – 23,102.50 ‣ Major liquidity draw and psychological level 22,935 zone ‣ Prior Thursday and Monday highs ‣ HTF rejection or continuation zone Watch for LTF sweeps or CHoCH before fading strength 🔽 Key Support Zones 22,785 area ‣ WED LO, SUN HI, and FVG...

📈 NASDAQ 100 (NQ) – Riding the Trend, Holding Above Key Daily Highs | 4H Chart NQ remains in a strong uptrend, respecting structure and reclaiming key daily highs going into the final trading days of June. 🔍 Key Observations: 🔼 Price is currently holding above Thursday’s high: 22,740 ✅ Strong support formed at Wednesday high: 22,693.25 🔁 Clean reclaim of Tuesday...

Description (for the Idea post): NASDAQ Futures (NQ2025) - June 19th Setup Breakdown Market showed textbook Smart Money behavior today. 🔹 Key Highlights: Price swept the Saturday Low and Wednesday Low, triggering sell-side liquidity. Reaction from an old Order Block + Fair Value Gap (FVG) zone near 21,780. Market Structure Break confirmed the bearish bias. Retest...