DGKC broke down after consolidating between 32-36 and is now trading at 124. The strategy is to exit if the price shows weakness when it revisits the 30-level mark. Downside Targets: 1. *First target*: 110 2. *Second target*: 102 This analysis suggests a cautious approach, with a focus on managing risk and potential downside targets.

Buy Recommendation: Accumulate on weakness below 530-515. Risk Management: Set stop loss at 507. Target Price Range: 580-617. This strategy suggests buying SYS stock on dips, managing risk with a stop loss, and aiming for higher targets.

Buying Opportunity - HCAR Buy Range: 297-307 (buying on weakness) Stop Loss: 294 Target 1: 325 Target 2: 339 Further Action: Hold if the stock sustains above 340.

SSGC give a buying opportunity for LONG. buying range 39-37 Stop Loss - 36 Target 1: 44 final target 50

Here is the corrected text: "CpHL is currently trading in the buying zone. We can buy: 1. Around 87-83 2. Second buy when price crosses or closes above 93 Stop Loss: 81 Target: 108 Further hold if closes above 108."

Here is the corrected text: "CpHL is currently trading in the buying zone. We can buy: 1. Around 87-83 2. Second buy when price crosses or closes above 93 Stop Loss: 81 Target: 108 Further hold if closes above 108."

NATF Stock Analysis: - *Buying Opportunity:* NATF is providing a buying opportunity. - *Buying Range:* 205-200 - *Stop Loss:* 195 - *Target Levels:* - Initial target: 215 - Final target: 238 - *Key Notes:* - Hold the position until the target is reached. - Use stop loss to minimize potential losses.

MARI Stock Analysis: - *Bullish Movement:* MARI is showing a bullish movement. - *Buying Opportunity:* Any weakness in the stock price is a buying opportunity, especially for new buyers. - *Buying Range:* 600-580 - *Target Levels:* - Initial target: 670 - Final target: 720 - *Stop Loss Strategy:* Use a trailing stop loss to lock in profits and minimize potential losses.

FFL Stock Analysis: - *Buying Opportunity:* FFL is providing a buying opportunity. - *Strategy:* Adopting a "buy on dip, sell on strength" strategy. - *Buying Range:* 16.26 - 15.30 - *Stop Loss:* 14.70 - *Target Levels:* - First target: 17.50 - Second target: 19 - Final target: 21

- *Price Range:* PPL stock is expected to move between 188-180. - *Buying Opportunity:* Any weakness in the stock price may provide a buying opportunity. - *Breakout Level:* If the stock closes above 188, it may trigger a bullish movement. - *Target Levels:* - Initial target: 198 - Final target: 213 - *Stop Loss:* Below 178

- *Buying Opportunity:* NML stock is showing a potential buying opportunity due to its ability to sustain above the 50-day Moving Average (MA). - *Resistance Area:* The stock is facing resistance around 104. If it breaks above this level, it may trigger a bullish movement. - *Upside Targets:* - Initial target: 112 - Final target: 124 - *Stop Loss:* 92

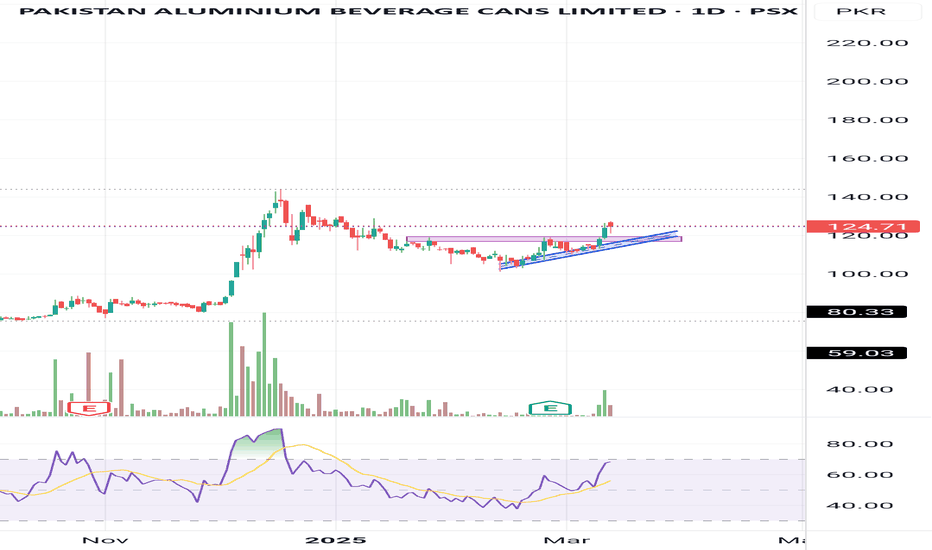

PABC showing breakout and now test breakout current price 124 buying arounf 124 -119 Sstop loss 117 next target 129-138.