It's gone less than a year or so since Palantir stock has joined on Friday, September 20, 2024 Stock Top Club, also known as S&P 500 stock index SPX . Palantir was one of the strongest contenders for inclusion in the broad market S&P500 Index. This inclusion, as well as Dell (DELL), came after tech companies Super Micro (SMCI) and Crowdstrike (CRWD) also joined...

"Two is a pair" means that the number two represents a set of two identical or closely related items that are used together or considered a unit. For example, a pair of socks, a pair of shoes, or a pair of gloves. It can also refer to two people, animals, or things that are grouped together. Here's a more detailed breakdown: Definition: A pair is a set of two...

Johnson & Johnson (JNJ) stands out as a bellwether in the global healthcare sector, and its nearly 18% stock performance in 2025 reflects both robust fundamentals and compelling technical trends. Fundamental Perspective JNJ maintains a solid financial foundation, underpinned by consistently strong profitability, a diversified business model, and effective...

In the Faraway Kingdom... In the Thirtieth Realm.... Somewhere in another Galaxy.. in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas . 1️⃣ What was your best trade this year? 2️⃣ What is your trading goal for 2025? Here's what we answered: 1️⃣ What was your best trade...

Copper prices in 2025 are up about 27 percent year-to-date, driven by a complex interplay of technical and fundamental factors, with geopolitical events such as the Trump administration's tariff policies and the escalation of geopolitical tensions in the Middle East having a significant impact. Fundamental Outlook: The main driver of copper prices in 2025 is...

Tesla's stock has recently suffered a sharp decline, dropping nearly 7% in a single day to about $294, marking a significant fall from its December peak of over $488—a plunge of roughly 40% since then. This downturn is largely attributed to growing investor concerns over CEO Elon Musk's increasing political distractions, particularly his announcement to launch a...

Tesla results in June 2025 draw an alarming picture of the future company. In the second quarter, car supplies were sharply reduced by 14% compared to last year, decreasing to 384,122 units from 443,956 earlier - a clear sign of a decrease in demand and increased competition in the electric car market (EM). Despite the short-term growth of shares after the...

Diesel Oil NY Harbor ULSD December 2025 futures contracts are trading around $2.25/gallon, once again above its 52-week average, with recent technical ratings indicating a strong buy. The market has shown a 4.50% rise in the past 5-Day time span, reflecting bullish momentum. Fundamental Perspective Supply: Distillate inventories are 20% below the five-year...

US stock futures edged lower Wednesday evening ahead of Thursday’s market closure for Juneteenth. The moves came after the Federal Reserve held interest rates steady, with Chair Jerome Powell striking a cautious tone amid rising geopolitical and economic uncertainty. Powell reaffirmed a data-dependent approach, pointing to unclear inflation impacts from...

The Israel-Iran ceasefire has triggered a sharp reversal in global oil markets, sending prices tumbling back to levels seen before the recent conflict. Brent crude ICEEUR:BRN1! fell below $70 per barrel and West Texas Intermediate NYMEX:CL1! dropped to around $65, erasing the risk premium that had built up during nearly two weeks of hostilities. This rapid...

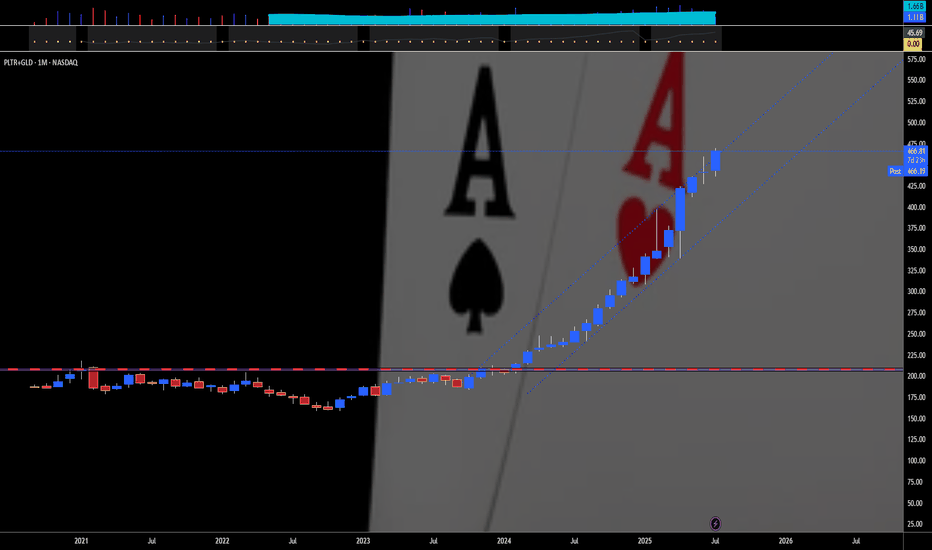

Far far ago, somewhere in another Galaxy, in late December, 2024 (yet before The Second Coming of Trump), @TradingView asked at it awesome Giveaway: Happy Holidays & Merry Christmas. 1️⃣ What was your best trade this year? 2️⃣ What is your trading goal for 2025? Here's what we answered: 1️⃣ What was your best trade this year? - Surely Palantir NASDAQ:PLTR ...

Gold market shines bright in first half of 2025, with nearly 25 percent year-to-date gain, which becomes one of the best start of the year in history ever following 1H 2016 (became a launching pad for Gold to more than Triple in price over next decade) and 1H 1973 (where Gold bugs sharply skyrocketed to infinity and beyond, printed more than 10x over next...

Over the past 6 months, Bitcoin (BTC) has demonstrated a very mixed up/down performance, marked by significant price fluctuations, appreciation and volatility. From late December 2024 to June 2025, BTC's price rose from approximately $92,000 to around $108,000, representing a gain of about 17.26% over this period. On the other hand. the price fluctuated between...

In previous posts, we have already begun to look at the key drivers of the US outperformance over the past decade. The US market dominance has been largely driven by the rapid rise of tech giants (such as Apple, Microsoft, Amazon and Alphabet), which have benefited from strong profit growth, global market reach and significant investor inflows. Unsatisfactory...

Gold mining stocks have emerged as one of the top-performing asset classes in 2025, driven by a combination of surging gold prices, improved profitability, and shifting investor sentiment. Here’s fundamental and technical analysis of the key factors behind this outperformance, by our @PandorraResearch Super-Duper Beloved Team : Record-High Gold Prices Fuel...

The NYSE Composite TVC:NYA is a stock market index, that covering all common stock listed on the New York Stock Exchange, including American depositary receipts, real estate investment trusts, tracking stocks, and foreign listings. Over 2,000 stocks are covered in the index, of which over 1,600 are from United States corporations and over 360 are foreign...

Over the 4 months since Donald Trump’s inauguration in January 2025, his administration’s policies have had a complex and in many ways negative impact on cryptocurrency markets, despite the overall pro-crypto agenda. Short-Term Market Volatility Due to Tariff Policy One of the most significant negative impacts has been caused by Trump’s aggressive tariff...

Tesla stock declined after Elon Musk’s departure from the Trump administration due to a combination of reputational, operational, and market factors: Political Backlash and Brand Damage. Musk’s close association with the Trump administration and his leadership of the Department of Government Efficiency (DOGE) generated widespread protests and alienated many...