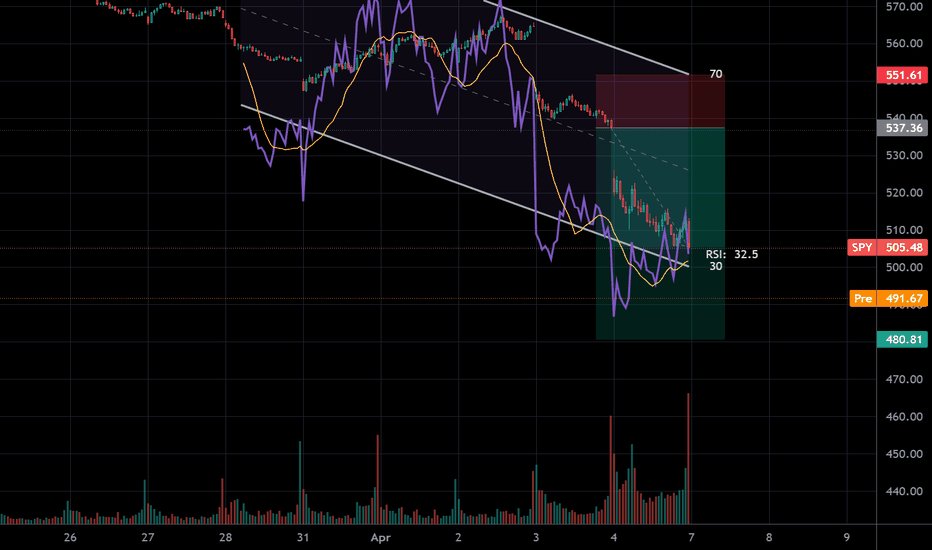

im expecting SPY to drop to $480.30 in the first little bit of the morning session. from there bulls will have a chance to send us up higher. i will be playing with an open mind and letting bulls have at the bounce

im expecting a drop to 4,480 on ES/MES in the morning session. from there i suspect bulls will step in and have a chance to send us up. i will be playing it by ear from there depending on how the bulls respond. Knowledge is power

Hey there friends! As you can see, I have two resistance trendlines plotted. Both historically have been respected very reasonably. On top of this, id like to mention that my software that signals weakness in the market has been triggered. Although it doesnt 100% predict the absolute top, it does show where weakness is and you can see how it has preformed in the...

What we have here is a very LOOONG pennant on VXX. We already had the breakout back in September and since then have created a whole pennant for the retest of the breakout. From how things look now, the apex of the smaller pennant is due to breakout no later than November 22. The yellow rectangles are gaps within the price action. The retest has a gap to be filled...

This is a trendline I am watching going into the weekend on $SPY The fact we did not test the bottom trendline before retesting the upper, suggest the next leg down will be more aggressive than the previous bear sessions. Also, based on previous bear sessions, we head down -17.50 after rejection within a 50 day window. If we use the same price action, we can...

We were in a descending megaphone after we rejected from major trendline resistance mid august, inside this descending megaphone we entered a descending channel (which has a bullish breakout) and we indeed broke out. The target of the descending channel (orange trendline) is 418.60. but trendline resistance for the descending megaphone (magenta color trendlines)...

As mentioned in the title, a possible INVERSE head in shoulders may be in play. What would need to happen is a price action very close to what I have drawn in red on the right shoulder and a retest of the neckline at around $430 resistance. If we can get these two things, I am confident we will have a breakout and a retest of the $452 resistance and gap fill...

I know this is a little bit of a messy chart. Alot of trend lines and yellow rectangles- Here is the breakdown and outlook for SPY leading into the weekend and next week- I am anticipating a small correction this morning that will lead us to Pre market gap fill with a target of 426.44. This will achieve gap fill and trendline support (Green box for reference)...

Well, looking at ES on a 30 minute time frame, right off the bat I see a nice Cup n Handle forming. Where right now we are forming the handle and are looking for a strong breakout to the upside. If this can hold valid, im expecting ATLEAST 4763 on ES. I think that is about 484 on SPY. We will atleast see a nice gap fill to 465 (labeled in the yellow box) That is...

$BYND as you can see, we have a nice pennant charted up with a breakout move of ~$130 We can see the breakout to the downside. But it seems that this is going to invalidate the initial breakout by catching support here and continue the breakout move up. If we can see just a tad more confirmation of this support, this would make my target for BYND to be...

This is what I have simply drawn up for QQQ Its kind of interesting, because i see a few things that could possibly happen- We see a nice megaphone pattern, and a break of it from todays lows. Im anticipating a possible gap down to retest yesterdays lows at 393.97. There is a good chance we will bounce there and it could FLY back up to test 399.41 resistance....

This is what I have charted up for the short time frame of things for SPY I am expecting a test of support trend line at 475.68. From there i am looking to see if we will break the support or if we will bounce again to test the upper trend line resistance at 478.55 Even if we do get a retest of the UPPER trendline, I anticipate that the lower support to be taken...

As the title suggests, the price action suggests a strong pop to 5.23 (it is at 2.60 at the time of writing) This is one i would be willing to play shares with and let it take all the time it wants. i assume they will release some kind of news that will be the catalyst for the move

As yall know, ive been holding this bad boy, since before the initial major breakout and i am STILL HOLDING. This coin is coiling for a nice strong move one way or the other. I will be holding this super long term. Atleast a few months. This has a lot of potential to easily see .03 and .05. What we are seeing now could be the beginning of a fundamental breakout

We can see a nice, clear descending channel. It is VERY tempting to want to short it here, however, i am not convinced it will reject (surprisingly) This was some really strong momentum retesting the upper trend line, along with A TON of buying pressure at the bottom and not so much selling pressure i can see at the top. Descending channels have a bullish...

Very simply, I am bullish to about $355.15.There, we will see a good bit of resistance. Combined with this very common theme we are seeing the market, everything will continue to be bullish for the short near future, before correcting slightly for some bearish days. These days should be quick and strong. When this happens, I anticipate FB will test 335.44 first...

AAPL, just like AMD looks primed for another day or so of a nice continuation of this bullish move we have seen. I called the bottom perfectly at the $168 level. What I anticipate is AAPL to continue to test the upper trend line resistance at around 184.75. Just like AMD and the rest of the market (SPY) i see a massive move to the downside coming. It will be hard...

TWTR is in a bit of an odd situation. I have had the breakout charted for some time now, with a target of about $25 (Thats insane) Looking at it right now, there might be some short term buying pressure to go long, but i am very skeptical. We have a short term bear flag that has its own breakout to $34. Any pump up, I would consider using it as an opportunity to...