Gold strategy steadily churning out the pips Here's a breakdown of trading dynamics: 1. Expecting price to break past for continuation up 2. Price might bounce back for which; will be looking for a continuation from -50/-100 or -150pips to the upside 3. Will be looking for double tops/bottom along the way As always price action determines trades.

Gold strategy proving functional and reliable thus far. Everybody loves Gold Part 3 takes a heavy bias towards the down side; all be it following the predicted price as highlighted. As always price action determines trades.

A good start to Gold Journey In Part 2, we highlight a cluster of levels around close of Week 21. Price could however gap up or down and that will determine next moves. At the moment though, we expected price to follow the arrow path for a down week.

Everyone loves gold. With sufficient pips in the bag, we start week 22 with the analysis on gold as highlighted on the chart. Trade parameters: SL: 50pips dtp : dynamic Take profit as momentum leads.

Not Always. Not always will price conform to hypothesis, but in following good RRR success is assured. We setup week 21 levels and zone as shown with the predicted pathways. Trade Parameters: Entry on 5 mins chart Sl 10-15pips TP usually dynamic but typically 5x Follow on for trade updates. As Always PRICE...

Winning on a roll here. But Market is still the king. This week could swing either way; i prefer a strategy where you can set alerts and walk away. Alerts to set 3427 and 2711 Sl always between 10-15pips from 5 min bar entry tp as the momentum leads. New market loading .....

Hope y'all had a good weekend with your profits. This week we go into a slight variation of our winning strategy and ask the question: what if Retracement is not fixed at the Fib levels but dynamic? And so whilst keeping the zone and primary values of 279/721, we mark 2 levels and the predicted price reaction around them. As Always price action determines trades

Slow and steady pace. Last week, it was mentioned that trading zone/level is calculated between 0-1000. This means price of importance is 1 of 2 values 1. x 2. 1000 -x This week will be 065/935 in addition to the zone below. As always price determines trades

Last week saw a good pinch on market pips. Aim to continue as always. Price swing levels are set; either a or b, price action directs. Levels/zones are calculated based on previous week H/L

Simple and yet effective. Price did retrace from upper pivot level yesterday. Today the upper trend should continue with bounce off lower pivot of 142.194, though most banks are on holiday

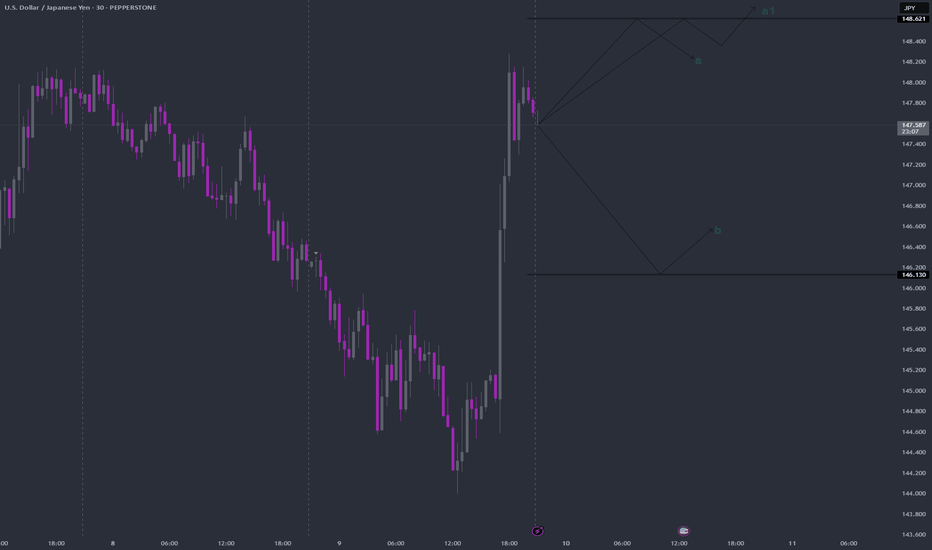

a or b?. Most Likely a. USDJPY in a slide. These levels are my take on predetermined values by Market based on previous day High and Low. As always price action determines trades

Hi team, USDJPY pivot levels are set. Watch out for break or bounce at these levels

Swing zone and levels are calculated and set. As always price action determines trades.

Levels are set Price had swift breaks of yesterday's levels, but shows, it must react to them.

Observe again the function of pivot levels. Use in conjunction with good money management plan

New Market, New SR Levels. Lets see how price reacts to them.

Following last week's sharp whipsaw that ended in a downtrend due to the tariff announcement, the expectation is for the downward trend to continue. That said, price action may ultimately tell a different story.

We'll stick with the same calculations as last week and before. Price should follow the same logic as any mathematical principle—calculable, predictable, and consistent. The key variables are the broader market factors and the strength of the trend. With that in mind, swing zones and levels are marked on the chart, and price will ultimately decide between...