Executive Summary: Go long after the price breaks Daily Resistance (R2) on the 4H chart Macroeconomics: Hedge Funds and institutions have been adding long positions on the CAD and closing out longs on CHF. The CAD had gained strength vis a vis CHF MultiTimeFrame Analysis. On the monthly chart, CADCHF is sandwiched between very strongly monthly support and...

BTCUSD stunned the market with a massive impulse northward on the M1 and W1 charts. We've also seen the requisite retrace/correction after each impulse so we can expect further continuation to the upside. Currently BTCUSD is trapped on the S/R zone on the D1 chart. My recommendation is to go long after BTCUSD tests this zone, rejects support and continues...

The market is in an overextended bullish phase on the Monthly, weekly and daily view. Expect a corrective retracement this Monday/Tuesday to the downside for about 50 to 80 pips, before a potential continuation to higher highs. Institutions have put int 15.2k BUYS last Tuesday and this supports LONG moves after watching the reaction on the drop early this week

Last week, EUR/USD exhausted steam within a range of 1.1815-1.1890; initially boosted vaccine optimism (Moderna's update) and a dovish tone from the FOMC and making highs in the 1.1890s, before reversing lower to set lows at the low 1.1800s on renewed concerns about the deteriorating condition of the global outbreak of Covid-19. Then on Thursday, the pair rallied...

The overbought advance of EUR has the potential to drive beyond 1.1915, HOWEVER, news of Pfizer's coronavirus vaccine ralled US stock and propped the US further. The next resistance is beefy at 1.1960. Terror attacks in Austria and France further knock the wind from further EUR growth. EURUSD upward pressureis fizzling and EUR is likely to trade sideways for...

Taking into account the prevailing risk aversion context, EUR / USD is teasing new multi-day lows in the 1.1740 region on the back of the persistent investor preference for safe havens. European coronavirus situation is worsening rapidly, the EUR / USD continues to falter after it's May-June rally to unexpected highs. Speculation about the US elections is...

On the dailies, EURUSD was making higher highs for several weeks (see the three peaks) until recently lower high consummated. Bullish weis waves have trickled to mere ripples. Price can no longer go higher as it is apparently hitting an invisible wall. Expect the currency pair to drop to 1.17 near the next strong support

Recent Commitment of Traders Report highlights continued investment of institutions on the kiwi. The pair is trending over the 20 and 200 period EMAs on the H1 to D1 charts. Momentum is reinforced by bullish Weis Waves from H1 to H4. Moderate market structure resistance within 80 pips may stall growth but I expect this to be breached with ease.

Yes, GBP is overextended on the bullish front, and yes a retrace is the logical expectation. Fundamentals will kill the technicals however and last week's Commitment of Traders data revealed that Institutions closed 9k short positions and opened 2k more long positions. Weis Waves continue to be bullish from H1 to D1 and the price remains well over the 200 period...

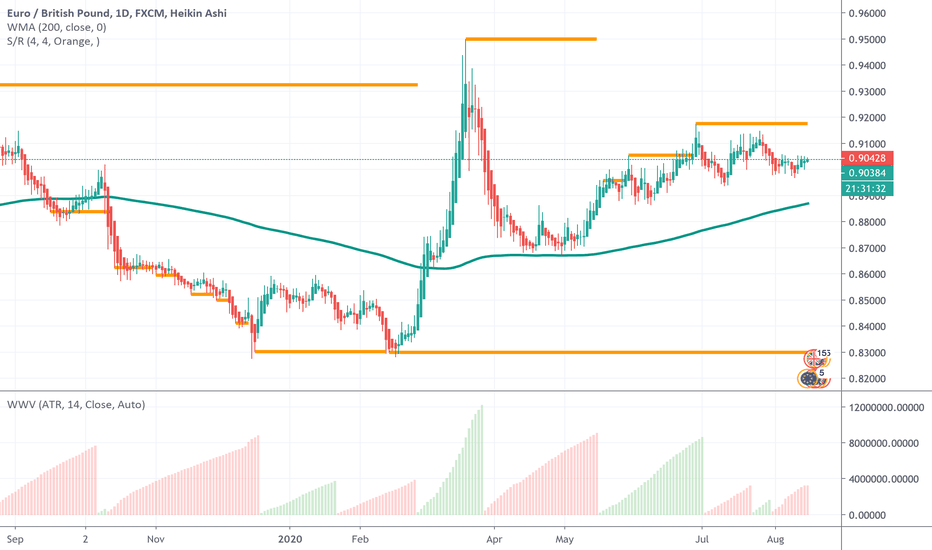

The continues to bounce off strong support trendlines on the D1 chart and creates higher highes and lower lows. The price maintains a healthy distance from the D1 WMA at 200 periods indicating the large direction of the pair. On the 4H chart, EURGBP rests at the 200WMA by a hair and we see that Weiss Waves at lower time frames continues to be bullish. If 9100 is...

improving sentiment on Brexit trade talks rallied GBP 70 pips from start of week however the pair is hitting a strong ceiling on the D1 and W1 charts. Weis waves shifted from green to red July 5 signalling potential reversal to the downside. As of today, August 14, the D1 ADX hovers on 65- strongly bullish but at the point of exhaustion. I've found that most...

On the monthly view, EURUSD continues on a downward trend line. Weis wave volume confirms the bearish trend. The past four month rally is a retrace within this trendline. Priceline will hit massive resistance close to 1.25 Now is not the time to open a short. Await price action close to the resistance line and appearance of red candles at the 4H, 8H and 12H Tfs....

AUDUSD sustains the head and shoulders thereby pointing to further bullish medium term drives. Expect a bit of ranging then further surge northward to the key resistance seen at 0.7206. As with EURUSD the D1 RSI momentum remains overbought but RSI nor stochastics have held back trends as strong as this. Note that the D1 and W1 200 period weighted moving average...

The master trend at H4 and H12 continue trend bullish however a key resistance level at 1.620 is being tested and RSI from H4 to D1 are overbought. Channel lines have been breached by the price which is now over extended. While price action has not yet given the signal to go short, I expect that the price will eventually drop to 1.2.

Hints of strong vaccine for COVID has weakend demand for the safe-haven Japanese yen (JPY) bolstered the pair of strong support. Priceline continues to grow above the 200 WMA on both H4 and H12. Expect the first chart target reached within mid week

Undisputed: priceline is fording lower highs and lower lows. Descending formation and the breaches beyond several support levels imply that the price will bottom out at lower levels. Indicators: RSI (Relative Strength Index) and MACD confirms affirm the bearish direction. Expect a minor retrace before further drops. 100 period EMAs, WMAs and SMAs point to...

BOE declaration together with civil unrest pertaining to COVID is rife on social media. The fundamentals reflected on the H1 and H4 charts with a slide below the pivot. There was a mild struggle that staggered into a drunken ranging. Mildly propping the UK include the positive Initial jobless claims , without which, we might see the Cable 50 pips lower. Note...

GBPJPY fell to strong resistance at 132 and hovered for a few hours. This impulse appears to be a corrective retrace against the H4 and H8 bullishw WMA at 200 periods. The candle is starting to show momentum up on the H4 and H1 charts. Prediction is to breach the 133 Pivot and storm the 134.132 R1 line . If it breaks this zone, expect further bullish action...