SFTBY showing entry by DPO and CCI at $40. Likely short to 41-42.

NVDA showing sellers not happy with earnings growth announcement for GPU, however relates to trade war and slump in electronics. This could be great bargain watch as GPU need for AI, self-driving cars, and many other high growth tech area's. Watch or short. Sell or Hold, what's your thoughts? $138 sell for lower entry on DPO day chart. await LONG...

48% down from earlier 2018 high. Detrended Price Oscillator shows entry crossing zero on 1 day chart near $138 and down from earlier high of $260. www.tradingview.com(DPO) Read more here on DPO on Tradingview.com/wiki. Volume: 494K shares traded Friday and typical higher and near 800K shares.

MTSI has some cool chip technology and beaten up like most tech stocks in US-CH trade war saga. Zack posts strong sell prior to MTSI have strong upward climb today after missing Q4 Rev. targets. Acquisition candidate>>>? What gives?? Zacks Investment Research, Inc. downgrades MACOM TECHNOLOGY SOLUTIONS HOLDINGS INC from HOLD to STRONG SELL. BY Investars...

AKAM The Akamai network has an inherent advantage running a distributed ledger in blockchain per JPMorgan 11.9.18 article. Currently has shown trend of large spike investment last 3 quarters and in 1w chart shows near CCI entry, while day chart is not indicating same. Watching. IBM is the largest patent filer in blockchain technologies, however has never...

Medical stock that's too thinly traded got mixed review on clinical trial results on Tivozanib, which showed efficacy, just not to level expected and testing new low for 2018 at 2.03 and below full fibonacci retracement of 2.10 as prior low. NASDAQ:AVEO

RPD FEYE Retest of recent low. Big boys taking and thrashing out more sellers.

Volatility - Retesting recent LOWS. CBoe VIX is going up today and coming into CCI buy zone, good for shorts and better buy entries.

INTC NVDA AMD Advanced self-driving cars will need processors and GPU's, which means Intel and NVDA or AMD likely. Would you put another brand in with that risk? Intel as at 618 Fib Retracement near 48.48, actual 48.53 right now and hitting resistance today. Expecting midterm election will drive this up to 500 or higher retrace soon. 4h, day and week...

LGORF Vanadium Flake and high grade source to V2O5 for making high strength steel. 0.5% V2O5 will double the strength of steel. Above this it can improve corrosion protection and harden metals like in aircraft engines. It is also offering a new battery technology that is more reliable than Lithium-Cobalt-Manganese batteries. The stock has already...

ATVI The November present might be a few days early this year. Pick a horse and enjoy the week into May of next year. For own use.

Truth: Supply & Demand gaps. See 2008-2018 Uranium Futures Truth2: Some Uranium miners also mine bonus rare metal Vanadium (pentoxide) for HSS, automotive, EV, aerospace engines, infrastructure HSS rebar. U UEC OTC:FOSYF UUUU 23% up, 10% down NYSE:AZZ LSE:YCA OTC:WSTRF TSX:MGA OTC:BKUCF TSXV:VONE FWB:JT71 FWB:U9M2 TSXV:GLV.H

ETSY is a beloved gem for on-line craft shopping around the holidays just a few weeks away and nearing a retest of recent low at 48.17 and headed below 786 Fibonacci Retracement and showing CCI driving lower from current 40.43. Watching for present.

9.05 headed to 9.80 range with mid-term elections giving positive vote. Short this

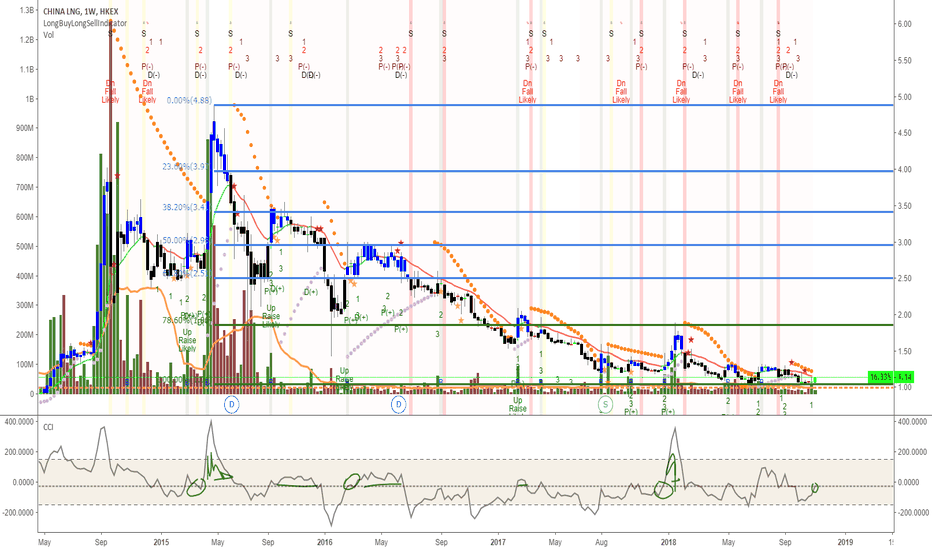

This has full retrenchment, as China demand for LNG for clean energy until they can build enough nuclear power had not gone well this year. Watching this one for break-out as standby on China's markets.

520M Mkt Cap Vanadium stock to watch. Not sure why 1day chart doesn't show.

Van Eck Precious Metals is showing a CCI entry point for potential short-term to medium hold. I remain neutral and await more volume or price confirmation. VanEck Vectors Rare Earth/Strategic Metals ETF (NYSEMKT:REMX), a tiny ETF with only $57 million in net assets, which emulates the holdings and performance of the MVIS Global Rare Earth/Strategic Metals Index.

Largest US Uranium and Vanadium mining stock Energy Fuels. UUUU Starts production of V2O5 (vanadium pentoxide) for high strength steel (infrastructure/rebar, military, aircraft engines, thin gauge steel automotive) for first month at 200-225K lb./ mo. Sorry no futures symbol for V, but UR1! is uranium. both are in tight global demand with 20% CAGR driving...