PouyanFa

EssentialAfter reaching the midline of the channel, a strong green shadow (wick) appeared and the price was rejected, but after that, there were no more green candles. It seems that the price is now inclined to move toward the bottom of the channel.

As we can see, Ethereum was moving within a channel, but toward the end, it could only reach the midline of the channel before getting rejected. This could be a signal for a drop toward the \$3,500 area. Otherwise, it might be a fake move, followed by a return into the channel and a move back toward the channel’s midline.

As we mentioned, the trigger has been activated, and the drop will likely continue down to 3,236.00.

Rapid move in oil. We need to see if something significant is about to happen in the Middle East — it usually is when we see moves like this.

Short-term bearish signals have formed for gold — we need to see whether they get confirmed or turn out to be fake.

I see a larger range where Bitcoin is showing compression and indecision. Whenever it breaks out of this compression, if it breaks to the upside, the first target would be the top of the channel, with hopes of a channel breakout. If it breaks to the downside, the first target would be the bottom of the channel, with hopes of a breakdown. In either case, we only...

I hope it doesn't return to that boring range and instead makes a pullback and moves upward. Although the price of oil depends on thousands of fundamental reasons.

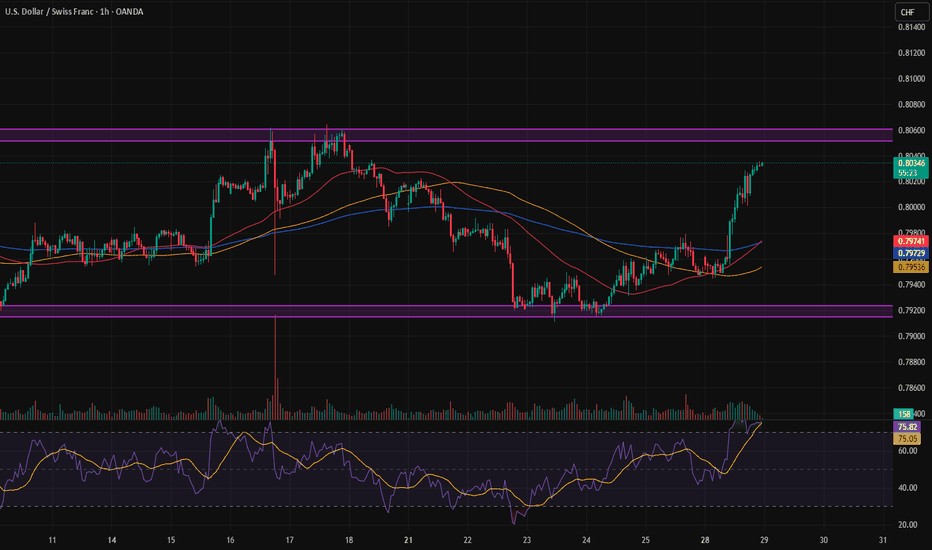

Today, with the first news release, we'll see whether the Dollar Index is making a correction before continuing upward, or if it's going to drop and fall back into the channel.

The entire market is waiting for the major news that will be announced one after another starting tomorrow.

Oil finally broke out of the range after 35 days, and now it’s time to wait for a trigger to enter and follow the trend.

Google stock is at a good spot where it could make a strong upward move. At this price level, we see multiple confluences both in terms of trend and from the perspective of indicators and oscillators. So, if it manages to break through this level, the price could move nicely.

We can take a position based on the range strategy. Note: When you have proper risk management, you can enter positions easily and with peace of mind.

Today is Monday. After the market opened, the dollar suddenly surged while the euro dropped — even though there was no scheduled news on Forex Factory. Personally, I searched everywhere but couldn't find any fundamental reason behind this move. We’ll have to wait and see whether this trend continues or reverses.

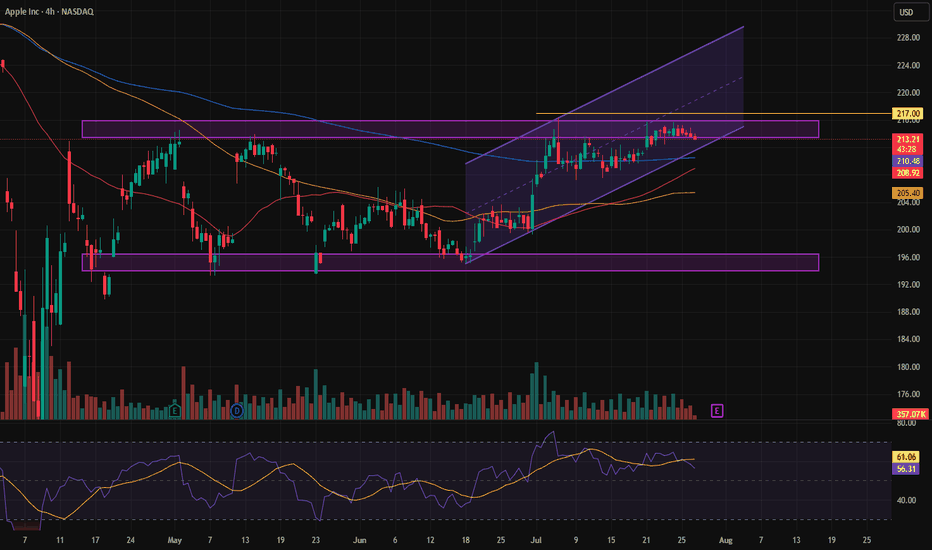

In the long-term trend of Apple stock, we all know it's clearly bullish. However, it has been going through a correction for a while now, and signs are starting to suggest that the correction may be ending. Once a trigger is confirmed, we can consider trading this stock and going for a buy.

It's at a very critical point, and if the price can't pull itself up, we could see a drop.

Gold is approaching the bottom of the channel. As mentioned in the previous analysis, due to the channel breakout, there's a possibility that the price could reach the bottom of the channel in the larger cycle.

In this week, which could be considered the most news-packed week of the year, anything can happen. Due to the strength of the news, there's a high possibility that many of our analyses might fail, while many targets could also be hit.