PouyanFa

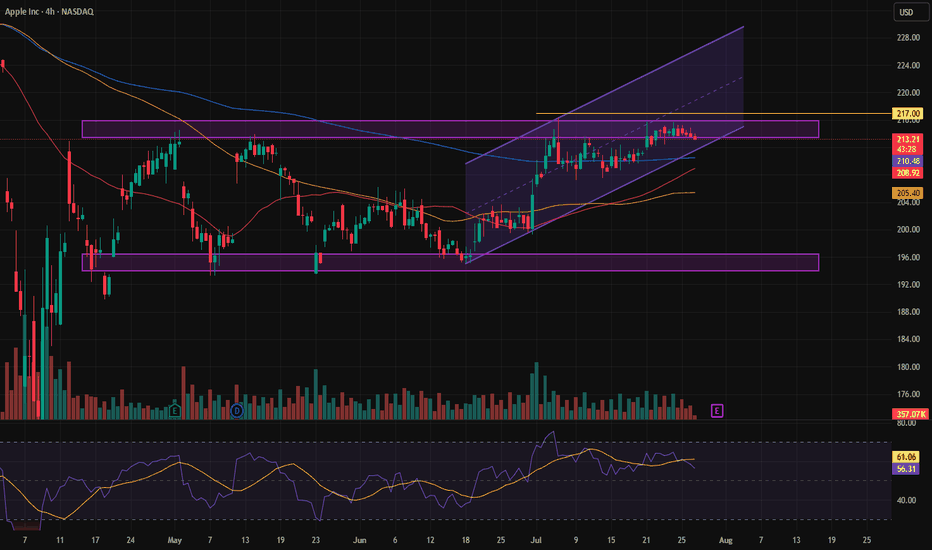

EssentialIn the long-term trend of Apple stock, we all know it's clearly bullish. However, it has been going through a correction for a while now, and signs are starting to suggest that the correction may be ending. Once a trigger is confirmed, we can consider trading this stock and going for a buy.

It's at a very critical point, and if the price can't pull itself up, we could see a drop.

Gold is approaching the bottom of the channel. As mentioned in the previous analysis, due to the channel breakout, there's a possibility that the price could reach the bottom of the channel in the larger cycle.

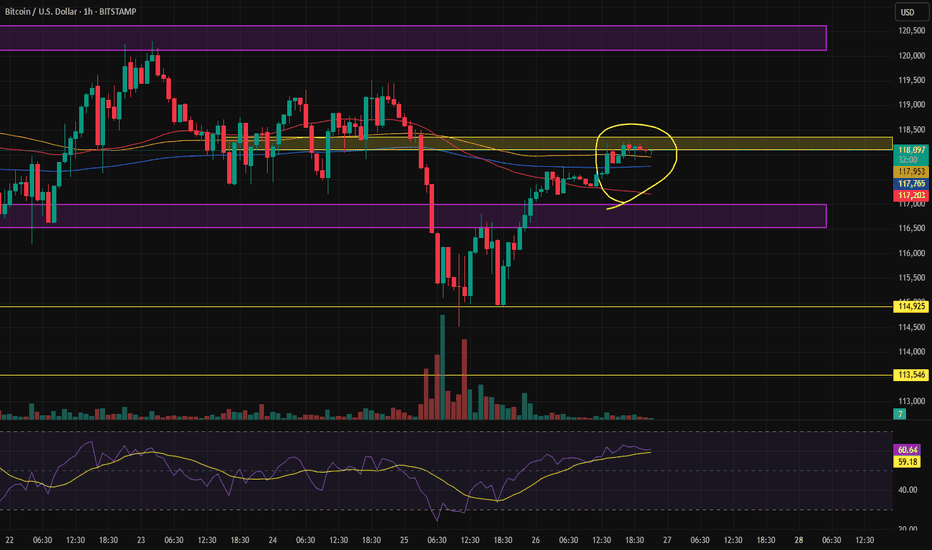

In this week, which could be considered the most news-packed week of the year, anything can happen. Due to the strength of the news, there's a high possibility that many of our analyses might fail, while many targets could also be hit.

The price has reached the midline of the 4-hour channel, and buying volume has decreased in this area. We need to see whether the price can break above the midline or not. If it breaks to the upside, our first target will be the top of the channel. If it gets rejected, our target will be the bottom of the channel.

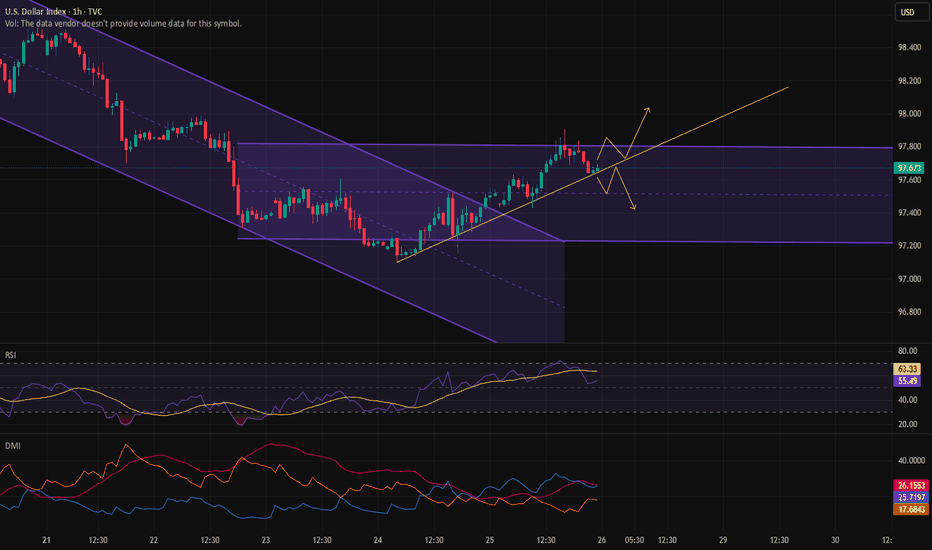

After the DXY broke out of the channel, it formed a range. We can see a yellow trendline where the price is moving exactly along it. If this trendline breaks to the downside, we can take a short position targeting the bottom of the channel. Otherwise, it would mean the trend reversal in DXY is confirmed.

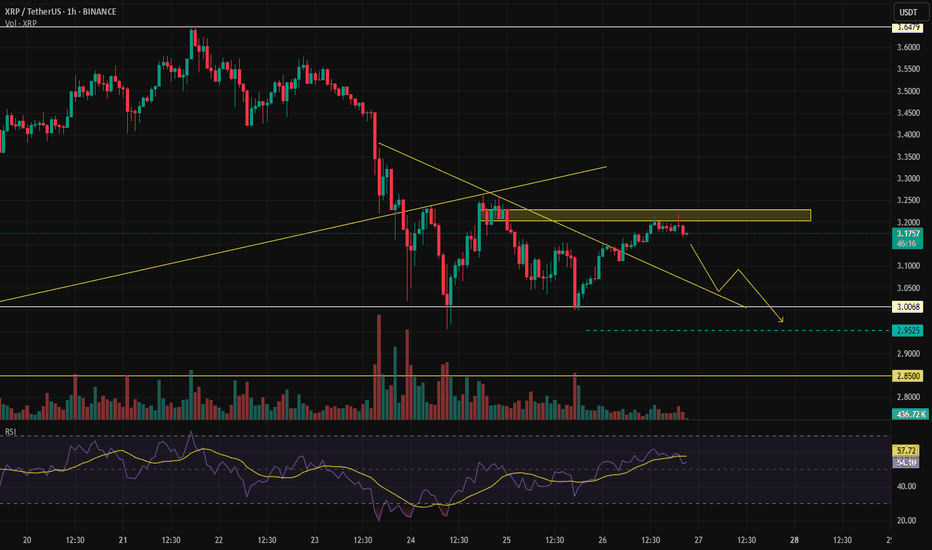

In the short-term timeframe, a short position can be taken, and using a trailing stop, you can stay with the trend if it continues — it's worth the risk.

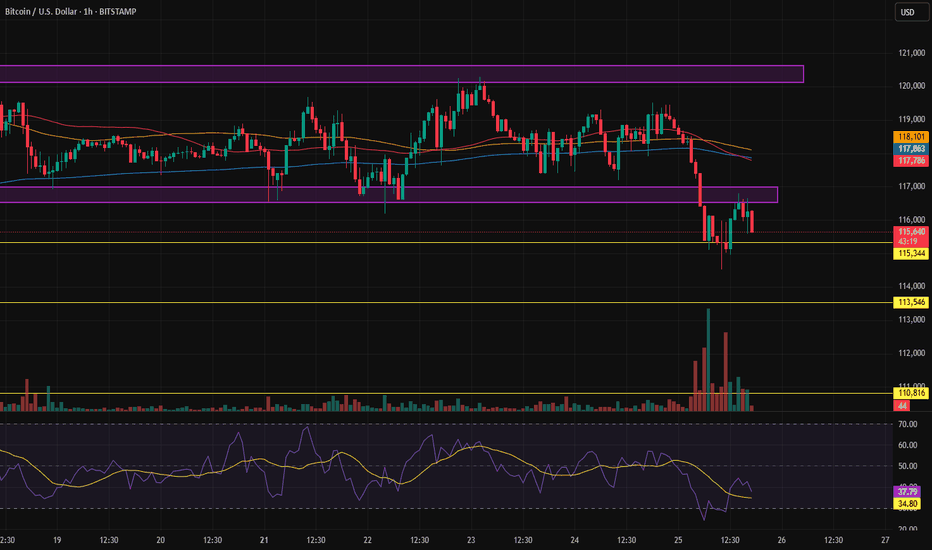

The market is in a state of indecision, and no indicator or oscillator can help determine the next move — none of them are useful right now. The market is waiting to make a decision, and so are we. We need to stay patient and see which direction it chooses.

Update on the previous analysis: We had anticipated a pullback due to the lower high, and that view remains unchanged — unless buying volume increases and we manage to break through the resistance.

Low volume before momentum — something’s cooking. Let’s see if it breaks up or down. 🔍📉📈

Due to a weak trend and a rejection from the all-time high, we’ve seen a strong rejection, suggesting that the price may drop further. If the sell trigger gets activated, it could be a good opportunity to open a sell position.

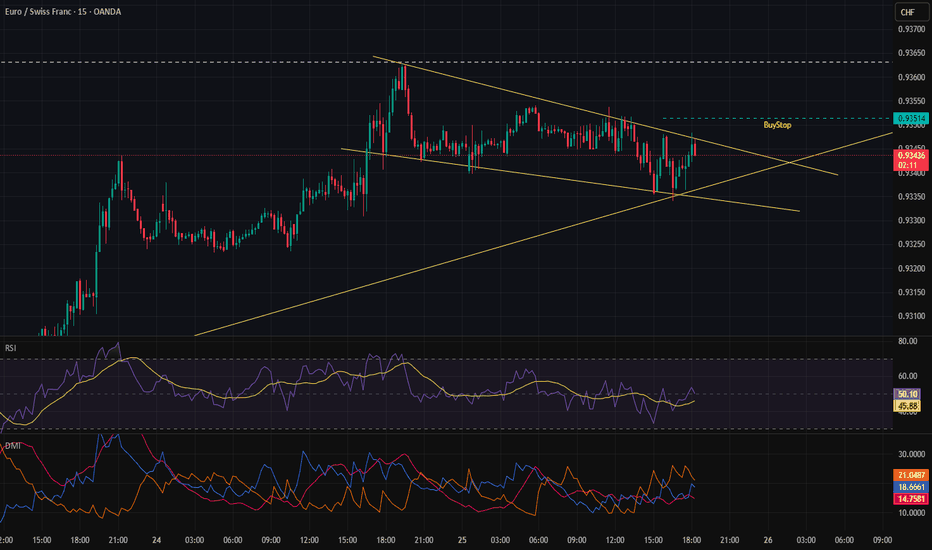

Because of the consolidation and the trend behind it, it seems reasonable to place a buy stop so we don’t miss out in case of a sharp move.

After breaking out of the channel and pulling back to the lower boundary (previous support) of the channel, we expect the price to decline.

After nearly 31 days, a consolidation has formed within the range, which could signal either a buy or sell opportunity.

In my opinion, even though the trend is bullish, short positions are easier to take right now. That’s because on the way up, the price keeps hitting the EMAs, which makes upward movement harder — but on the way down, there’s nothing in its path.

We’ll decide the next move after reaching the top. Good luck!