High Timeframe Technical Analysis: 2-Week Chart 📊 MARKET OVERVIEW The GBP/USD pair is currently in an uptrend. Based on the latest pivot analysis, price action has respected key pivot lows and is approaching critical pivot highs, which serve as resistance zones. 🔴 Sell Orders (Resistance Zones) Sell Order @ 1.43770⏳(Supply Zone) Sell Order @ 1.41784⏳ Sell...

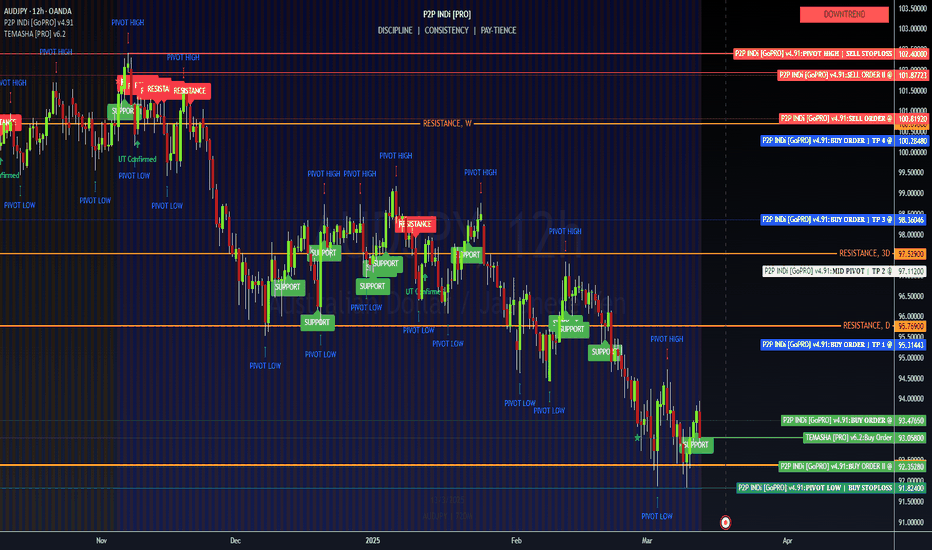

🏆 Trade Setup & Recommendation 📉 BEARISH SCENARIO (Primary Bias) Sell Zone: 94.50 - 95.50 (retest of resistance) Entry Confirmation: Bearish rejection candle near resistance Targets: TP1: 93.47 ✅ TP2: 92.99 ✅ TP3: 91.82 🎯 Stop Loss: Above 96.00 (invalidates bearish setup) 📈 BULLISH SCENARIO (Alternative Setup) Buy Zone: 91.82 - 92.50 (if...

📊 Still sideways on the D timeframe ↗️ 2H shows Buyers in control @ 1.0801 👈 📈 Support within Range 1 could cause an UT continuation 👈 UPPER RANGE 1: 1.0757 LOWER RANGE 1: 1.0727 🚫 If Range 1 doesn't hold, EXIT LONG POSITIONS 📉 HIGH-RISK shorting opportunity SSO @ 1.0725 TP @ 1.0475 ↗️ Buy the Dip within Range 2 👈 UPPER RANGE 2:...

General Observations The USDCAD (2D) chart shows an overall Downtrend currently measured as “Moderate, 4.8% Confidence.” SUPPORT & RESISTANCE 🔎 Resistance near 1.47–1.48 ( Pivot High & Sell Stoploss region ) Mid pivot area ~1.4107 that may act as interim support/resistance Support around 1.36–1.34 where prospective Buy Orders reside TREND ANALYSIS...

TREND OVERVIEW The current structure indicates a downtrend after reaching a recent pivot high. Price is reacting to key resistance zones, with multiple sell orders placed at strategic levels. The GBPCAD 288m chart highlights a well-defined trade structure with clear resistance and support zones. A short position remains favorable unless price breaks and holds...

SUMMARY GBPAUD is currently in a moderate downtrend , with sellers defending key resistance levels. A break below 1.9874 could trigger further downside towards TP zones. However, bullish buy limits at 1.9648 and 1.9613 suggest potential demand at lower levels. Trade cautiously, manage risk, and follow the trend confirmation signals. TREND & MARKET STRUCTURE ...

TREND OVERVIEW Downtrend with moderate confidence (38.1%) Trend Score: -80 = entering a downtrend Key resistance at 160.84 (PIVOT HIGH) RESISTANCE: 161.95 (Stop-loss Zone) 160.84 (PIVOT HIGH) 158.60 (Supply Zone) SUPPORT: 154.34 (TP 1) 150.76 (TP 2 / MID PIVOT) 148.12 (TP 3) 144.05 (TP 4) Critical Support: 140.55 139.57 (PIVOT LOW...

Market Overview The pair shows an uptrend (Moderate, 28.6% Confidence) , supported by higher lows and a bullish slope on the moving averages. Current Trend Score of 0.60 suggests mild upward momentum with room for potential continuation. Focus on price behavior around these pivots. A confirmed breakout or sustained rejection at key resistance will shape the...

EUR/USD TECHNICAL ANALYSIS REPORT – 90 MINUTE CHART CURRENT MARKET OUTLOOK The EUR/USD pair is currently in a downtrend , trading near key levels highlighted by pivot highs and lows. Price action indicates institutional activity with a focus around the Institutional Buying Target (Y) level at 1.0309. The pair is consolidating beneath key resistance levels,...

TECHNICAL ANALYSIS REPORT: USD/DKK (4H) OVERVIEW The USD/DKK 4-hour chart indicates significant price action dynamics with multiple pivot highs and lows. The pair is currently trading within a defined range between key support and resistance zones. The overall trend appears to be upward , as highlighted on the chart, with higher-timeframe pivots supporting...

Summary: The NZD/USD is poised for a potential breakout above 0.56464, supported by bullish technical signals and positive momentum. Traders are advised to monitor price action closely and adhere to the provided trade setup to optimize profitability while managing risk effectively. 📊 Market Overview : The NZD/USD pair is currently consolidating near the...

🔹 Symbol: EUR/NZD 🔹 Current Price: 1.83706 Key Observations: Recent price action suggests a bearish trend as EUR/NZD approaches a critical resistance zone, indicating potential downside momentum. Indicators such as RSI and MACD on higher timeframes show signals of weakening bullish strength, aligning with a possible trend reversal. 📉 Sell Order at...

🔹 Current Market Overview: The AUD/USD pair is trading at a current price of 0.62085 . Recent price movements suggest consolidation near this level, forming a potential base for upward momentum. 📈 Buy Signal Details: Entry Price: 0.6243 Stop Loss: 0.61994 Take Profit: 0.62866 🔹 Key Observations: Trend Analysis: The pair is recovering...

Market Overview The SPX500USD index is currently trading within a moderate downtrend with a Trend Score of -40, as identified by BreadWinners INDI v2. The price is hovering near the Point of Control (POC) at 5,889, showing significant selling pressure. Short-term indicators suggest bearish momentum, but long-term moving averages hint at potential support near...

💸 ATTENTION POSITION & WEALTH TRADERS!!!! 💵 +438-pip Opportunity 🤑 EUR/USD Weekly Analysis - January 14, 2025 Key levels and technical insights for this week’s trade setup: Support Level (2-Month): 1.0354 Resistance Level (52-Week): 1.0792 Stop Loss: 0.9916 Take Profit Target: 1.0792 Technical Overview: The EUR/USD has been in a ...

The EURCAD remains bearish as price respects lower pivot highs and holds below critical moving averages, confirming the ongoing downtrend. Sell Entry Zone: 1.4974 SSO @ 1.4890 ⌛️, add-on TP1: 1.4865 TP2: 1.4773 TP3: 1.4705 TP4: 1.4601 Watch the demand zone (1.4576 - 1.4486) for a potential bounce or consolidation. Buyers might emerge around the...

What’s Happening Now on the High-Timeframe? The DXY measures the strength of the U.S. dollar against other major currencies. On the 72-day chart, we’re seeing signs of a potential shift, but the overall trend is still in downtrend territory. Keep an eye on how the price reacts to these levels and stay ready to adjust your strategy! RESISTANCE (Areas where...

The EUR/USD pair is showing signs of potential recovery from oversold conditions on the 4-hour timeframe. While the broader trend remains bearish, several oscillators are indicating the possibility of a short-term bullish reversal. Key support levels are holding firm, suggesting that buyers may soon step in to regain control. Although the EUR/USD pair is under...

![[b]USDJPY 2D:[/b] [i]Technical Analysis USDJPY: [b]USDJPY 2D:[/b] [i]Technical Analysis](https://s3.tradingview.com/u/UE4bSMXs_mid.png)

![[b]USD/JPY 1H TECHNICAL OUTLOOK[/b] USDJPY: [b]USD/JPY 1H TECHNICAL OUTLOOK[/b]](https://s3.tradingview.com/i/ijlt9bBY_mid.png)